Klue Compete

The Competitive Enablement Platform

Learn More

How revenue leaders are responding to competitive market conditions

Klue has talked with 300+ revenue leaders to understand their strategies for hitting revenue targets as the market tightens.

Hitting revenue targets has never been more difficult. New business and renewals face more scrutiny and budget constraints.

So, what are revenue leaders doing

as the pie begins to shrink?

When asked what they’re prioritizing today, leaders responded that the priorities most crucial to succeeding in their role this year are:

“When your revenue targets get into the millions and more, you can’t get there with herculean efforts from a few. You’ve got to actually get everybody pulling in the same direction or you’ll hit a wall.”

SCOTT BARMMER

Chief Revenue Officer

Revenue leaders are prioritizing how to maximize revenue and improve performance as efficiently as possible across the business.

However, the biggest threat to achieving efficient revenue growth: More competitors popping up in their deals. Like weeds.

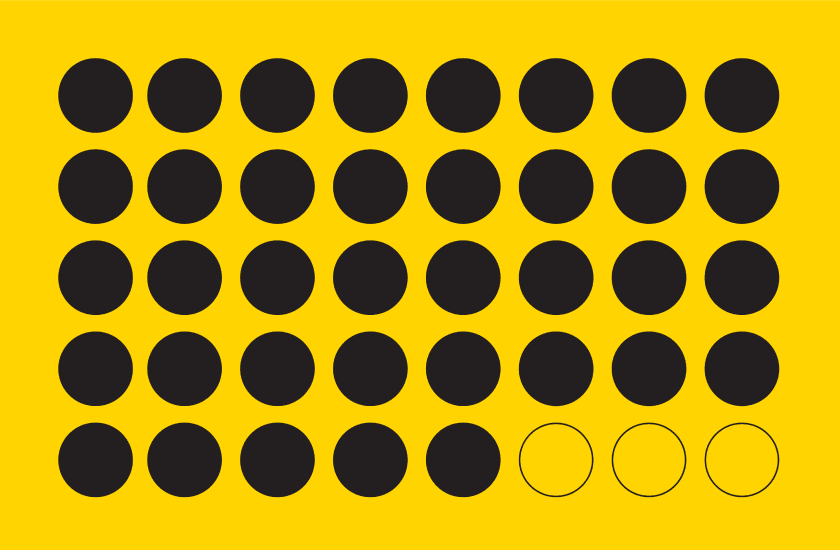

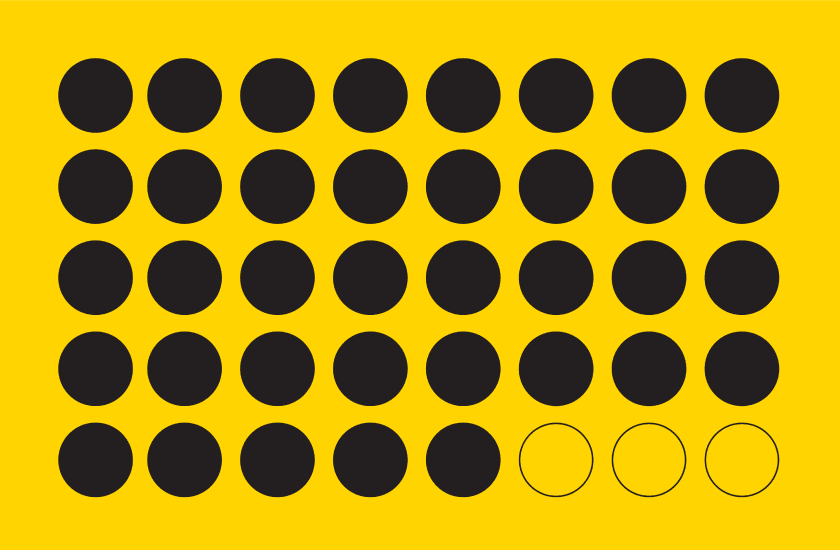

On average, respondents estimated that 21% of their deals were lost directly to a competitor. And of those lost deals,

one in three were winnable.

Losing these winnable deals doesn’t just sting your ego.

These are deals where the buyer has:

84% of revenue leaders noted that losing these

winnable deals negatively impacted their sales efficiency.

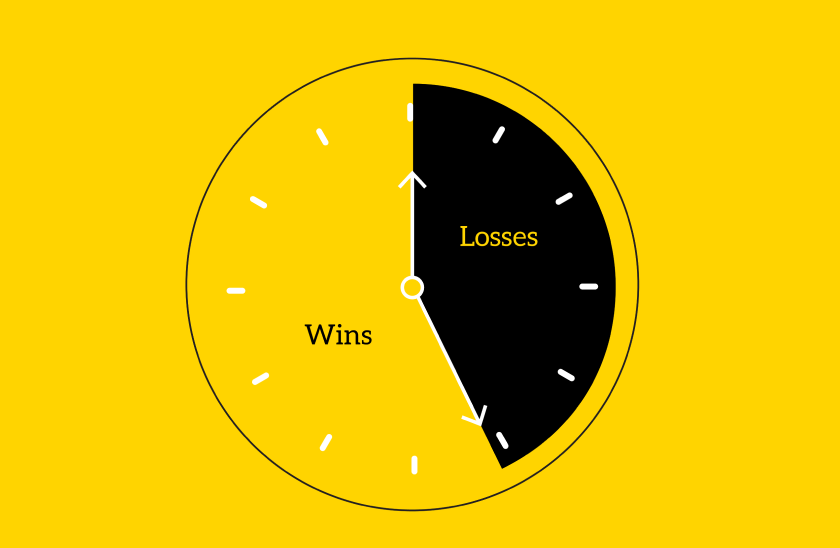

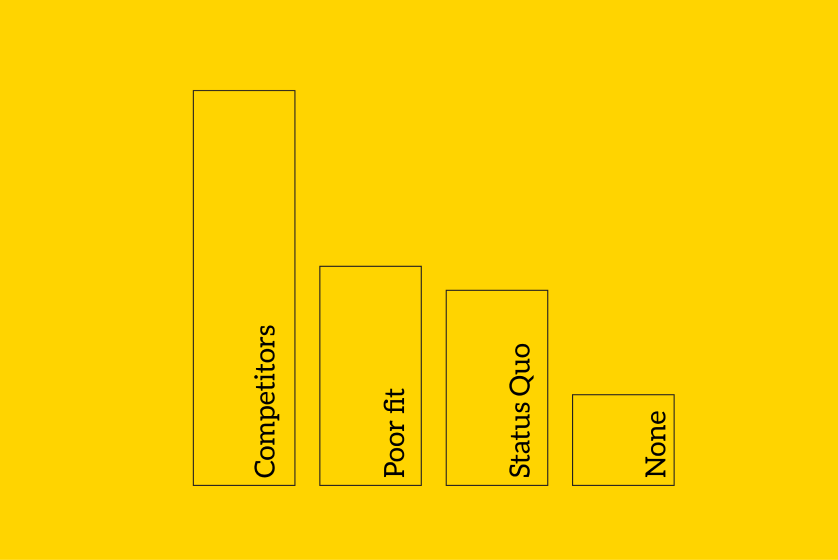

After won deals, competitive losses took up the largest portion of their reps’ time.

Wins: 57%

Losses to Competitors: 24%

Losses due to poor fit: 11%

Losses to Status Quo: 5%

None of the above: 3%

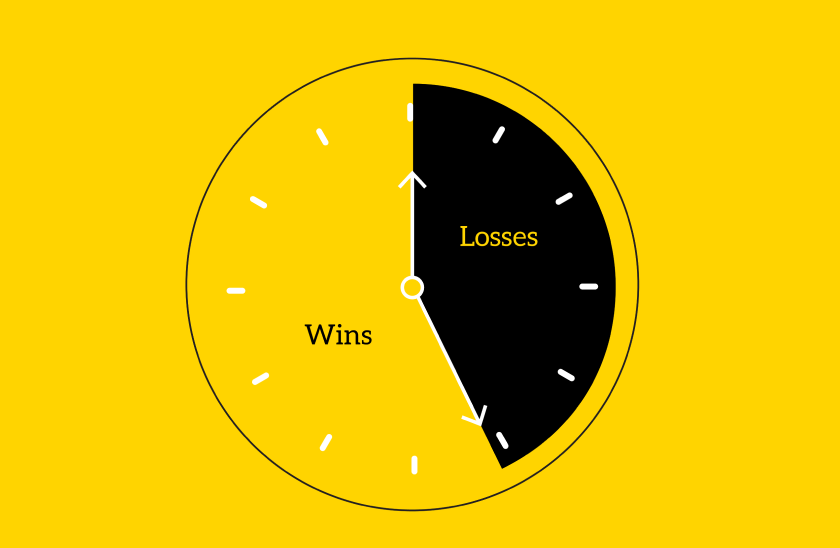

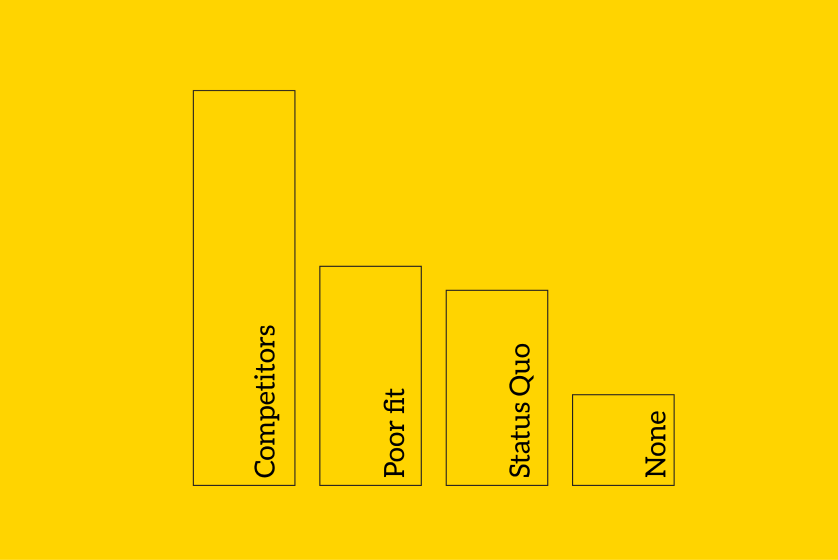

Competitive losses also have the most negative impact on their sales reps’ morale:

Losses to Competitors: 64%

Losses due to poor fit: 25%

Losses to Status Quo: 24%

None of the above: 6%

When asked what was under their control in order to tip those winnable deals and close their competitive revenue gap, respondents said the most effective methods were:

As deals become even more competitive, 76% of revenue leaders said that they’ve seen a greater separation between top performers and low performers on their teams.

“For the last few years, if you stood under the basket, you were going to get points. Now it is harder to win business as there’s going to be more heat in all of these deals. There are more people chasing less pie.”

KRIS HARTVIGSEN

CEO

What separates the best sellers from the rest in competitive markets? Knowing versus executing.

Nearly three in four revenue leaders are confident their reps know their biggest differentiators, but only 30% say their reps can show this differentiated value effectively within a deal.

Sellers are also spotting competitors too late in the deal.

Nearly half (47%) of revenue leaders say that their reps are only picking up on a competitor’s presence in a deal when it gets to the

negotiation stage or later.

13% say that their reps don’t know who they competed

against even after the deal closes.

Closing the competitive revenue gap and hitting targets isn’t just about winning the deals that you should have won.

Customers churning to another solution is a double blow – this is lost revenue lining your competitor’s pockets.

Because of this, customer success teams are now the second most supported stakeholders with competitive enablement in their organization:

93% of revenue leaders say that their company is prioritizing renewal and expansion support for their customer success teams this year.

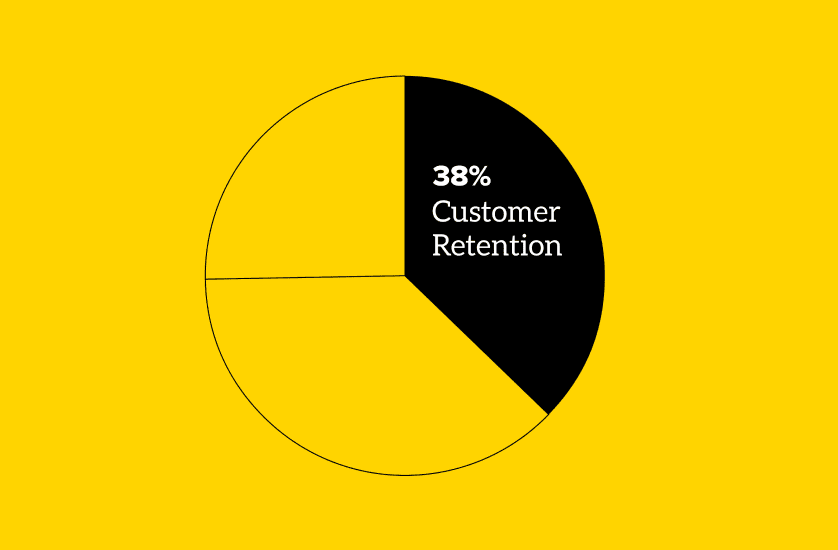

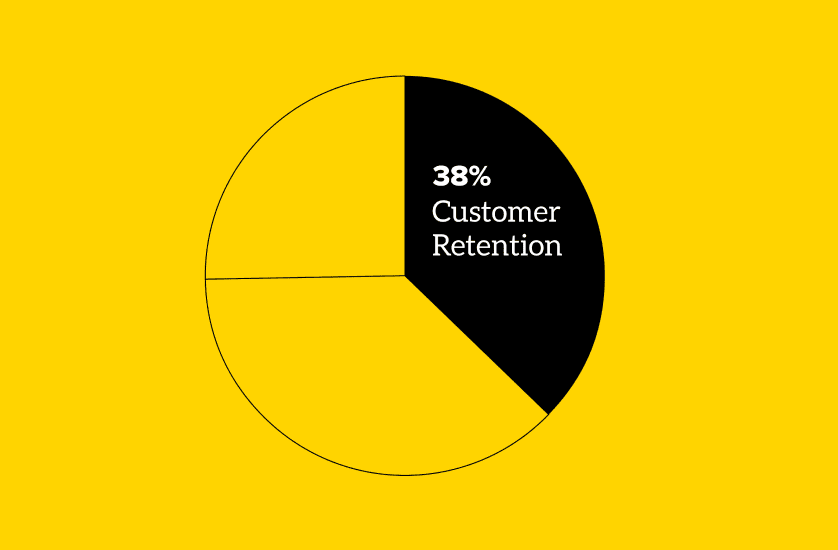

Respondents also say that customer retention is the most impactful revenue stream for hitting targets:

Customer retention: 38%

Net new business: 37%

Expansion within existing accounts: 25%

As markets tighten, businesses go after where there is already budget. Your customer base.

However, revenue leaders don’t have confidence that their customer success teams are equipped or prepared to handle more competitive renewal discussions.

40% are confident that their customer success teams know when a competitor is present during a renewal.

41% are confident that their customer success teams are able to demonstrate differentiated value from competitors during a renewal.

Revenue leaders are increasingly turning to win-loss analysis to win more against the competition. Nearly three in four respondents said that they’re using win-loss analysis within their business.

74% of revenue leaders are using win-loss analysis within their organization

Quantitative

82% are conducting quantitative win-loss research

Qualitative

49% are conducting qualitative win-loss research.

Leadership teams are most commonly reviewing these

insights on a quarterly cadence:

Those that aren’t using win-loss analysis are losing ground

to the competition…

Respondents not using win-loss analysis were 86% more likely to say their business does a poor job of understanding competitor strategies.

Respondents not using win-loss analysis were twice as likely to say their business does a poor job of developing strategies to stand out in the market.

Only 52% of revenue leaders say their organization quantifies the lost revenue to each competitor within their market.

Identify what competitors are your biggest threat to hitting targets this year by quantifying and closing your Competitive Revenue Gap.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X