Klue Compete

The Competitive Enablement Platform

Learn More

FIND OUT MORE >

This article is part of our By the Numbers series, where we share findings from compete data. We analyze aggregated results from maturity assessments, battlecard audits, and more to help your business compete better. Subscribe to Coffee & Compete on LinkedIn to read more data-driven articles on competitive enablement.

Raise your hand if this is a familiar message in your work chat:

‘Competitor X just came up, anyone know anything about them?’

‘Competitor Y is saying this about us, how should I respond?’

As the product marketer leading competitive enablement, you lock yourself away, dial in your research, and build battlecards on all of the competitors that have been mentioned to help your revenue teams the next time these questions come up.

Job done, right?

Then they collect dust. Unused. Left unread.

And you start to see the same questions pop up again…

‘… Hey do we know anything about Competitor X?’

If your blood’s boiling, you’re not alone. And we’ve got the data that explains why your battlecards aren’t getting used.

First off, it’s not that you’re not a valuable resource for revenue teams.

They need all the help they can get to win more business, especially in today’s economy.

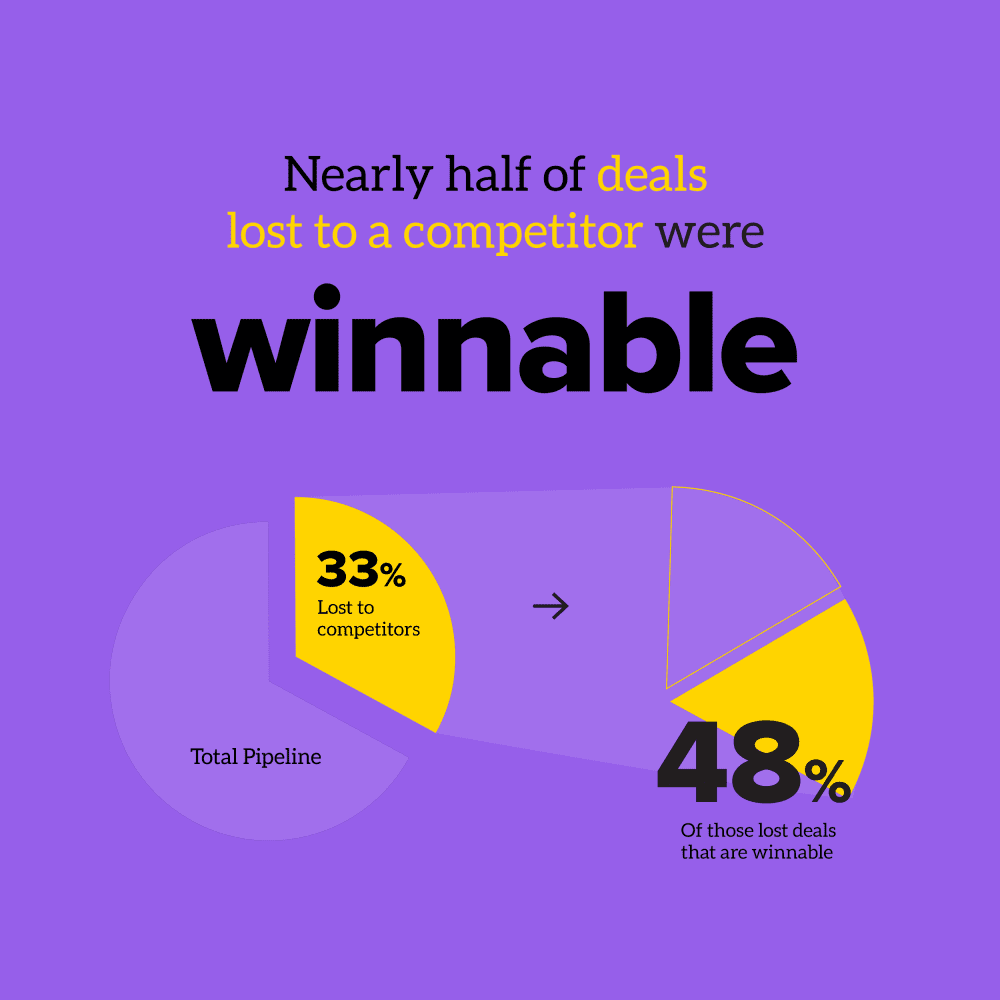

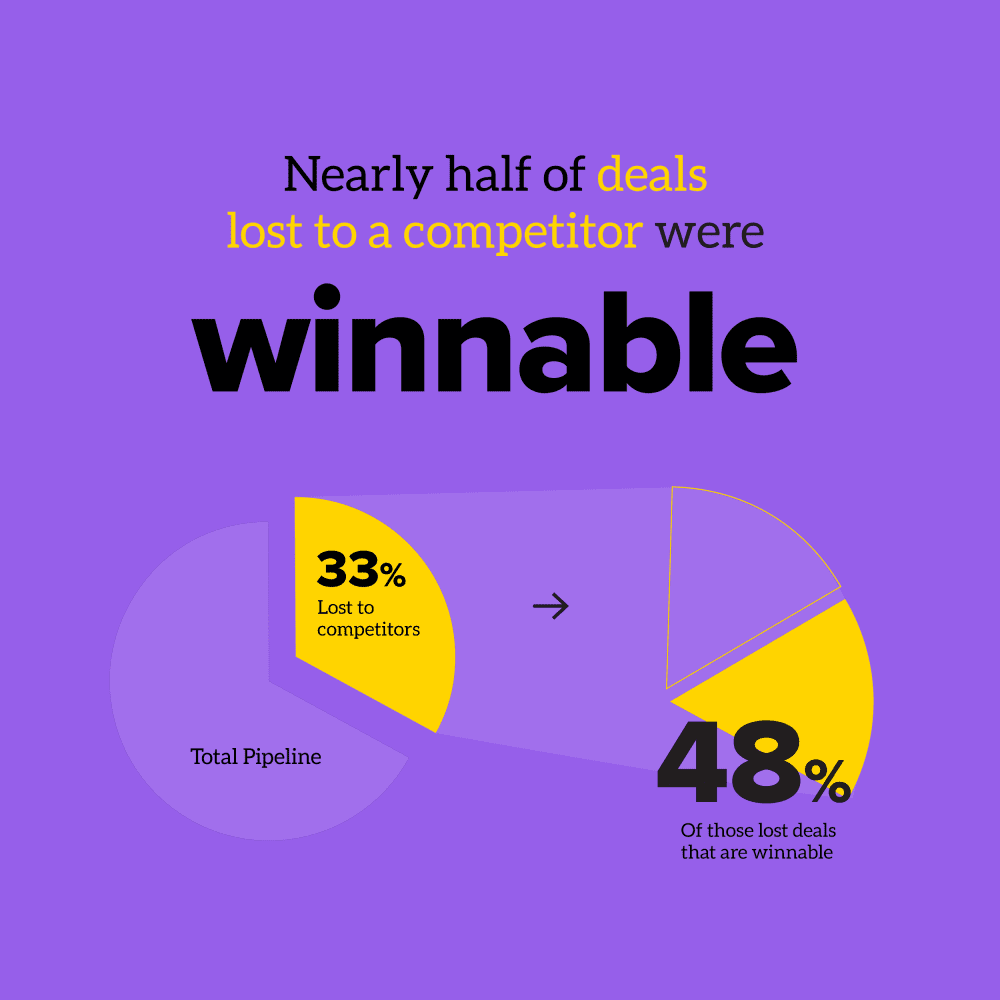

According to the data from our Competitive Revenue Gap calculator, respondents said that 33% of their deals are currently being lost directly to a competitor.

Sure, you’re gonna lose deals to the competition. Babe Ruth didn’t hit a homer with every at-bat.

However, respondents noted that nearly half of those lost deals were winnable.

Ouch.

So, then why aren’t revenue teams using battlecards at their disposal to win more against the competition in these winnable deals?!

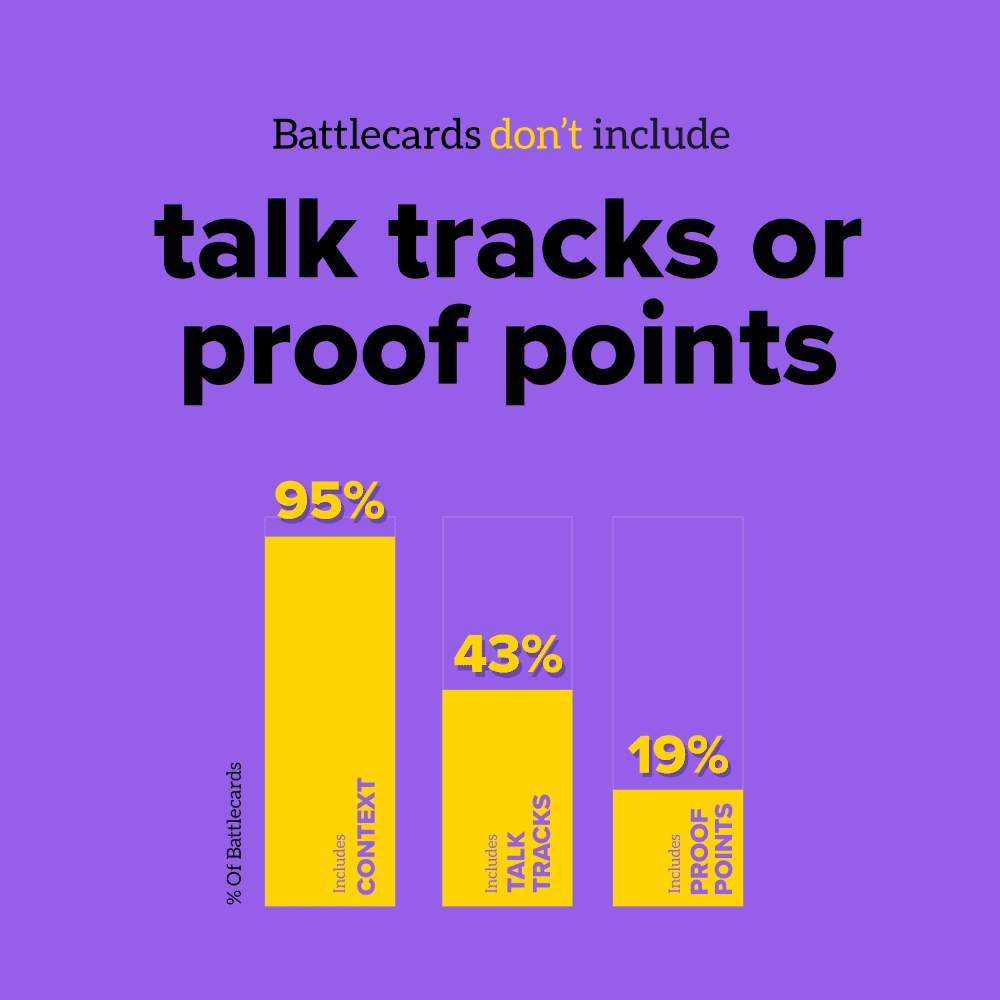

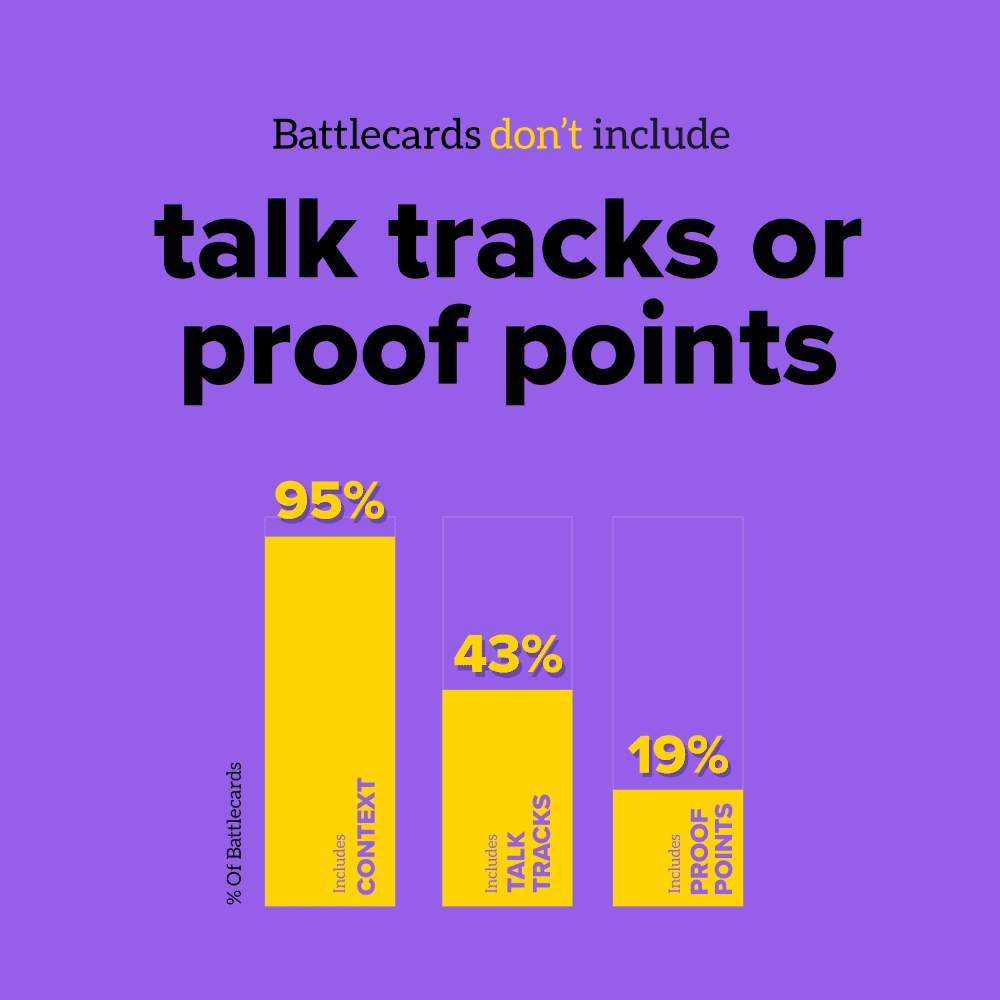

After conducting over 150+ battlecard audits and maturity assessments, then comparing those results to battlecards we’ve anonymously analyzed with the highest adoption rates, a few things stood out.

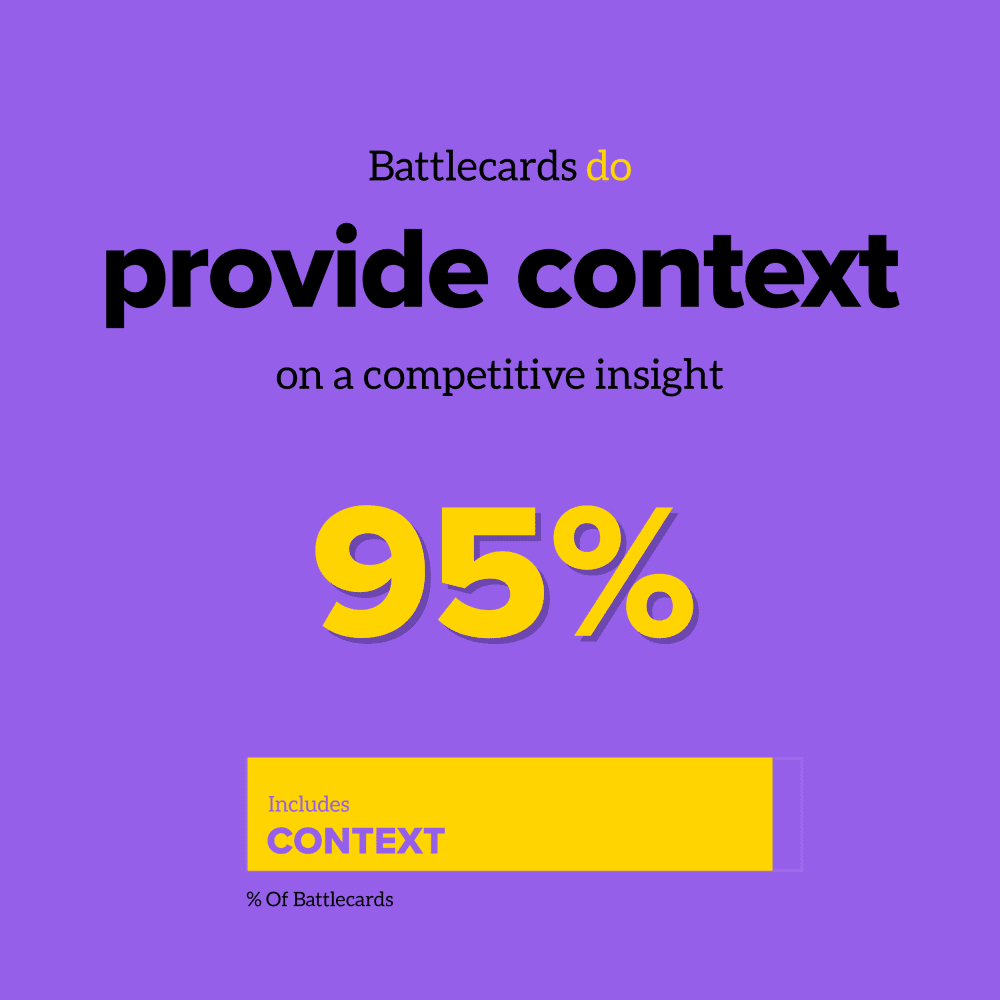

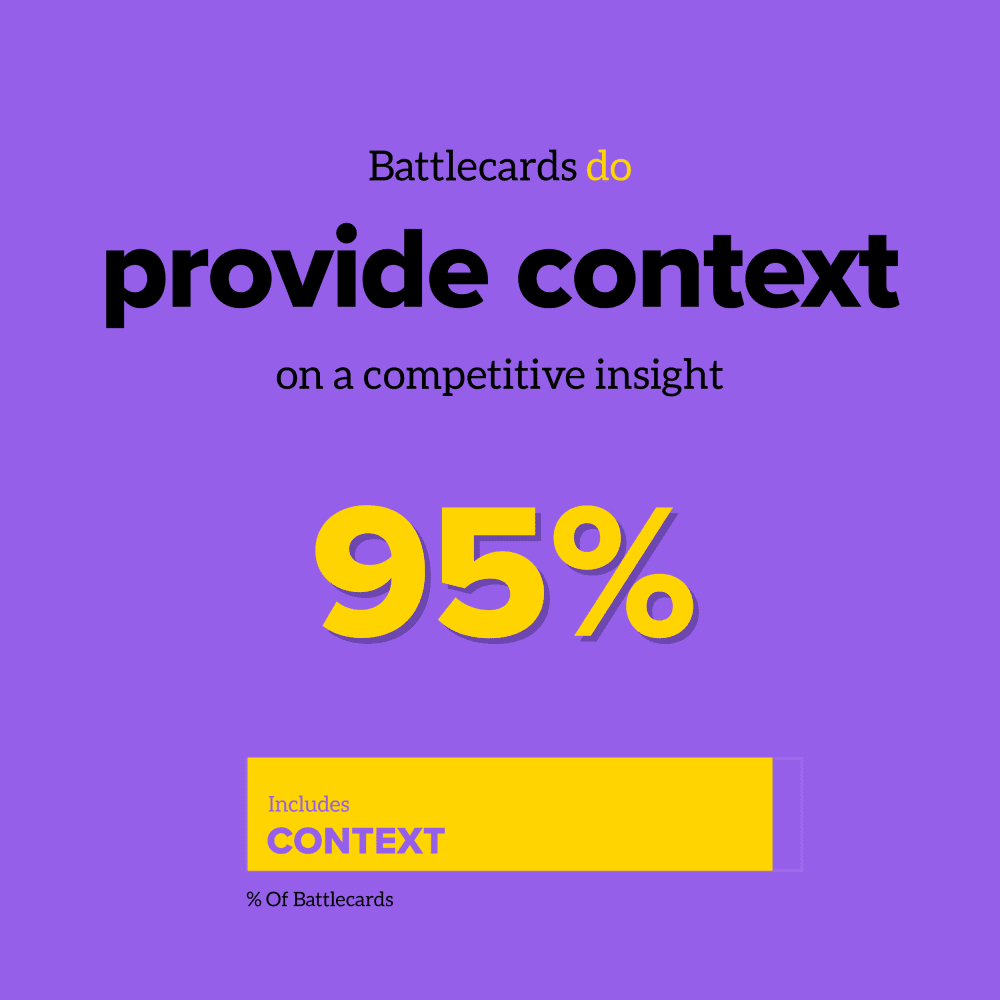

First things first, there isn’t an issue of a lack of information.

In fact, an overwhelming majority of battlecards provide context on the relevant insight or competitor.

But that’s where they stop.

Providing context around a competitor or situation is critical. But it’s table stakes.

How are sellers taking that information and using it to win a deal?

That’s where battlecards are falling short.

Only 43% include talk tracks to use, and 19% provide supporting evidence or proof points to reinforce the information you provide.

Meanwhile, every single battlecard we analyzed with the highest retention rate (meaning stakeholders came back to the content repeatedly) contained this information.

Before you get out your calculators, that’s 100%.

At Klue, we call including these pieces of information into your battlecard as the Know, Say, Show method.

But what is stopping folks from adding Say and Show to their battlecards, then?

Grab these templates to start building sales battlecards yourself.

When Andy McCotter-Bicknell joined me on The Competitive Enablement Show, he shared his biggest screw-up. It’s one that every marketer is guilty of once or twice.

“I was using words like ‘robust’ and ‘seamless’, these gross marketing words within all of these battlecards…

Then a seller offered to give me feedback, and just tore it apart.”

Why do people effortlessly get stuck in the seamless trap of next-level marketing lingo?

Because the talk tracks being built aren’t coming from the sellers’ mouths.

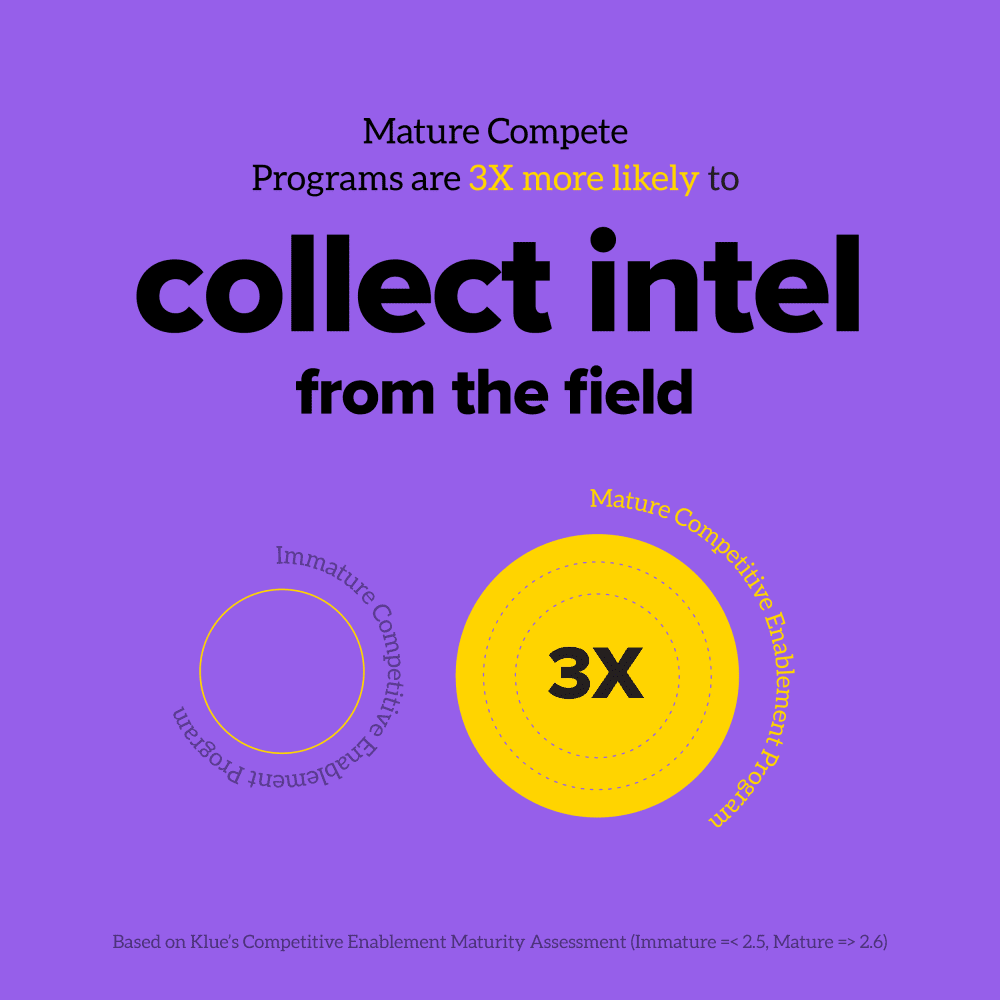

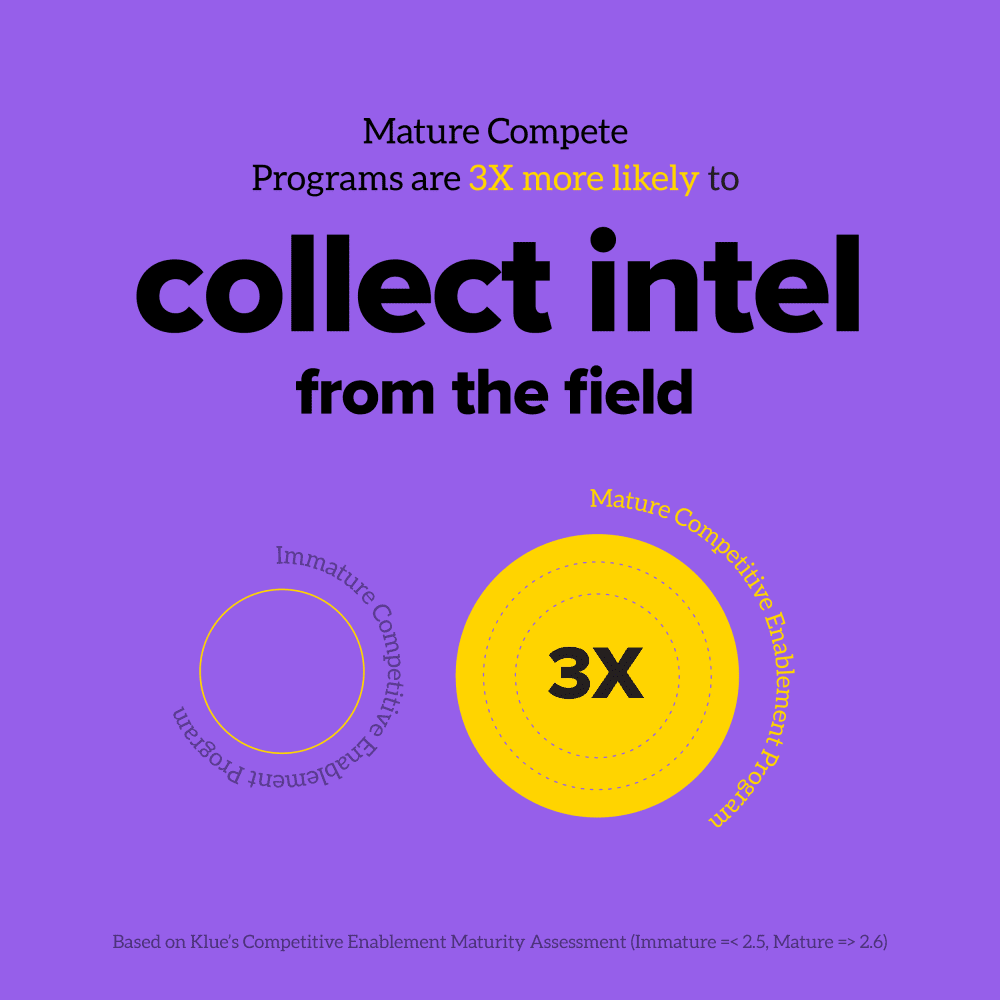

Results from our Competitive Enablement Maturity Assessments showed that business’ with an immature compete program were three times less likely to collect feedback and intel from revenue teams in the field.

That sounds like a recipe for making talk tracks outta thin air, to me.

It’s not on you, the product marketer, to magically create a talk track with just some elbow grease and a can-do attitude. They already exist amongst revenue teams that have sold against a competitor more times than you can count.

Using their language, tactics, and talk tracks automatically improves the credibility of your compete content.

Building a talk track to say isn’t enough to build a deal-winning battlecard that actually gets used.

Because context is everything.

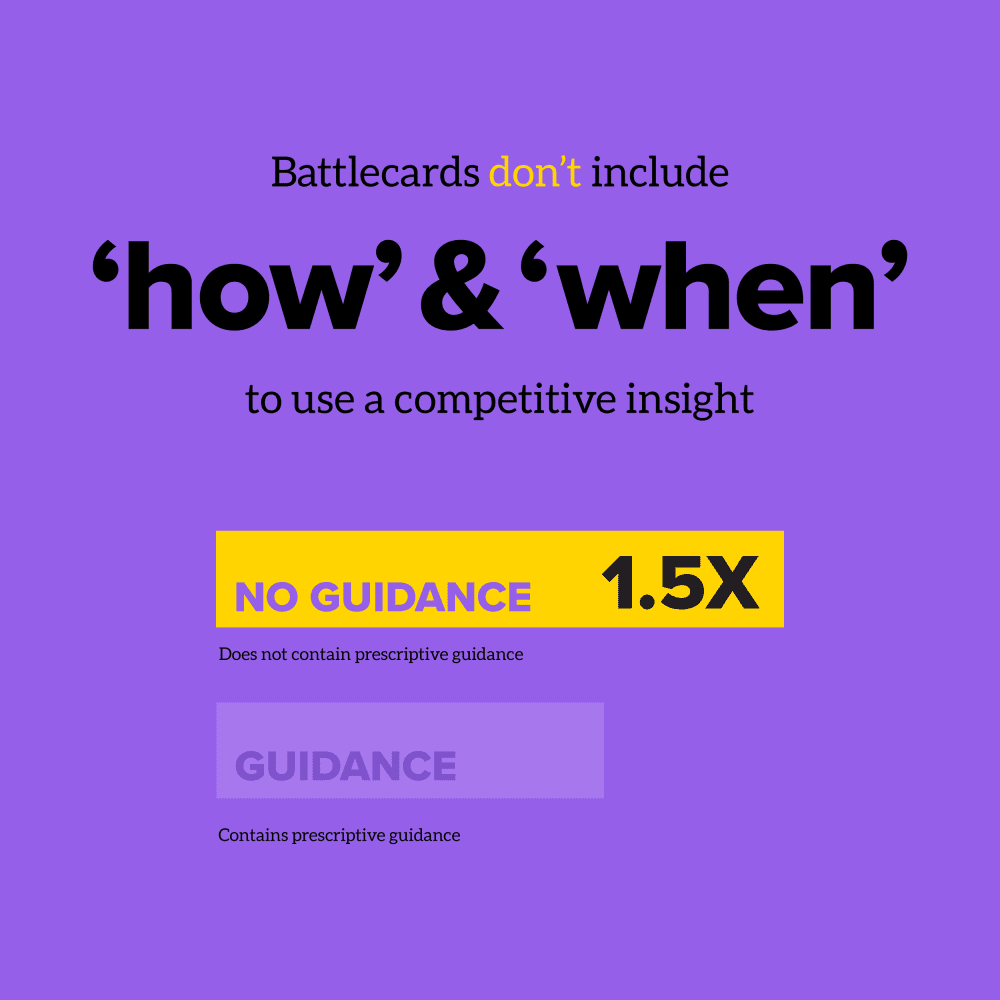

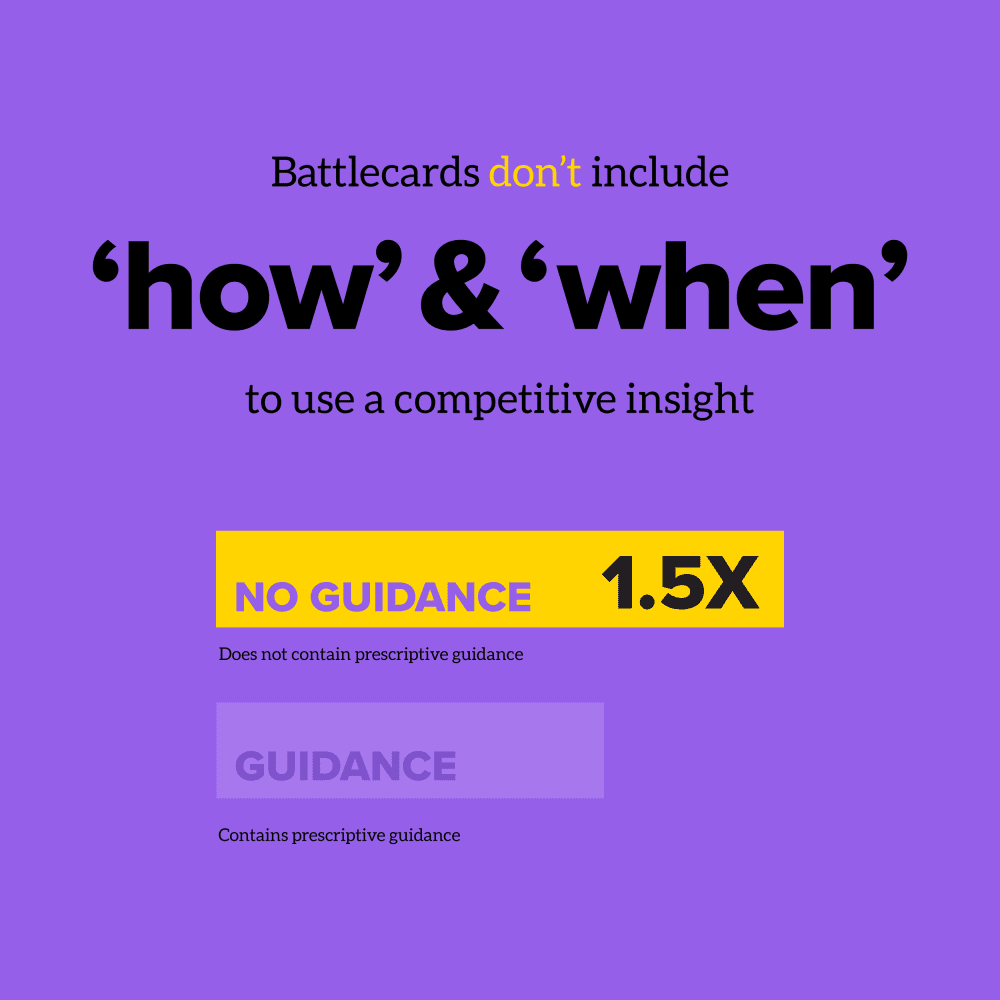

Your revenue teams need to know when to use a competitive insight and how to use it. This is what turns your battlecard from interesting, to indispensable.

However, battlecards were 1.5X less likely to include prescriptive guidance explaining how to use the intel provided, when, and in what situations.

You don’t want your sellers to dive deep into the weeds about how your product functionality stacks up compared to a competitor on an initial call.

Especially when you don’t know if they’re even in the deal yet.

On the flip side, you don’t want reps to rely on de-positioning at a high level in a deal where the buyer used your competitor’s product in a previous role.

Psst… two of Klue’s Competitive Enablement Consultants, Hunter Sones and Sylvia Rainer, dove into this data and shared the tips needed to build battlecards sellers can’t live without. Check out the full episode of Competitive Enablement LIVE here.

Buyers don’t blindly decide to buy a product over other options just because a seller tells them that theirs is better.

You need receipts. Proof points. Validation that you’re not just full of hot air.

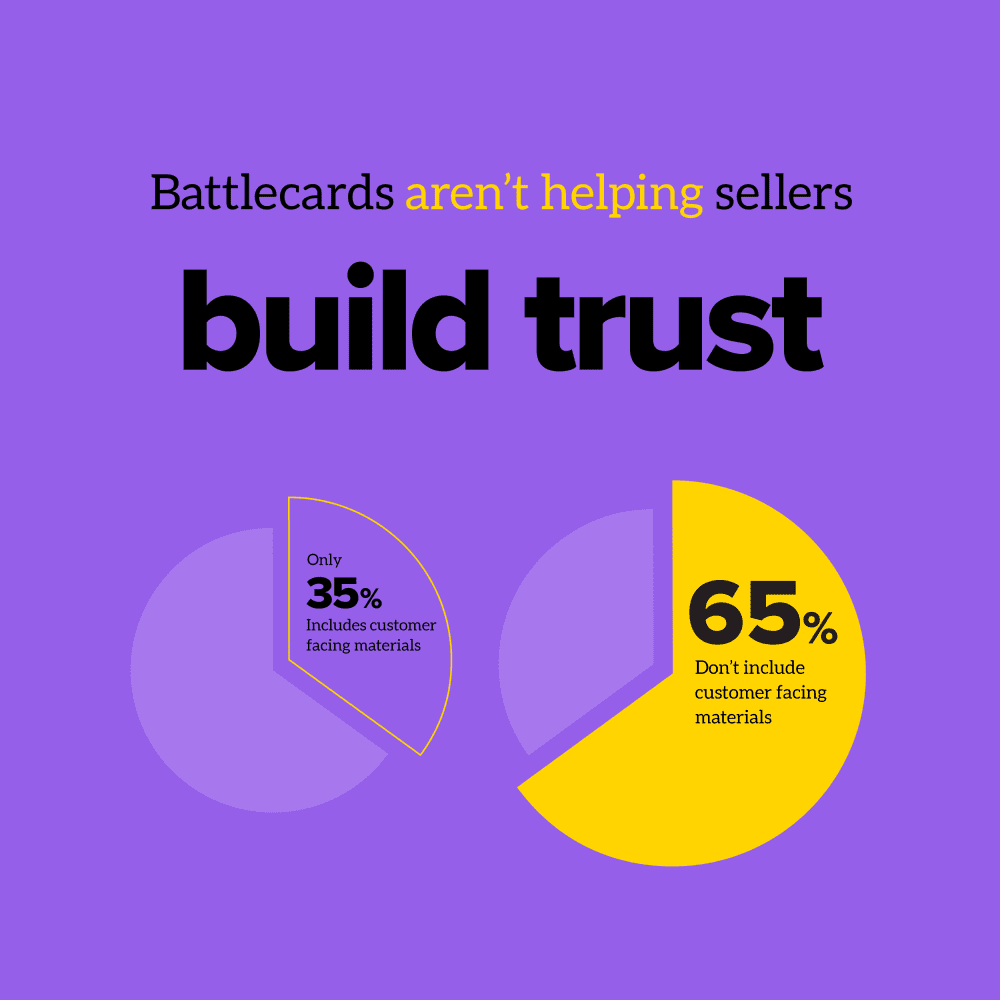

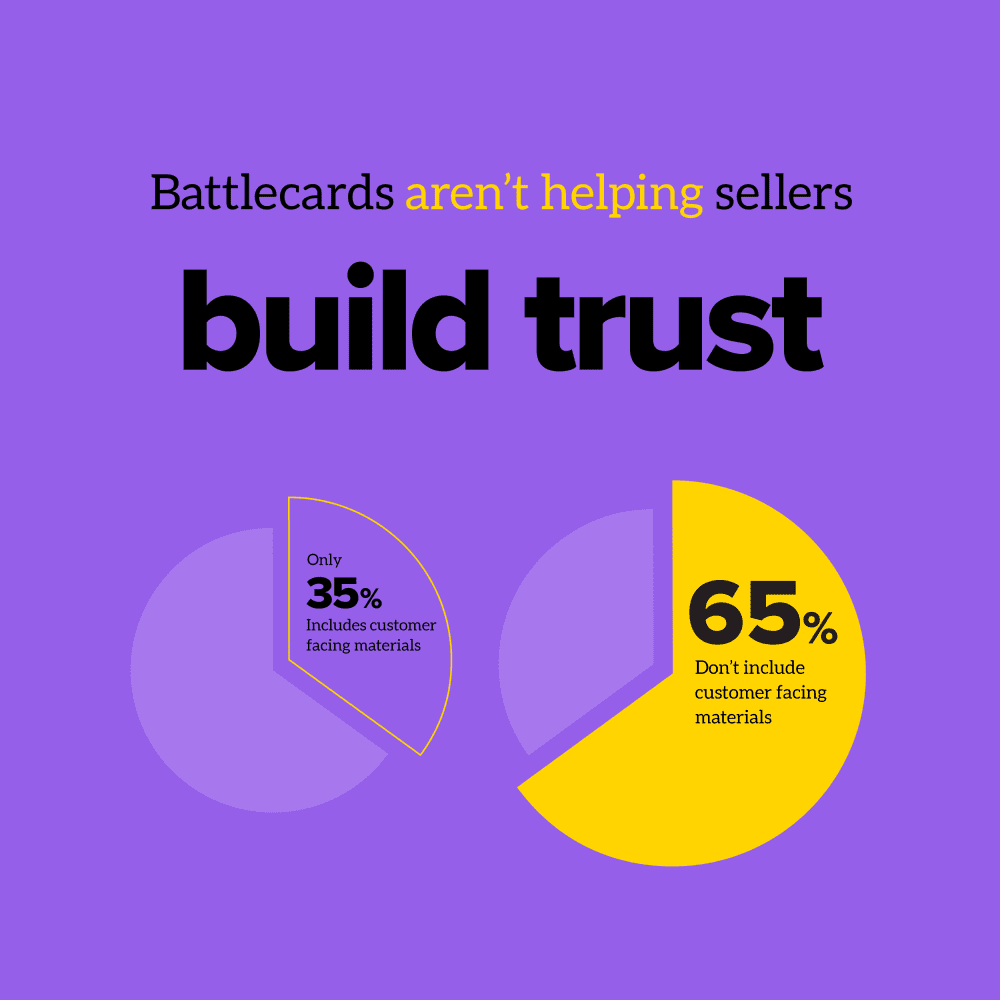

But of the battlecards audited, only 35% of them included customer-facing proof points.

Let’s say your seller is in a deal with a competitor that you knoooowww has crappy customer support.

We’re talking being put on hold for hours with nothing to support you but the sultry tones of some mediocre elevator jazz music.

Your buyer doesn’t know that yet. They haven’t lost those three hours of their lives… yet.

Why should they believe that your customer support is better?

A battlecard with strong reinforcing proof points could include data that shows your competitor’s support team has been shrinking over the past six months compared to yours. Accompany that with a customer reference, and now it’s not just a subjective opinion coming out of your sellers’ mouth.

This is the credibility that makes a competitive claim powerful.

You clearly care about building better battlecards for your revenue team. Great.

This article alone isn’t enough to help you nail the ins and outs of a perfect battlecard.

That’s why we launched our Competitive Battlecards course.

Nine episodes from Klue and industry experts. Four walkthroughs of how to build specific battlecards. Dozens of practical tips you can apply into your battlecards immediately.

This course will help you build better battlecards that actually win business for your revenue teams.

You can check it out for free here.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Competitive Enablement

Product Marketing

If your competitive intel game is too strong for automation, too pure for data privacy, and too rebellious for accuracy — then Klue AI is probably not for you.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X