Klue Compete

The Competitive Enablement Platform

Learn More

INTRODUCING KLUE INSIGHTS

FIND OUT MORE >

What are the most essential competitive intelligence metrics you need to build a dashboard and track your KPIs?

For a discipline like competitive intelligence and competitive enablement that touches all aspects of the business, success can’t be boiled down to one statistic.

But by assessing your compete program across several metrics — and tracking changes over time — you’ll begin to paint a quantifiable picture of the impact you’re having.

Here are 11 competitive intelligence metrics that you should be using to gauge the impact of your compete program.

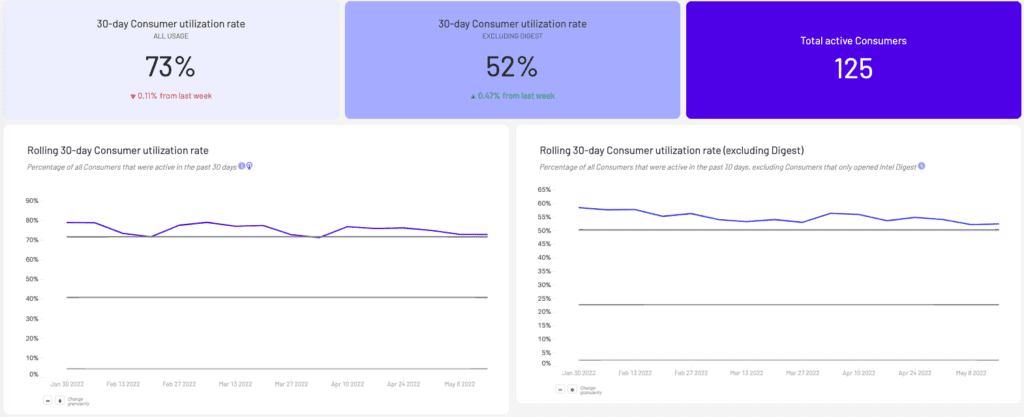

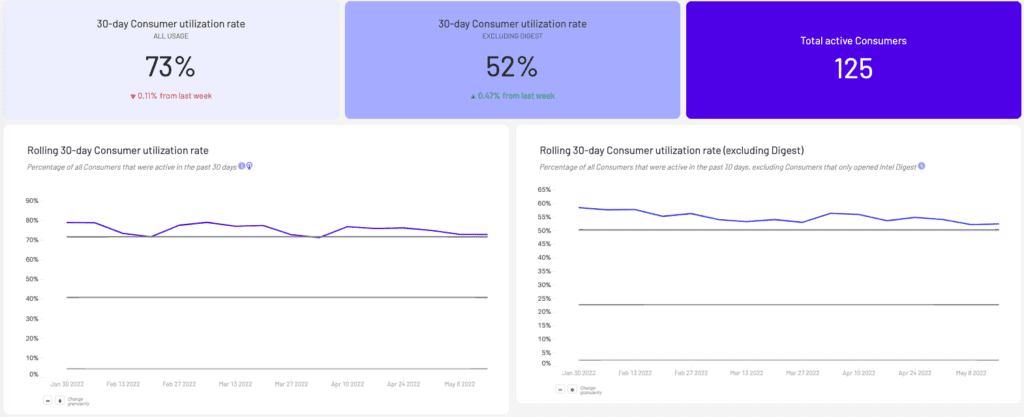

Adoption and usage underpin virtually every other metric you’ll find on this list.

For starters measuring adoption help you understand what content is working and inform your team’s priorities.

And more importantly, it lets you connect adoption and usage of your competitive content to the success of the reps who use it.

That’s why adoption/usage is one of your most basic — and most valuable — competitive intelligence metrics.

Although consumption can be lumped into one broad category, there are many different layers to dig into.

If you’re looking to report cross-functionally on how many reps are accessing competitive content, a simple consumer utilization rate should suffice.

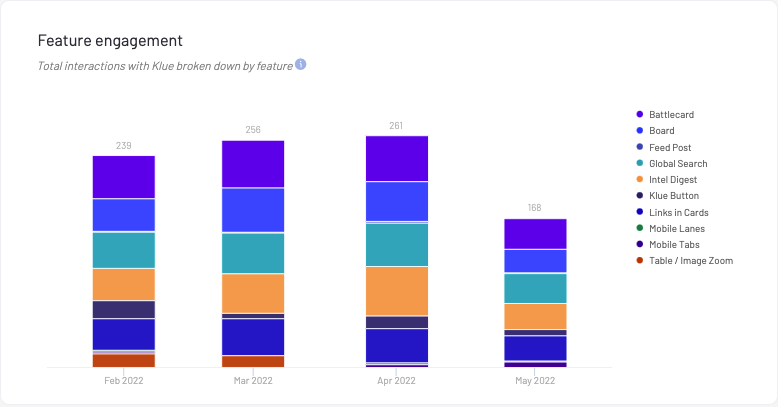

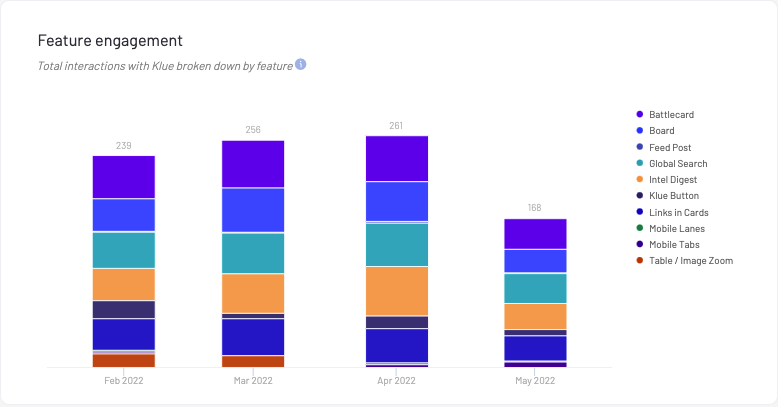

But if you, as the compete expert, want to understand the most popular features of your compete platform, you could look at a feature engagement report.

Beyond that, understanding who your top competitors are (and how that might be changing over time), seeing what battlecards are most popular, and which tags are being used all provide valuable insights to gauge the success of your compete program.

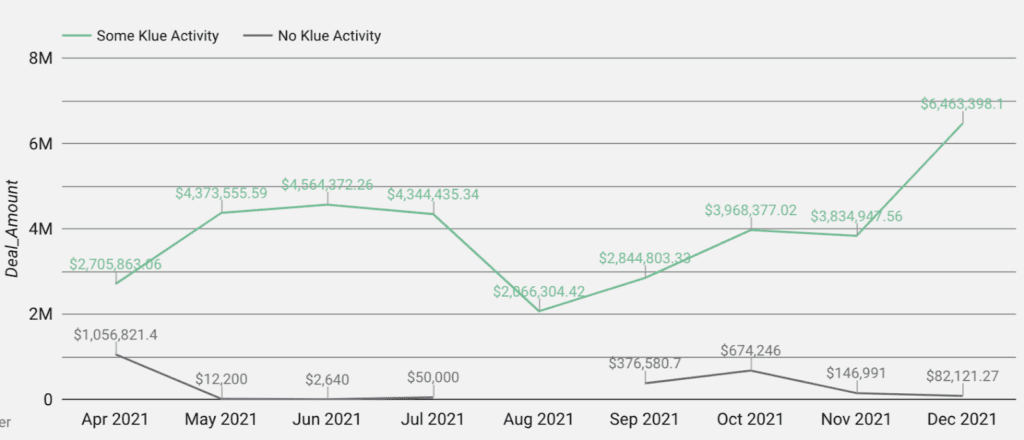

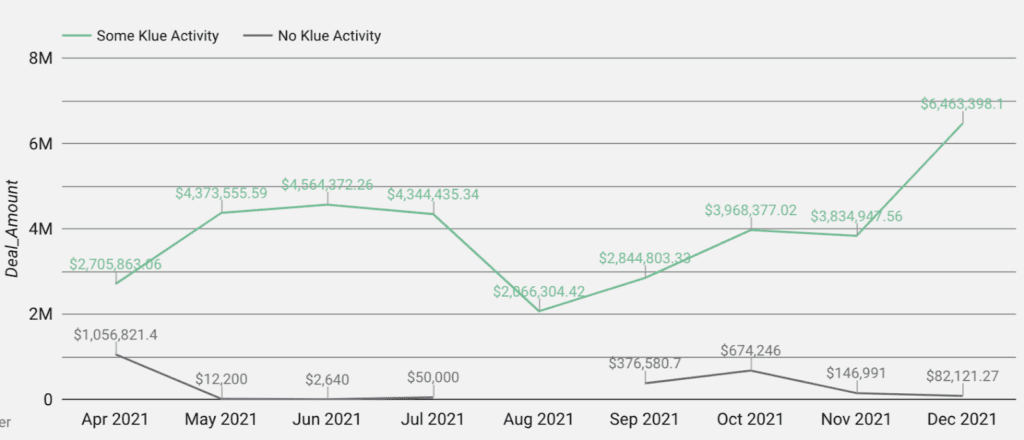

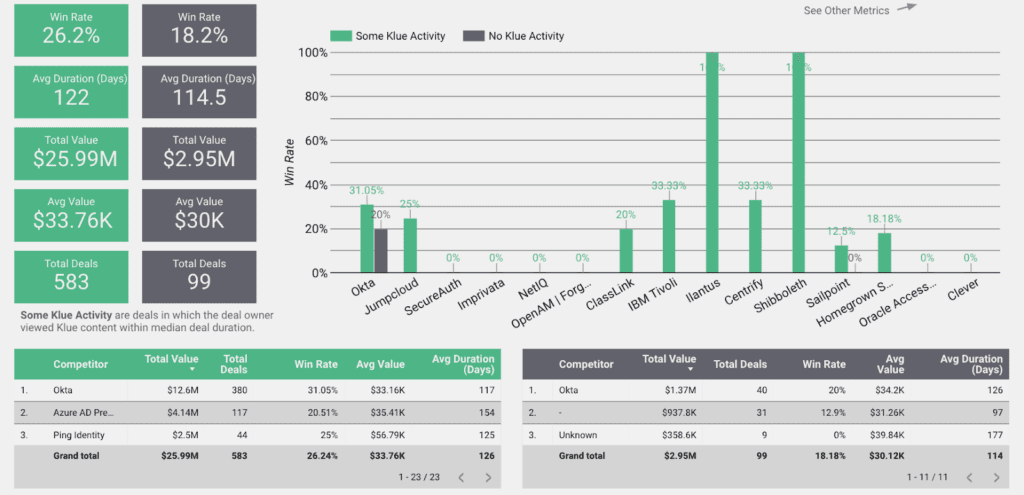

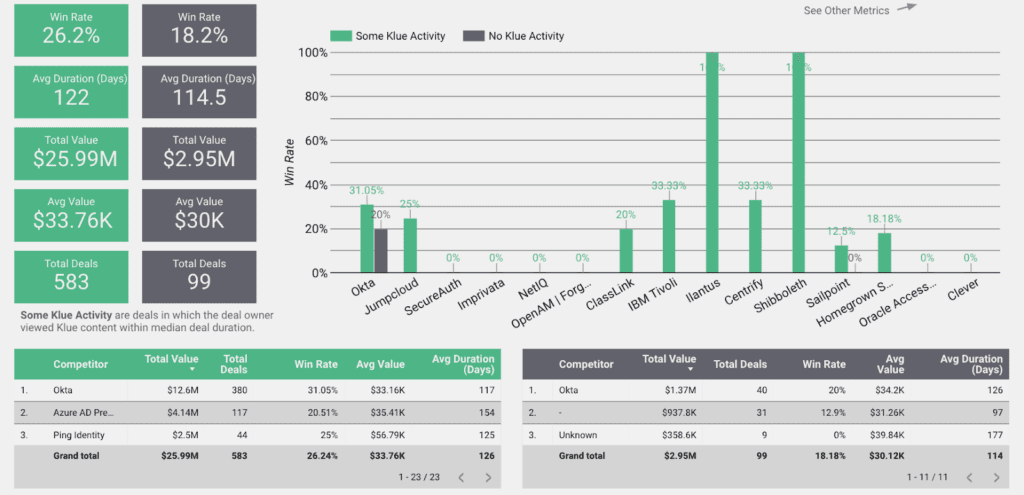

Getting a grasp of the adoption and consumption of your competitive content ladders up to an even more powerful metric: revenue impact.

By comparing revenue generated by reps who use your competitive content versus those that do not, you get a stronger sense of the impact your content is having within competitive deals.

This is the simplest metric to share with leadership to highlight how you’re helping close your businesses’ competitive revenue gap.

You know in your gut that competitive enablement helps win more deals. Conducting a revenue impact analysis moves you past the hunch and into meaningful data.

A wise seller once said, “knowledge plus experience equals confidence. Confidence leads to trust, and trust leads to sales.”

Your competitive content — and the entire program at large — should be a vehicle for the knowledge that leads to trust and ultimately sales.

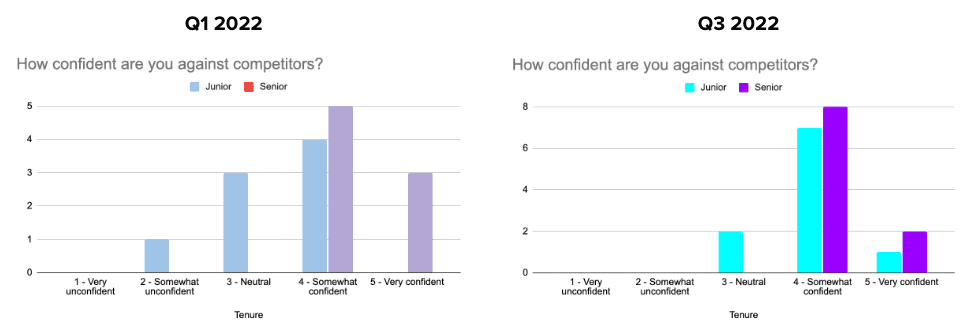

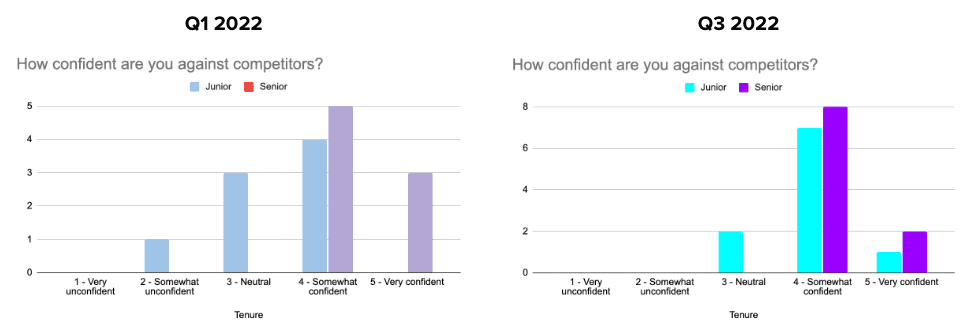

Conducting bi-annual competitive confidence surveys, and tracking changes in responses over time helps you measure to what extent your competitive content is stoking confidence in your front-line users.

On a recent episode of the Competitive Enablement Show, Klue’s Competitive Enablement manager Brandon Bedford talked about why a competitive confidence survey is so important.

“I want to understand, what gaps do I need to fill? What problems do I need to solve?”

The questions you ask in your competitive confidence survey should be a mix of competitor-specific questions and general confidence in your compete program.

And once you have a few quarters of data, you’ll begin to see why competitive confidence is one of the essential competitive intelligence metrics.

Competitive content tips the scale in your favour and turns near losses into comfortable wins. That’s why win rate is one of the most common competitive intelligence metrics around.

You don’t need a math degree to understand this particular metric. It’s a simple percentage of deals won divided by the total deals in a given timeframe.

But just like revenue impact gets more interesting when you look at the effect your competitive content has, tying win rates to adoption and usage is equally illuminating.

If you’re building a compete program from scratch, look at win rates before and after the program implementation.

However, if you’re inheriting an existing compete program, ClickUp’s Andy McCotter-Bicknell says you’ll want to be a bit more careful when setting KPIs around win rates.

“You need to make sure that people know exactly where to go for competitive [content]. A lot of things need to be checked before you can actually improve like a specific win rate,”

Winning more deals is all that matters. If you’re compete program isn’t helping to that end, which often takes form in win rates, you should be making necessary adjustments.

While increases and decreases in overall win rate provide directionally accurate data, looking at win rates against specific competitors helps deepen your analysis.

For you to get the most out of competitive win rate as a competitive intelligence metric, you’ll need reasonably clean CRM data in order to accurately capture which competitor your rep was up against in a given deal.

If you just threw up a bit in upon reading the words “clean CRM data”, Freshworks’ Tracy Berry has two biggest pieces of advice for data hygiene:

“You have to make it required fields so that sales or whoever’s inputting the data has to complete it. And then you have to enable around it heavily, constantly, consistently, so that people (…) understand why they’re being asked to to do this, what’s important about it, and what’s in it for them.“

You should already have a grasp on who your number one competitor is. But poring over CRM data can give you a sense of any new competitors starting to chip away at your win rates.

What’s more, competitive win rates are another opportunity to layer in adoption and consumption as a way to validate your compete program’s success.

Start measuring your competitive win rates. Dive into the data to understand what’s impacting the results. And leverage those insights to adjust your competitive enablement efforts.

Proving direct causation of any two independent variables is intensely difficult.

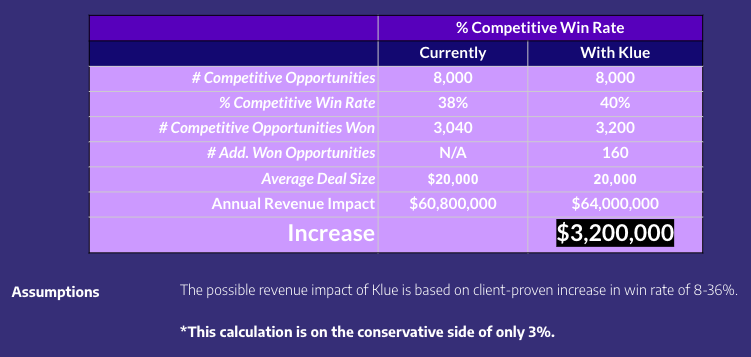

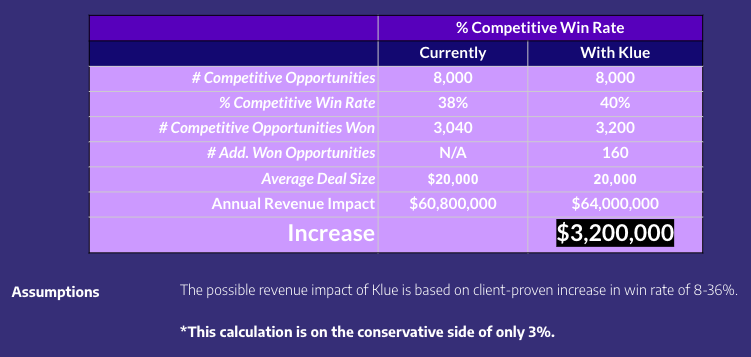

And while causation trumps correlation any day of the week, by applying predicted increases in win rates your compete program is achieving to your business’ current state of affairs, you begin to make a very strong case for a competitive enablement program.

That’s because when you connect the dots between the increased win rate and the revenue it entails, the argument against competitive enablement is hard to support.

The key here is to represent the increase in win rates spurred by your compete program and compare it against the status quo, which is why it’s critical to consistently measure and overlay who is winning deals alongside who is using your competitive content.

Also known as a ‘rip and replace’, a competitive displacement is when a prospect who currently uses your competitor’s product or service switches to yours.

Prospecting into accounts using your competitor takes finesse. The kind that often requires support from the competitive expert in your organization. You know, the people that are assessing how we’re differentiated in the market each and every day.

When done correctly, competitive displacements are a huge buoy to your compete program and the organization in general.

“Another thing that we track is the number of competitive displacements. So how many customers have we stolen from our main competitors over the years? That’s a great way to demonstrate success,” says Highspot’s Senior Manager of Product Marketing Justin Topliff.

You probably won’t experience dozens of these each quarter — so plotting them on a graph won’t look particularly impressive.

But telling the story to execs of how you helped a new customer see the light of your solution? AND they came from a competitor? Those are the type of qualitative metrics that will last long in the memory of your execs.

Qualitative metrics are metrics too, after all.

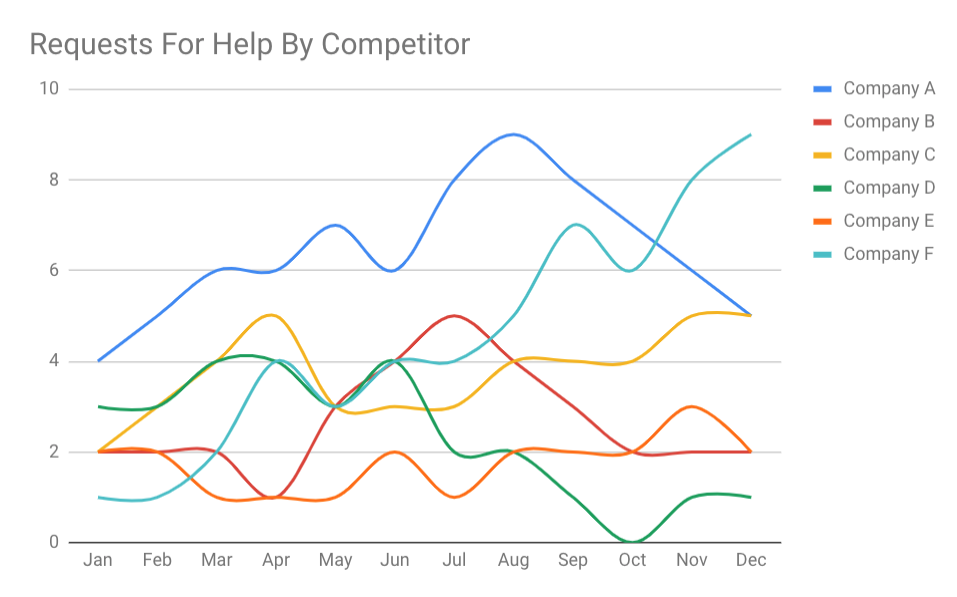

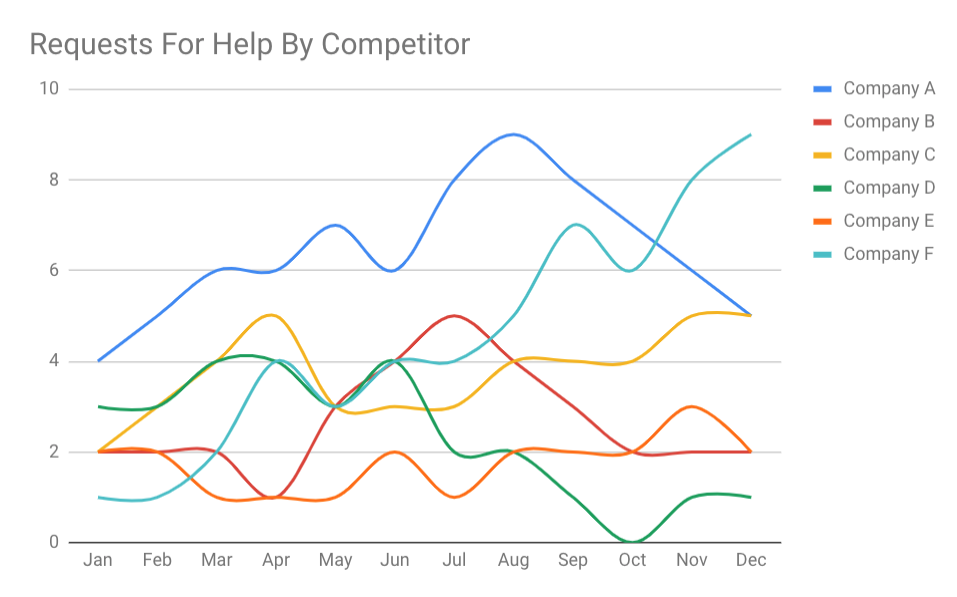

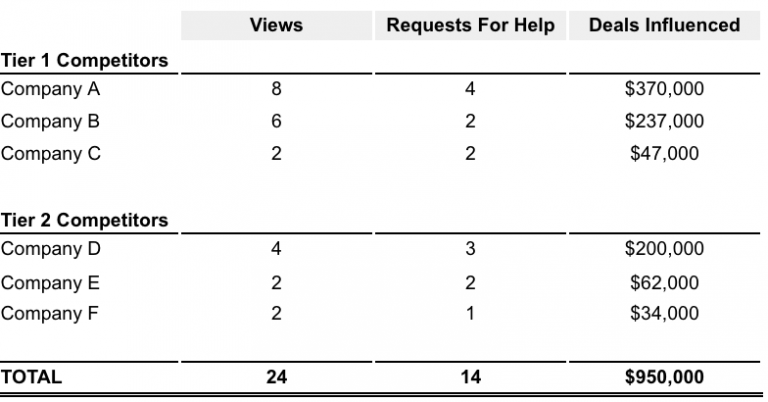

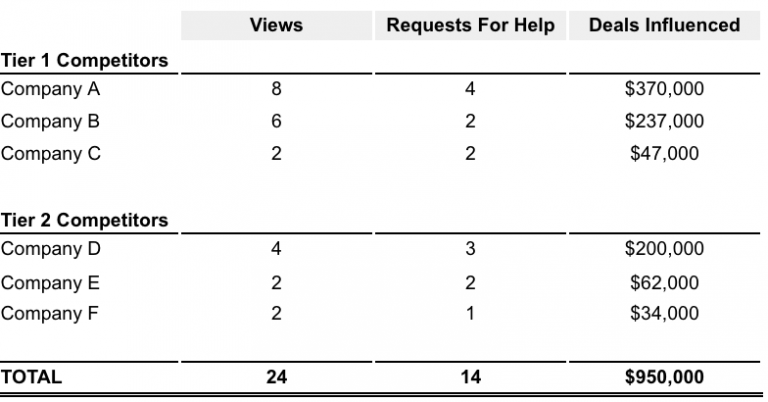

Deal support or “requests for help” measures the number of times you or your competitive team were asked to provide support in a deal.

The best competitive experts don’t just sit on the sidelines. Yes, they enable their reps to differentiate against competitors, but the best experts get their hands dirty in deals too.

An increase in deal support indicates that your compete program is building a strong internal reputation. People know that you (or your team) are the people they need to win business.

Sometimes deal support isn’t needed, and you can point a rep towards competitive content already built to solve their pain. Nonetheless, it demonstrates a demand within your business for competitive enablement.

Whether deal support requests are a metric you’ll keep for internal purposes or share with the rest of the organization is up to you.

But it’s an indispensable metric for compete pros nonetheless.

Good competitive content enables your reps to deposition the competition earlier on in the deal cycle.

Even at later stages of the deal cycle, your reps can close deals faster thanks to the winning messaging and positioning they have access to through your compete platform.

Either way, the result is the same: shorter deal cycles.

Reps who use a competitive platform at SymphonyAI Retail shortened their deal cycles by a massive 75 days on average.

Time savings like this free up sales reps’ time to do more client prospecting and close more deals.

It’s a virtuous circle.

Simply put, if your reps are closing bigger deals thanks in part to your compete content, it’s a story you should share widely.

More, if your account managers are succeeding in retaining customers and expanding use within them, you should take note.

Like all the other competitive intelligence metrics on this list, it’s not the be-all-end-all, but average deal size is another data point that helps paint your compete team’s success.

Learn more about how you can take your competitive intelligence program to the next level by signing up for our weekly Coffee & Compete newsletter.

You’ll get an in-depth summary of the best content of the week every Sunday.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Competitive Enablement

Product Marketing

If your competitive intel game is too strong for automation, too pure for data privacy, and too rebellious for accuracy — then Klue AI is probably not for you.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X