Klue Compete

The Competitive Enablement Platform

Learn More

FIND OUT MORE >

Conducting competitive intelligence research involves two main components. And one without the other leaves your research incomplete.

First, you need to know the most valuable sources of competitive intelligence. Then you need to know what to do with it.

With the right sources of intel in your hands, it’s far easier to develop an effective competitive intelligence program. From there you’ll have to discern what information matters, why, and to whom it matters to.

While internal sources of competitive intelligence are often the most insightful, there’s a wealth of intel collect from external sources.

As such, we’ve put together some of the best external sources to get started with your competitive intelligence research.

Keeping tabs on your competitor’s personnel is an important source of competitive intelligence research because it sheds light on where they’re currently focused, and can suggest where they’re headed next.

Looking at a competitor’s hiring trends helps you forecast their next move. But to really glean insight from this source, you need to go beyond just job titles. For instance, ask yourself:

These insights don’t just indicate a competitor’s growth, but also provide a glimpse into their strategic plan.

Take a look and see if the responsibilities of several openings are closely aligned. For example, a competitor may be hiring specific engineers to build out their product.

Or, if the job openings are located in a specific location, your competitor might be building a team to enter a new region.

Specific job postings will also tell you something about a competitor. If they’re openly looking for a Salesforce developer, you can safely infer that that is their CRM of choice.

Perhaps the strongest indicator of a strategic shift with respect to personnel changes, new C-suite hires can greatly inform your competitive intelligence research.

A new executive or board member with a materially different background from the core business, a change may be afoot.

For instance, a new VP with a history of dealing with enterprise businesses joins a company that traditionally works with mid-market businesses could be suggest they’re moving upstream.

But it’s not just a hire’s background that can mean a shift.

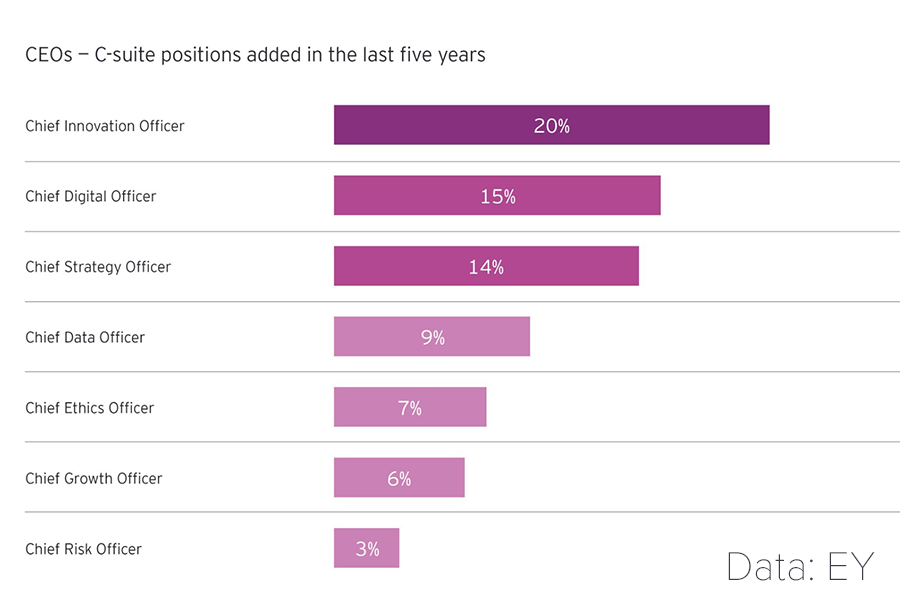

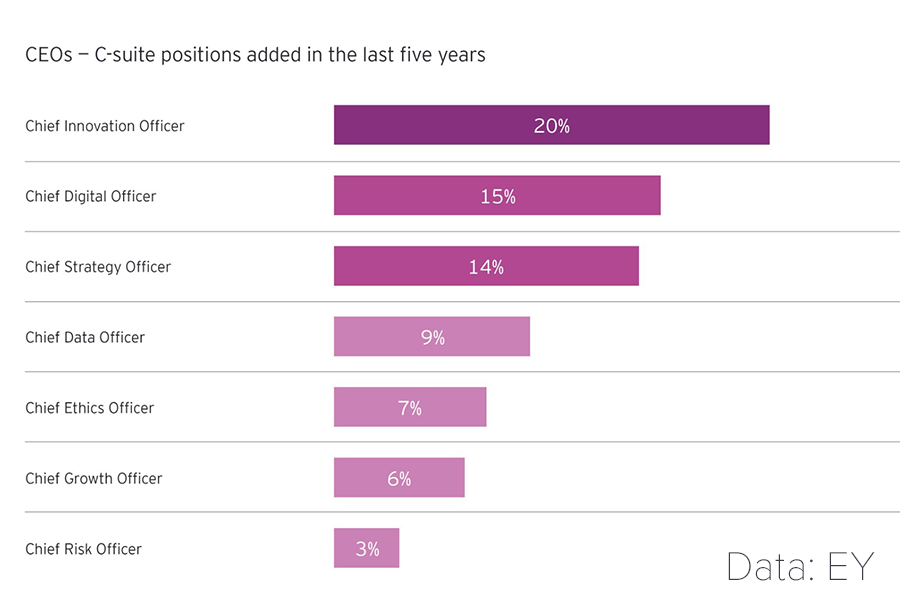

The executive level isn’t remaining stagnant. EY’s 2019 study shows that 82% of CEOs have added a C-Suite position over the past five years to prioritize different areas of the business.

Given the influence the C-Suite holds over a business’ direction, knowing their makeup and change over time is a must-have for your competitive strategy.

Tracking what current and former employees say about a business on review websites is another easy way to learn about how they operate.

It’s a peek inside the decisions a competitor is making behind closed doors. And knowing how employees perceive a workplace — both good and bad — provides vital information.

When leveraged, this information enables your sales reps by allowing them to target competitor weaknesses with prospective clients. What’s more, your recruiting team can better position your company culture.

Tracking a competitor’s news coverage, press releases and events boosts your ability to build a full competitive profile.

These conveniently time-stamped pieces of content can help piece together their story, where they are headed, and what they value.

A company’s press release page is a strong indicator of what they want current and potential customers to care about.

These announcements are a tool for competitors to position themselves. Through press releases, your company may introduce new funding and partnerships, product advancements, or if a business is scaling up.

By keeping tabs on these updates it is easier for your team to proactively prepare yourselves against whatever new angle a competitor takes.

It is also important to research what news outlets are writing about your competitor. There may be a new website that isn’t on your current PR outreach covering them; build a relationship with these reporters to expand your network and increase the coverage of your next big announcement!

Similarly, being aware of awards that are presented to your competitor is another way to understand their strengths.

Finding value in event sponsorship and participation can be difficult to quantify. However, one way to determine your own strategy is to see what events your competitor is involved in, how long they have done so, and the pitch that they deliver.

Not only does this arm you with information on how to differentiate yourself, but it also can provide insight into your competitor’s positioning.

For example, at Klue many of our webinars have been focused on battlecard strategy and creation. This is because our clients love how we build them and it is one of our key differentiating factors.

Analyze the content of your competitor’s events. You may have more insight into a topic that was covered. They might be using these platforms to feature a new aspect of their product.

Stay on top of your competitor’s events page and subscribe to event calendars that are relevant to your industry.

A competitor’s products and offerings are an essential source of competitive intelligence research. You need to know how you stack up.

Knowing exactly how your competitor is positioning themselves, and better understanding their prices and features helps your reps immensely when they find themselves in competitive deals.

But the value of this kind of intel goes well beyond your sales team.

Every department across your business can use the information on what competitors are offering, the solutions they provide, and how their pricing changes over time.

Collect the intel, understand it, and adjust your product and marketing strategies accordingly.

A competitor’s FAQs and support threads are great ways to assess their user experience (UX) and identify the key strengths and weaknesses of their product.

This is an opportunity for your customer success team to shine; target where competitor clients are struggling with the product and ensure that your team provides better support in that area when helping clients adopt the product.

Marketing teams can also capitalize on this information by crafting campaigns that focus on resolving these ‘pain points’ that consumers find difficulty with.

Postscript’s Senior Market Intelligence Manager Mindy Regnell always dives into her competitor’s FAQs as part of her competitive intelligence research.

“Your competitor’s website is a valid source of truth in most cases. Then you can go a little bit farther by going into their help center documentation and trying to find gaps.”

Of course, any glaring weaknesses are an opportunity for your sales team to capitalize and deposition a competitor by laying a landmine.

Pricing is always top of mind for potential customers. Pricing tiers can often be found directly on a competitor’s website, or on customer review sites like G2 Crowd.

But it isn’t just as simple as tracking a competitor’s prices. And we all know what the number says on the bumper sticker doesn’t play out in the field. Instead, understand their pricing strategy.

For example, you could notice a trend from your sales team that competitor X continually slashes prices to try to win market share. With this information, you can prepare your sales team to have positioning messages ready in order to avoid ugly price wars that steer away from value-based solutions and reframe your competitors’ race to the bottom as a negative for your buyer.

Or, your competitor shifts their pricing model to include a freemium offering that they position as a cheaper alternative to you. With this information, you need to enable your reps to understand the limitations a competitor’s freemium offering so that they can then convey this to the buyer and recenter your solution around their pains.

Another layer of insight into your competitor’s strategy is to look at how they package their product.

Running a product analysis will provide a clear picture of what a competitor is offering, how they are positioning themselves in the market, and how your own product matches up.

Once a sales cycle is complete, conducting win-loss interviews is an important part of competitive intelligence research.

And don’t just rely on what your sales reps say. Conduct interviews with new clients or those who chose an alternative option. Now that the sales pitch is over, prospects are far more candid about the reasons why they chose you or a competitor.

Make sure that you ask questions that will give the answers you’re looking for.

Who exactly is your customer? Use competitive intelligence research to craft more accurate buyer personas that will enable your sales and marketing team to aim their efforts with precision.

First, start looking at who your competitors are bringing in as clients, the size and industry type of these customers, why they chose to sign with your competitor, and if they are satisfied.

Customer feedback isn’t just useful internal information that shows your strengths and weaknesses. How well they endorse your product or service on various review websites is an essential way to establish your company’s credibility and is a great resource for your marketing and sales teams to use.

These organic comments that support your product are a source of social proof; it’s why marketing teams provide case studies for prospects that are in similar situations.

User review sites, such as G2 Crowd, Capterra, or Trust Radius, are a simple way to begin your competitive analysis. A brief browse will hand you the bare bones needed to identify the variety of customers your competitor has – their pain points, and satisfaction levels.

Now let’s take it a step further.

What are the reviews that your competitor has gone to great lengths to highlight on their website and social pages?

Are there new in-depth case studies or customer testimonials?

These types of content provide insight into your competitors’ buyer personas and the solutions that they provide, but it also indicates the types of prospective clients that your competitor is aiming to attract in the future. You can use competitive intelligence to piece together exactly who they are targeting.

Another tip is to extract keywords from customer reviews. This method quantifies feedback in a more intuitive way and will save time parsing through lengthy reviews.

Pool together the most common keywords associated with good, bad, and average reviews from you and your competitor’s customers. These results will provide more actionable insight than manually sifting through hundreds of reviews.

Tracking negative user feedback is also a great tool to enable your sales team for future deals. With a thorough understanding of a competitor’s weaknesses, you can deposition them by ‘laying a landmine’.

Looking for another cheeky way to use your competitor’s reviews?

Nick Larson, Sr. Product Marketing Manager at Staffbase, frequently adds a dissatisfied Glassdoor review from a competitor’s employee within his org-wide competitive intelligence newsletter. Okay, so this might not be a tactical piece of intel to use in deals, but it’s a fun and creative way to rally that critical culture of compete within your organization.

Nowadays businesses put a massive emphasis on content.

Whether it is in the form of blogs and social posts, podcasts and videos, or the more granular e-books and case studies, businesses are pumping out content to showcase their brand and establish themselves as thought leaders in their industry.

Before you dive into the world of content creation in order to keep up with competitors, take a step back. Breathe. Use competitive intelligence to determine your strategy and use your time more effectively.

Frequently checking a competitor’s content production will help you build out your own strategy. How regularly are they posting blogs? What are the main topics that they are trying to ‘own’? What calls-to-action are they embedding in their content?

Most importantly, what is the knowledge gaps in how your competitor is covering a given topic that you can take advantage of?

Get ahead of competitors by creating informative content that addresses the pain points prospective customers face. Combine this method with SEO best practices and you will begin to improve your search ranking.

It’s also useful to track how your competitor schedules out their content — maybe they are churning out weekly blogs, but are only running webinars and longer content on a bi-monthly basis. These insights will provide you with benchmarks to assess your own content strategy. You may also be able to dominate an area of content where your competitor is lacking.

Social media is such a vast landscape that it can be difficult to determine what channels are worth your time.

However, there is value in monitoring the platforms that your competitors get the most engagement on, the conversations that they are having there, and how they share their content online.

This will help you devise your own social strategy, unearth new questions that are being asked in your field, and connect with the thought leaders who are providing engaging insights on these topics.

The campaigns that your competitor runs provide fodder for your competitive intelligence research. Diving into their campaigns and supporting ads will arm you with the exact initiatives and messaging that your competitor is focused on and how they want to position themselves.

So, where do you look to research a competitor’s campaigns and promotions? Here’s one place to go.

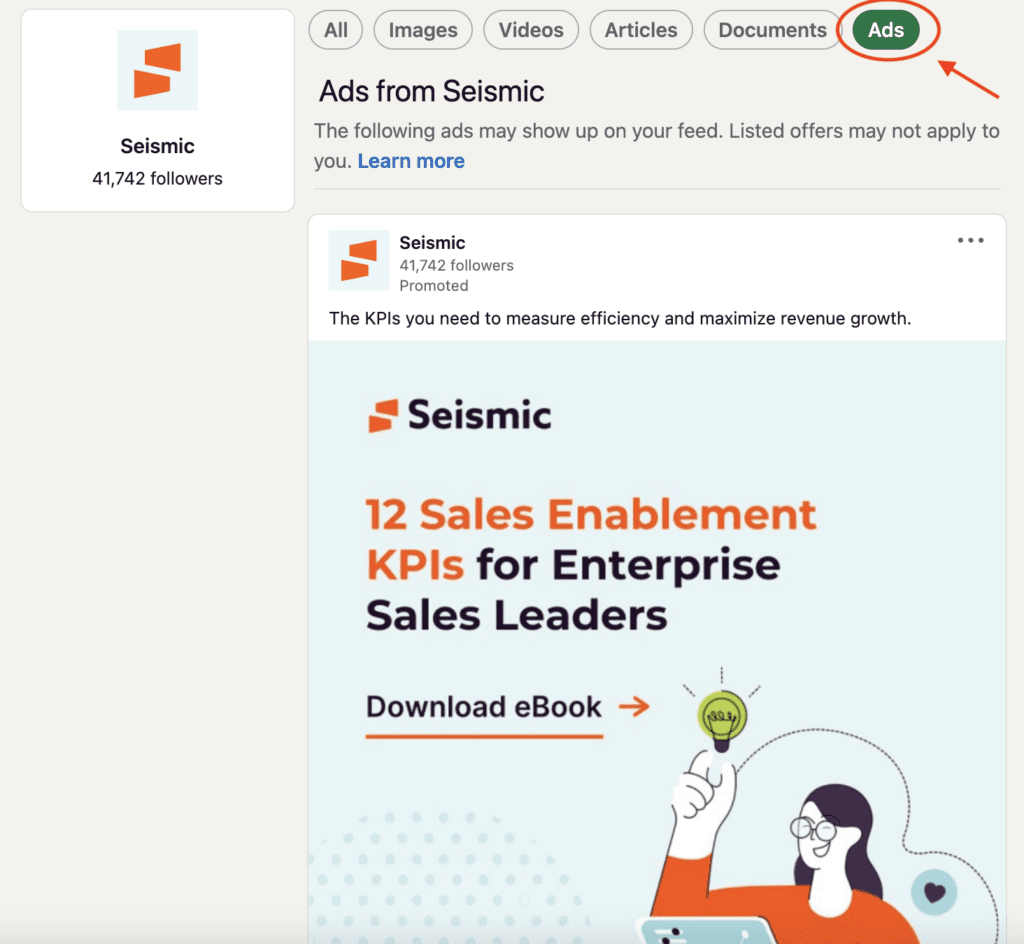

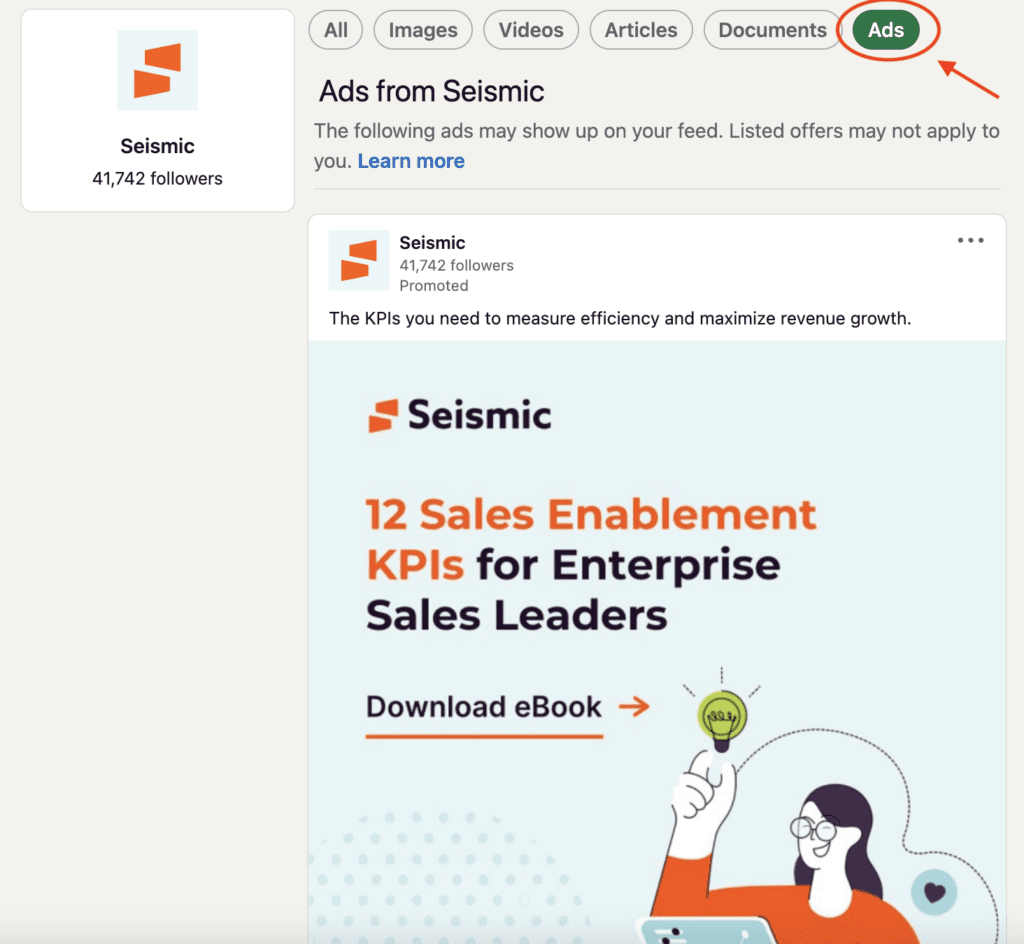

Head over to your competitor’s LinkedIn page. Click ‘posts’. On the right hand side, click the tab ‘Ads’.

Voila. A selection of the ads that your competitors are currently running on their social channels.

A competitor may be highlighting several case studies specifically aimed at how their new product shortened their customer’s sales cycle length. Read between the lines of these campaigns – what was the solution they provided, the size and industry of the customer company, and what was the role of the customer who provided quotes?

This not only spotlights how a competitor wants to position themselves, but it offers a glimpse into what their ideal customer profile looks like. Even more importantly, these bottom-of-funnel campaigns are typically used to close a customer meaning that these case studies should indicate who is currently in a competitor’s pipeline.

The quality of your competitive intelligence program relies on getting insights that scratch beneath the surface of your competitor. The deeper you dig, the clearer the picture.

These external sources for competitive intelligence research will add more ammunition to your program, but don’t forget that the core of your competitive intelligence process should centralize the intel that your customer-facing teams are hearing on a regular basis with customers and prospects.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Competitive Enablement

Product Marketing

If your competitive intel game is too strong for automation, too pure for data privacy, and too rebellious for accuracy — then Klue AI is probably not for you.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X