Klue Compete

The Competitive Enablement Platform

Learn More

INTRODUCING KLUE INSIGHTS

FIND OUT MORE >

If you’re looking to set up a competitive intelligence framework or level up your existing program in 2021, you’re not alone. Our recent report shows that 64% of businesses are planning to increase their competitive intelligence efforts in the next 12 months.

In either case, we want to share how you can set up your competitive program to drive more revenue n the new year.

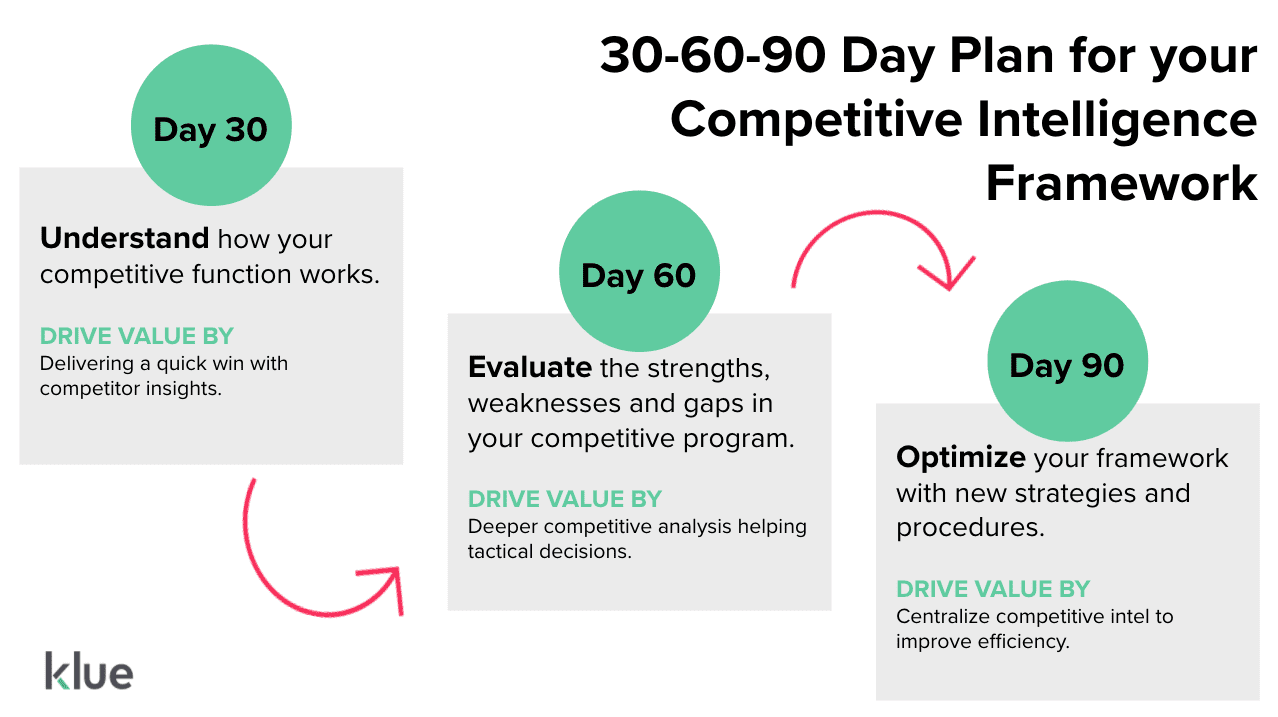

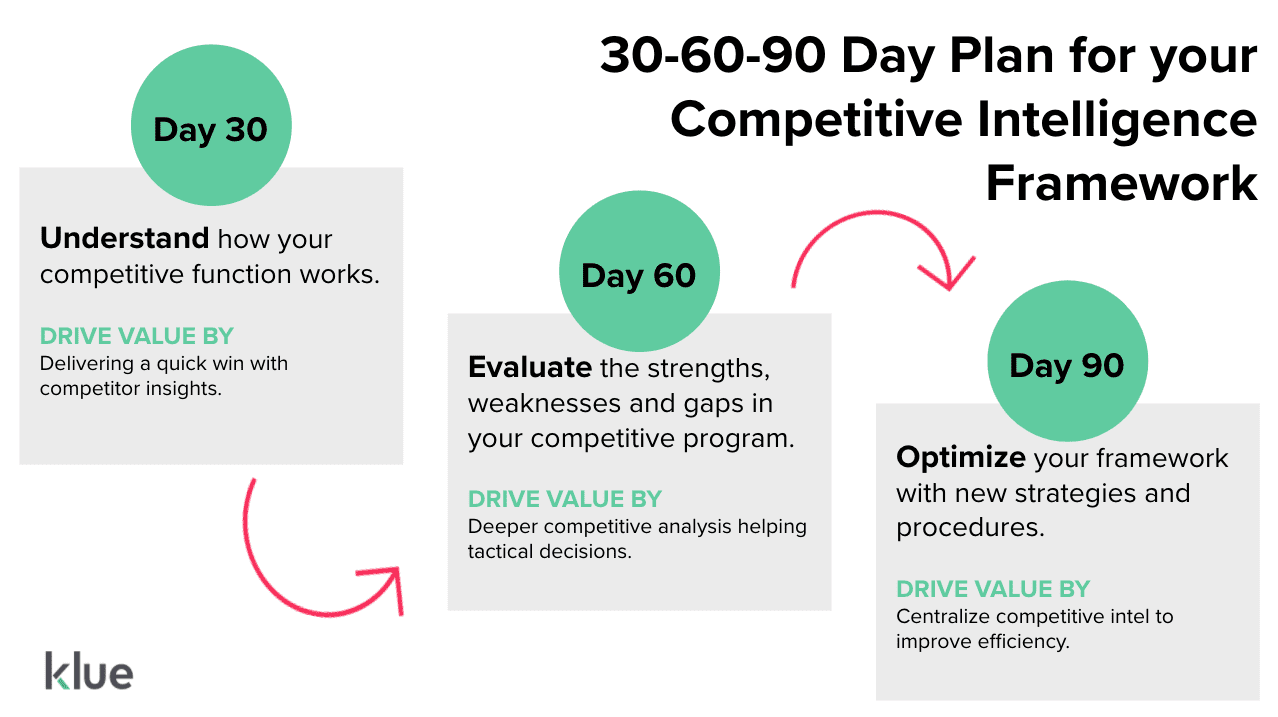

We recently hosted a webinar with Tracy Berry, Sr. Competitive Strategy Manager at Service Max and dove into the 30-60-90 day framework she used to establish an effective competitive intelligence program. Here’s how it works:

The key objectives for the 30-60-90 day plan:

In order to establish a strong competitive intelligence program, it’s important to first understand how the current function operates. The first thirty days are about learning, identifying the key stakeholders, and getting an idea of the current gaps where your competitive program can deliver the most value.

There is the inevitable onboarding process to go through if you enter a new industry. However, as a competitive intelligence professional it’s about learning the details that matter in the market landscape: understand exactly what the product is and how it’s a differentiator in the market, discover who’s winning and losing deals, how your company currently positions themselves, and what internal competitive materials exist today. You will want a wide amount of information to paint a broad picture of the landscape that you’re walking into.

A great way to demonstrate the value of your competitive program early is to bring some quick wins to the table while you’re gathering competitive information and building out the template of your function.

One example to do this is by building out a competitor profile while you learn about the industry. In Tracy’s case, there was a new competitor strongly emerging in deals that sales had no intel on. So, she conducted some preliminary research and created a specific competitor profile that enabled the sales team during deals and quickly showed the capabilities of a coherent competitive intelligence program.

Competitive intelligence is a two-way street. Getting early stakeholder buy-in is another quick win that is critical in evangelizing the importance of competitive intelligence. In order to do this you need to identify the stakeholders that you see as essential to supporting your program. We’re not getting into the weeds yet, but explain to them how you envision the competitive program broadly supporting them in their roles and the wider organization based on the preliminary research you’ve conducted.

Preliminary conversations with key stakeholders and informal conversations with employees from different departments helps in getting a sense of how competitive intelligence can best be used in the company. This is about getting a feel more than providing concrete solutions.

Similarly, being a fly on the wall during some internal strategy conversations in competitive deals will provide a lot of insight into the gaps in your company’s understanding of the competitor and their own positioning. There are several opportunities where you can be proactive and listen in such as quarterly business reviews, preliminary calls before a sales demo, or pricing strategy discussions.

After identifying key stakeholders and gauging the temperature of how the organization currently views their competitive process, it’s time to do a full evaluation. Conduct longer interviews with stakeholders to get a strong understanding of exactly where the competitive process is falling short and what they want in order to be more effective in their role. A clear and honest evaluation of the current framework will allow you to begin mapping out a more efficient competitive intelligence function.

Conduct thirty interviews with key stakeholders for thirty minutes each to talk about their perceived strengths, weaknesses, and gaps in the current competitive strategy. These are structured interviews that ask the same questions to multiple people across the organization.

The purpose of these conversations is to deeply understand the current competitive program, and also track how different departments are using or struggling to use the intel. Typically, there will be common problems that arise in every interview such as finding the right information, or a lack of trust that the intel is up to date. The findings from these conversations will be a large component in driving how you map out the competitive program.

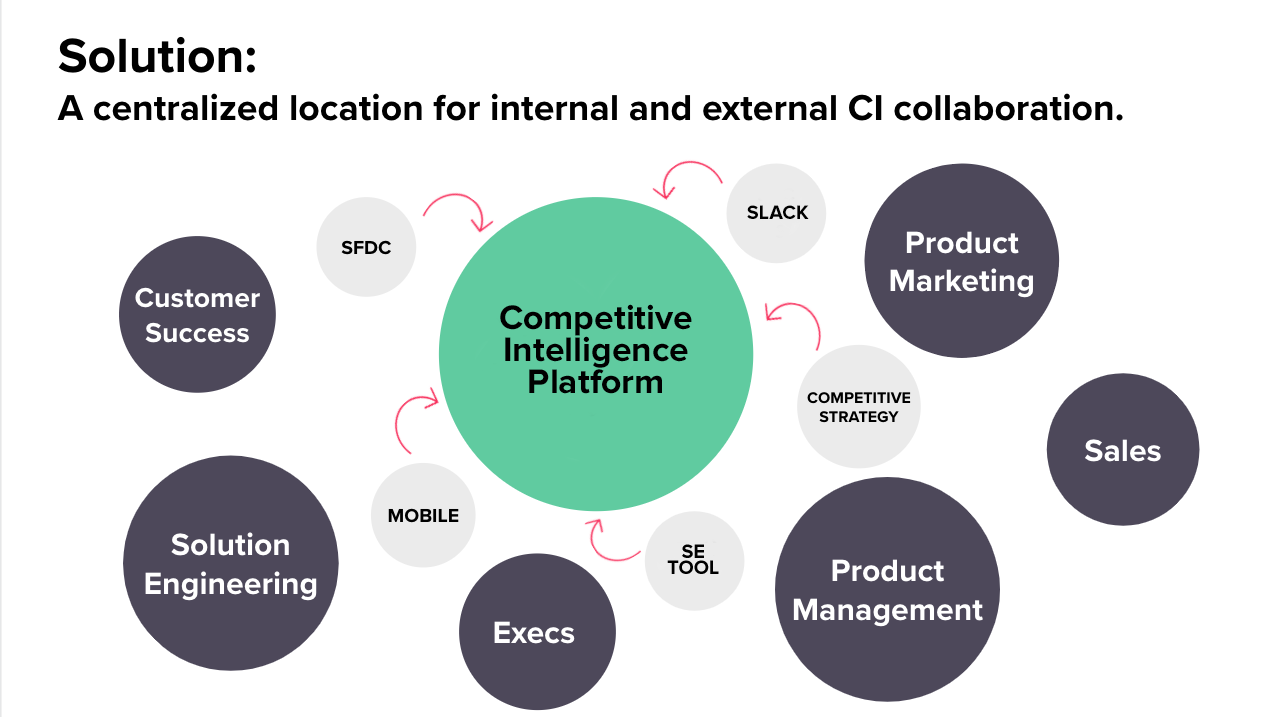

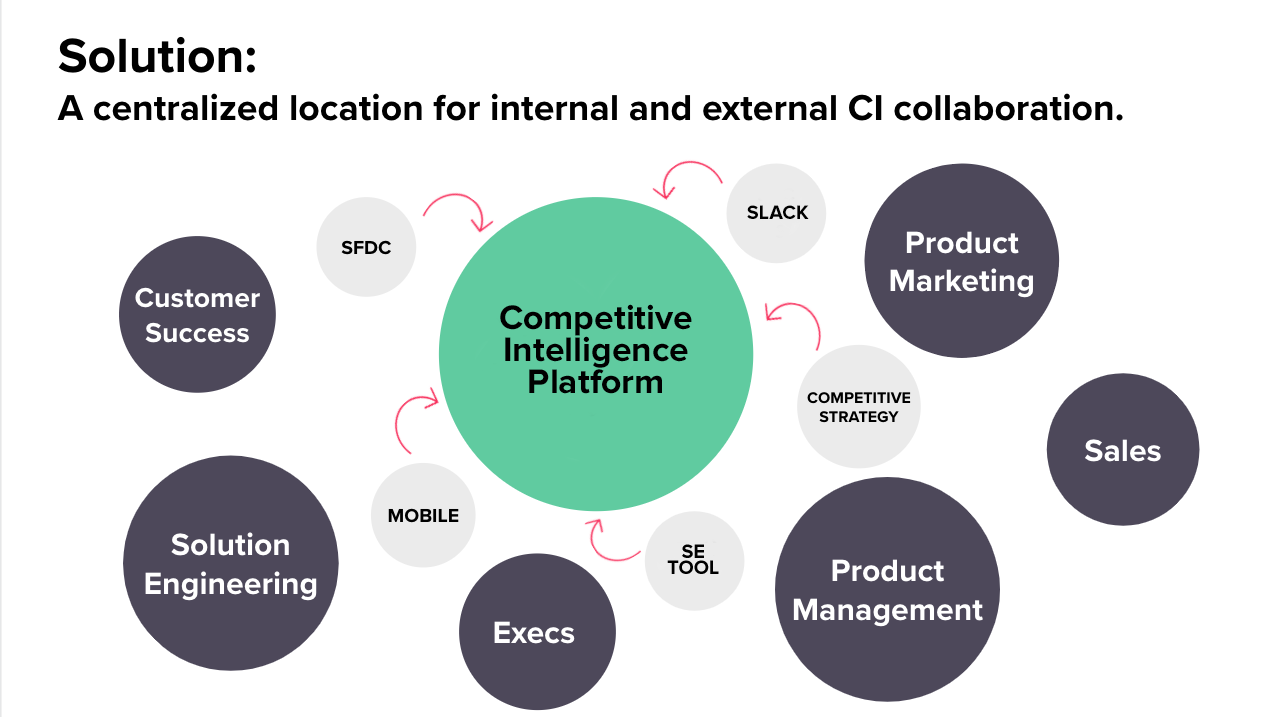

Diagram the existing flow of competitive information as a way to visualize exactly how intel is being communicated across the organization. This helps you to clarify the key requirements of your updated function, and map out how they will fill in current gaps. When doing this, separate the flow for short-term tactical insights from the long-term strategic insights as they will feed different consumers at a different cadence.

It is also the point in which you have to determine the technical aspects of your competitive process: what intel you will collect, how to collect it, where it will be stored, and ultimately how it will be shared to employees. The earlier stages of your plan guide the focus of your program, nailing the technical components will ensure that competitive intelligence flows smoothly throughout the organization.

Evaluate what internal and external tools will be valuable to the collection, organization, and distribution of your competitive content. There are products that can help with competitor monitoring, news aggregation, centralizing intel, battlecard creation and user adoption, win/loss analysis, and scenario analysis.

The quick wins you provide during the first thirty days are valuable but they are limited given the lack of time available. The insights you can deliver after sixty days should be a natural extension from this and go deeper. Provide competitive analysis that goes beyond just offering intel but actually enables teams to use the information against competitors effectively.

For example, leading an internal webinar on the competitor profile you created in the first thirty days. In a webinar you have more time to give context as to why certains pieces of intel matter, who they matter to, and how they can leverage it best. This setting allows the intel to become more applicable, and will naturally spark more feedback and collaboration between those that will use this competitive content.

The evaluation stage requires a lot of research and preparation in order to establish the framework of your competitive program. The final thirty days are about optimizing this framework. In this period it is crucial to build buy-in amongst teams, identify external and internal needs to fill in the gaps of your program, and establish expectations and measurements of success to decision-makers.

Establishing a relationship with sales is a must from the moment you start building the competitive intelligence program. They will be the lifeblood of its success. By the ninety day stage you should be a constant presence in sales spaces, and supporting them with competitive insights that they can use in the field.

Sales meetings, deal reviews, and quarterly business review meetings are a handful of settings that you should be present and attentive in. Build these strong relationships with senior level salespeople and collaborate on the platforms that they use to communicate with one another.

A clear budget outlining what you need from decision makers for internal hires, external tools, and third-party contractors is a starting point. However, also presenting how you’ll measure the ROI that your program drives will justify that expenses won’t be thrown at competitive intelligence without a tangible idea of what its impact was.

Brand competitive content so that there is a logo attached to any piece of competitive intelligence. By branding this content it will familiarize employees with competitive intel; the moment they see that logo they know they’re about to read something important. This is another subtle way to further cement buy-in among stakeholders.

You want to make sure that all of the requirements and business needs will be met by your competitive program. Therefore, deciding what will be done in-house and where you will need contractors and technology are critical to ensuring that all of the gaps in your program are filled.

Look into competitive intelligence tools that help with the efficiency of your program’s collection, storage, and distribution of competitive intelligence.

Present an internal timeline to decision makers that will help you set realistic expectations as to how you will roll out the full competitive program over time now that you have established the foundation.

Also, communicate with teams to inform them what the cadence for competitive intelligence distribution will be from you. Providing up-to-date information and regular basis will build trust amongst employees in the competitive program. The long-term goal will be to have employees contributing intel as well, however providing weekly digests with specific context is another step to ingraining the competitive intelligence function into business operations.

This ninety day plan is not only a guide for those looking to create a new competitive function. It can become a regular framework that reviews your existing program. An organization’s competitive intelligence needs change over time and a purposeful step-by-step review of your function is essential

This framework is just a starting point. If you’re looking for tactical steps to launch your Compete Program? Check out our nine steps — with resources to nail each — below.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Competitive Enablement

Product Marketing

If your competitive intel game is too strong for automation, too pure for data privacy, and too rebellious for accuracy — then Klue AI is probably not for you.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X