Klue Compete

The Competitive Enablement Platform

Learn More

FIND OUT MORE >

Wouldn’t it be nice to know exactly what your stakeholders wanted from your competitive enablement program? A little truth serum, perhaps?

Well, we decided to take out the guesswork and ask them in our 2021 Competitive Enablement Report, the first-ever report on competitive enablement.

We’ve gathered data from over 300 stakeholders and 200 CI & Product Marketing leaders from across the globe in order to identify what stakeholders (and the C-Suite) want from your competitive enablement program. There are also firsthand insights on how competitive enablement drives value to some of the leading high-growth companies like Slack, Salesforce, and Hootsuite.

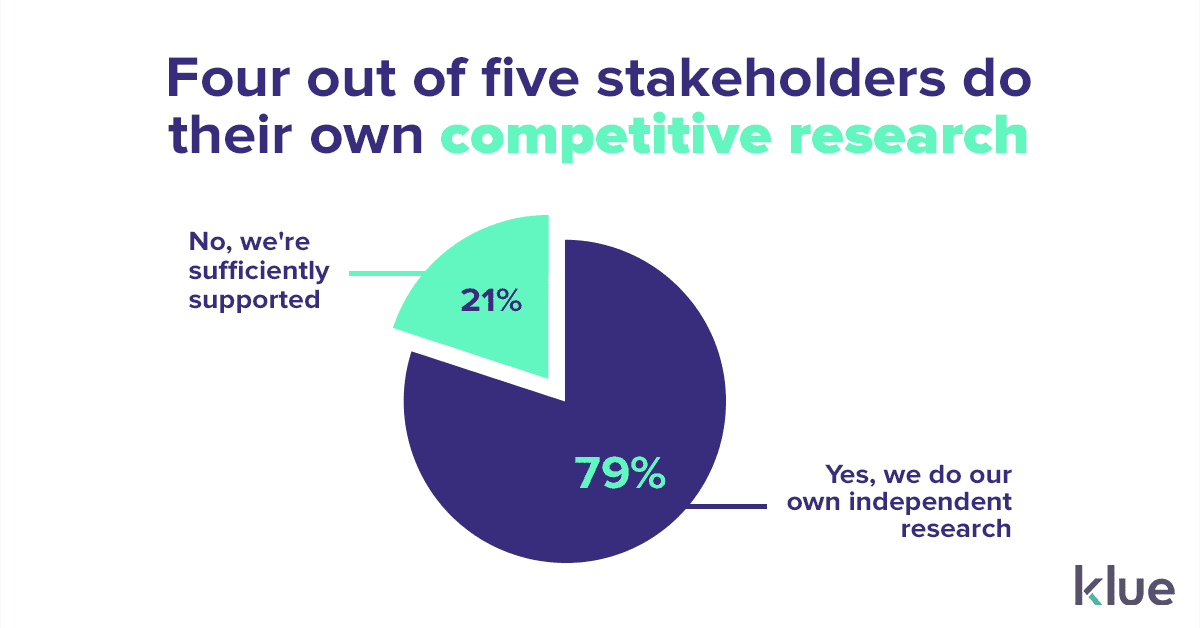

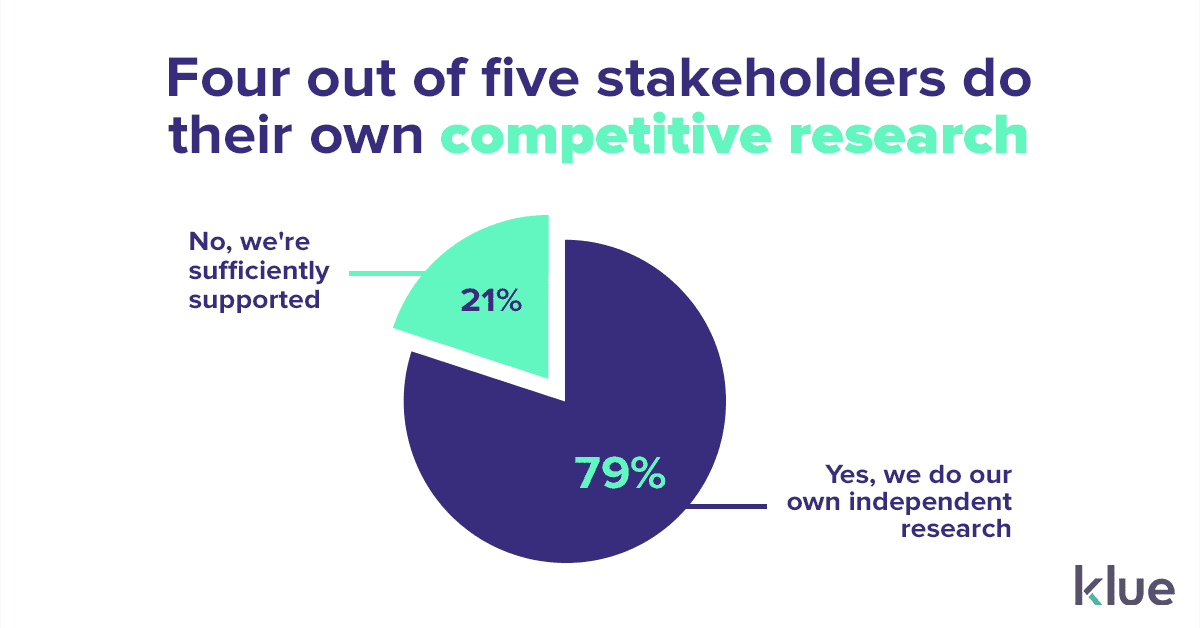

Despite competitive intelligence professionals and stakeholders near unanimously (99%) saying that competitive intelligence is important to their company, our report found that nearly 80% of stakeholders are having to conduct their own independent competitive research outside of the function.

Quite frankly, that’s way more than we expected. In this report, we’ll dive further into WHY this is happening, and what opportunities this presents for your competitive enablement program.

Here are the ten biggest takeaways from the 2021 Competitive Enablement Report.

Four out of five stakeholders doing their own competitive intelligence independently is not a good sign for the effectiveness of the competitive function in their company. Although 44% responded that they are primarily responsible for competitive intelligence, another 34% felt that they need to go beyond the intel that they were being provided.

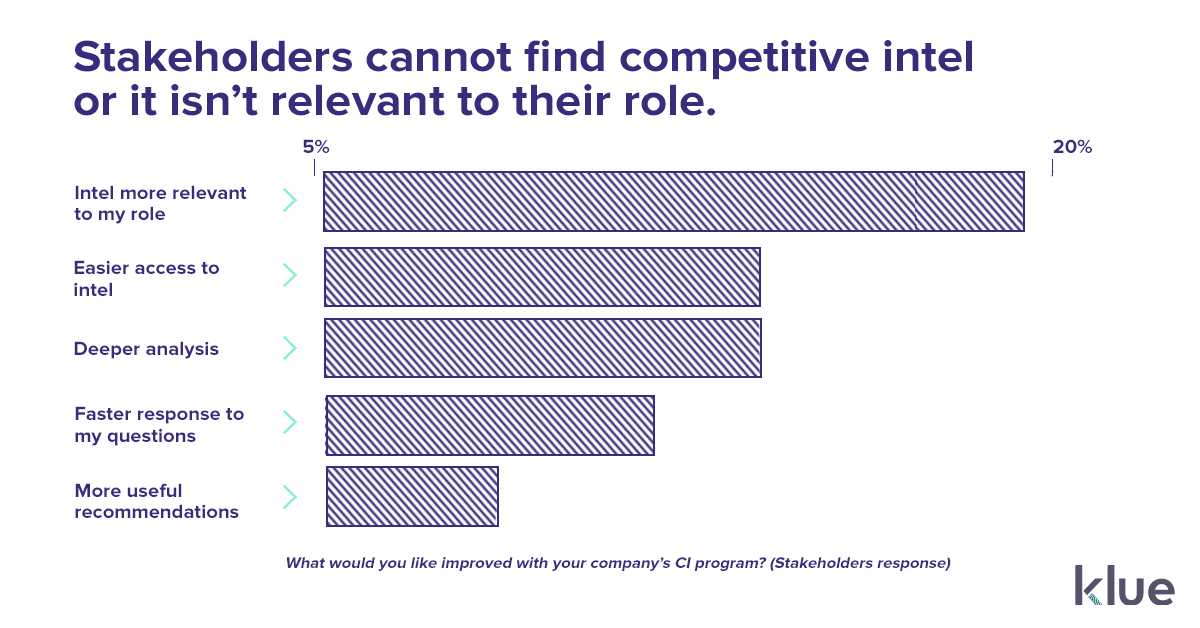

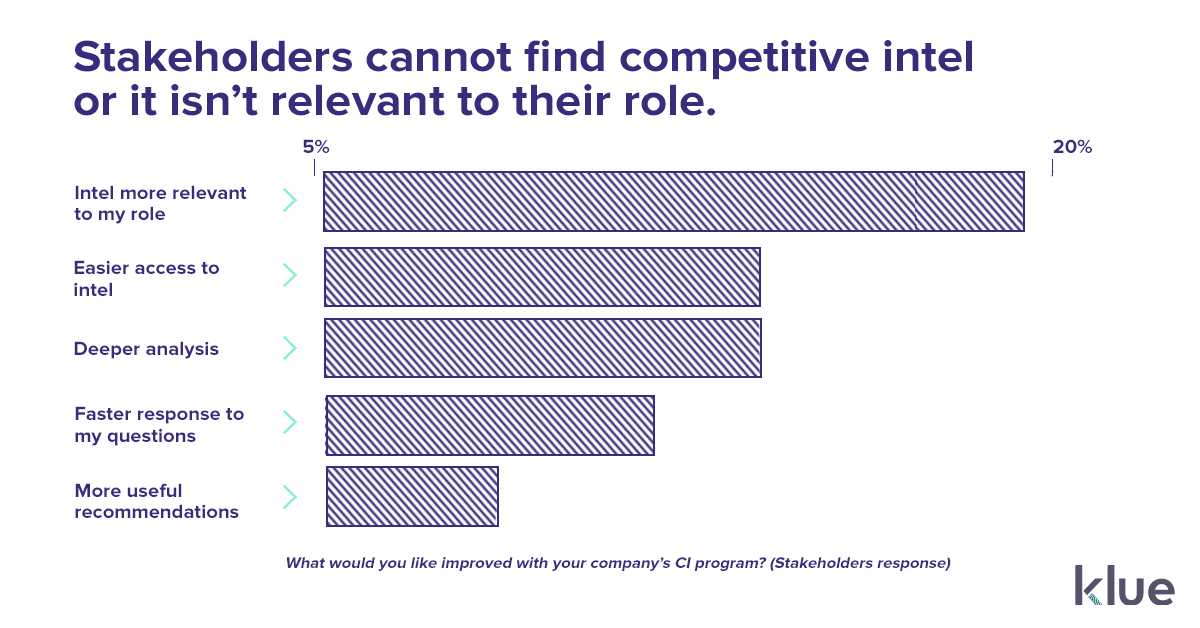

The two primary reasons that stakeholders conduct their own competitive research is because current competitive intel isn’t helpful (18%) or it is too hard to access (14%). Consumers of CI aren’t getting the competitive insights that they want, when they want it.

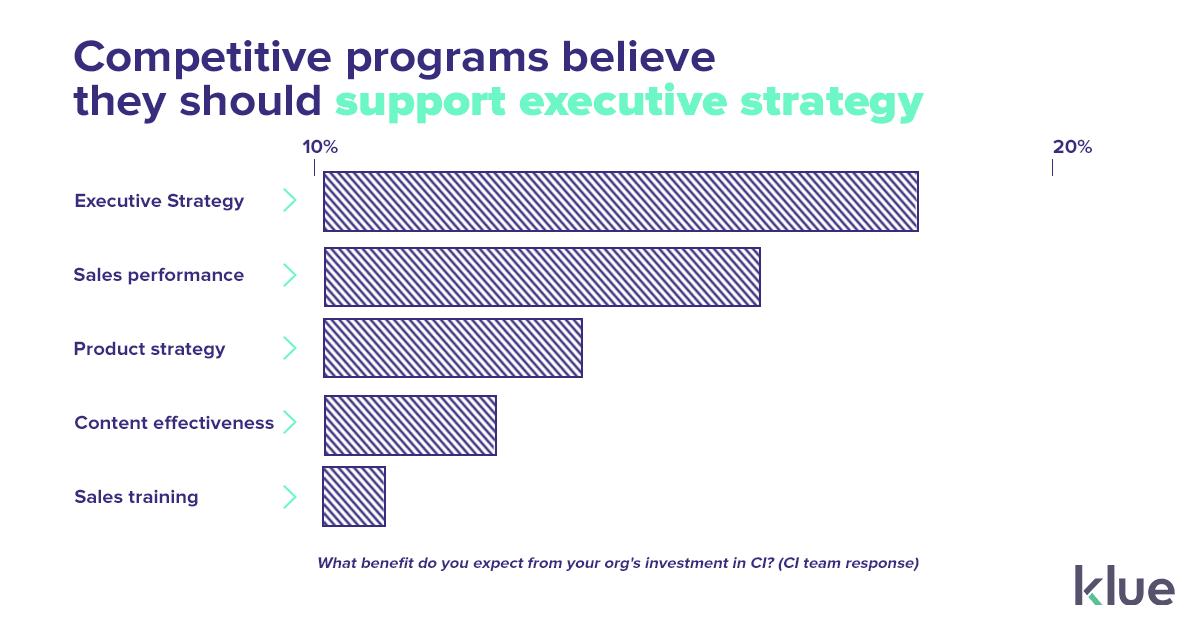

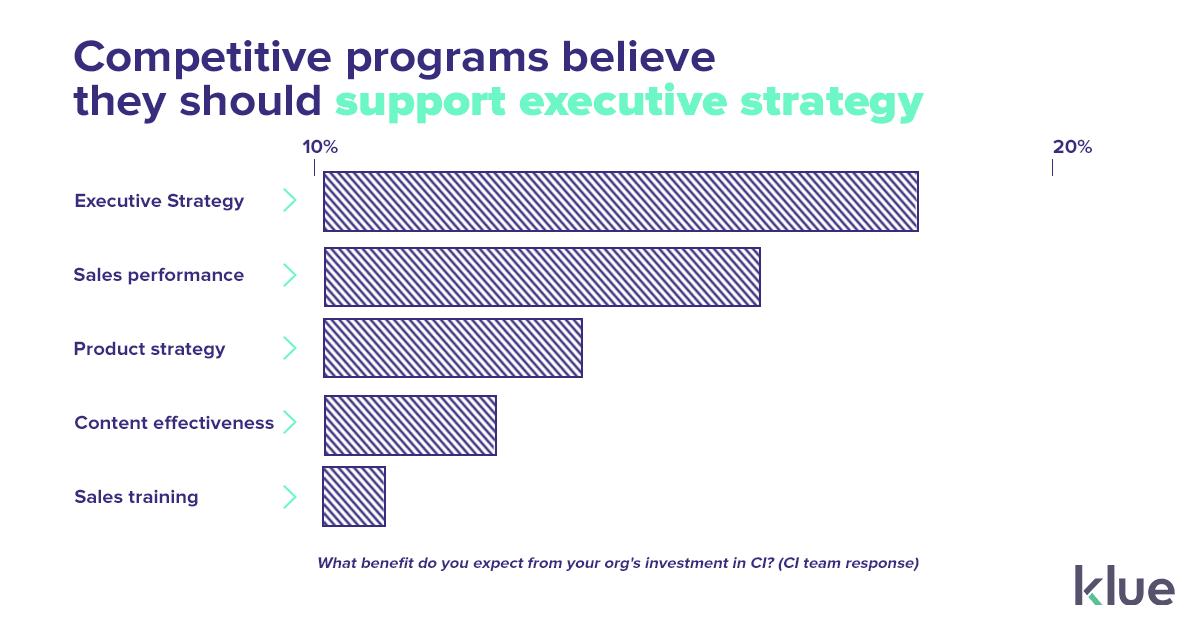

Uh oh, a misalignment you say? Competitive teams rated supporting executive strategy as their most important contribution to the organization…

…while stakeholders feel that competitive intelligence should primarily support sales performance. They also drastically differed on the importance of customer retention, as it didn’t even crack the competitive team’s five most important benefits.

The C-Suite ranks customer retention as the greatest benefit that they expect to see from investment in competitive intelligence, followed by improved sales performance and product strategy. Ironically, decision-makers prefer competitive intelligence to serve revenue teams above helping themselves with strategic insights.

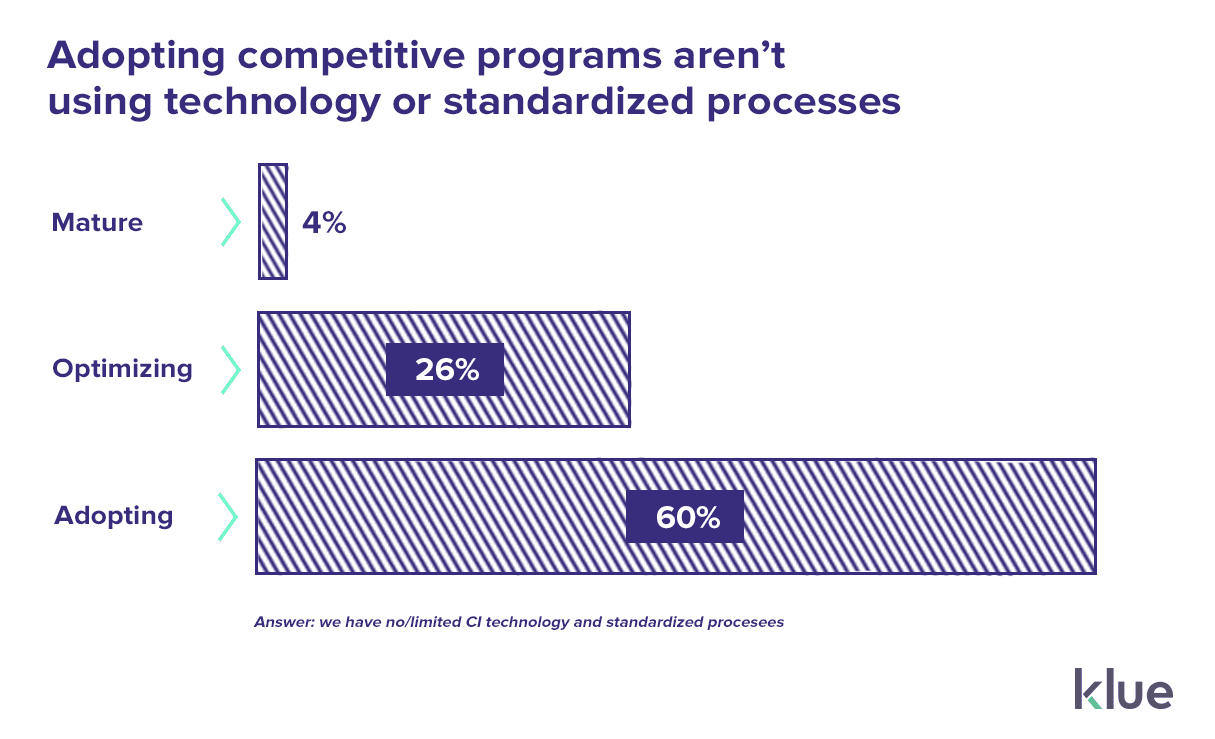

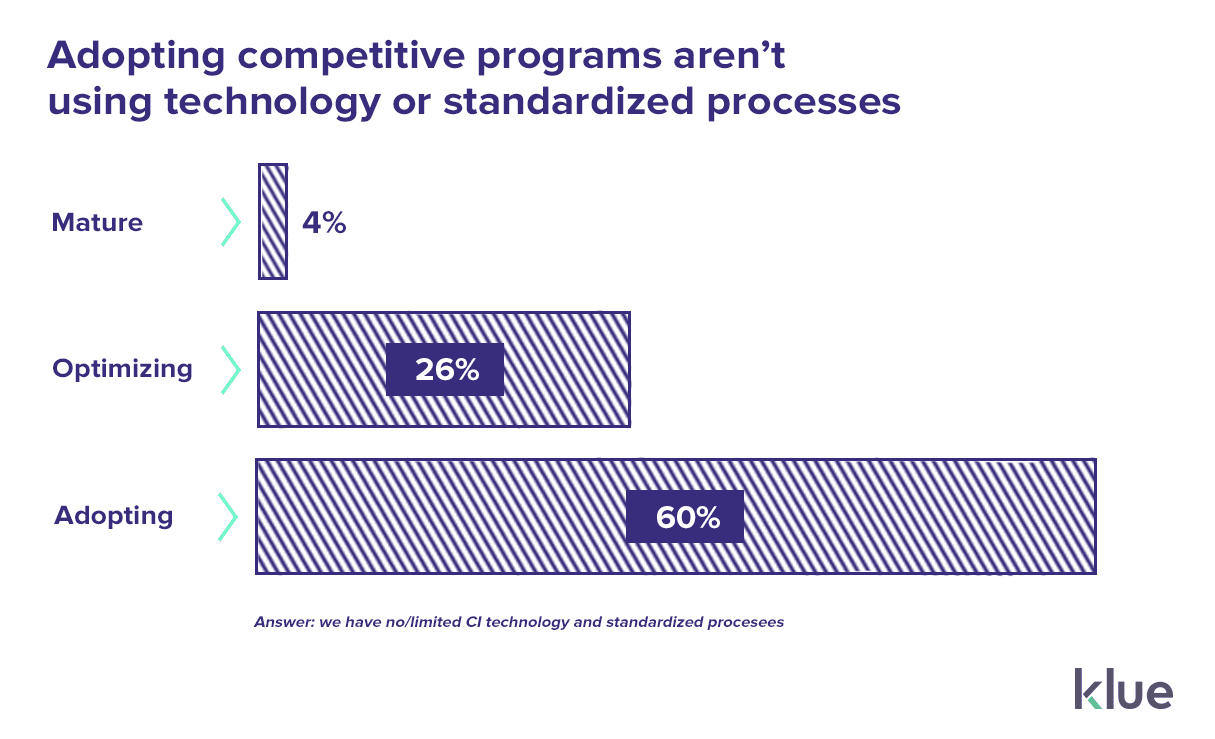

Six out of ten ‘adopting’ competitive programs have little to no CI technology or standardized processes. On the other hand, this is one of the defining features of ‘mature’ competitive programs, who nearly unanimously (96%) have some level of standardization. Not having this process nor technology established makes it difficult to build a scalable and repeatable competitive function.

Mature competitive functions are bringing in various departments to collaborate in the competitive process. They primarily use an ongoing, cross-functional approach (48%).

This engages multiple teams in the collection of intel, but also having a SWOT team of stakeholders across various teams ensures that the intel will also provide organized deliverables for all departments. In contrast, adopting functions are mainly relying on ad hoc projects (28%).

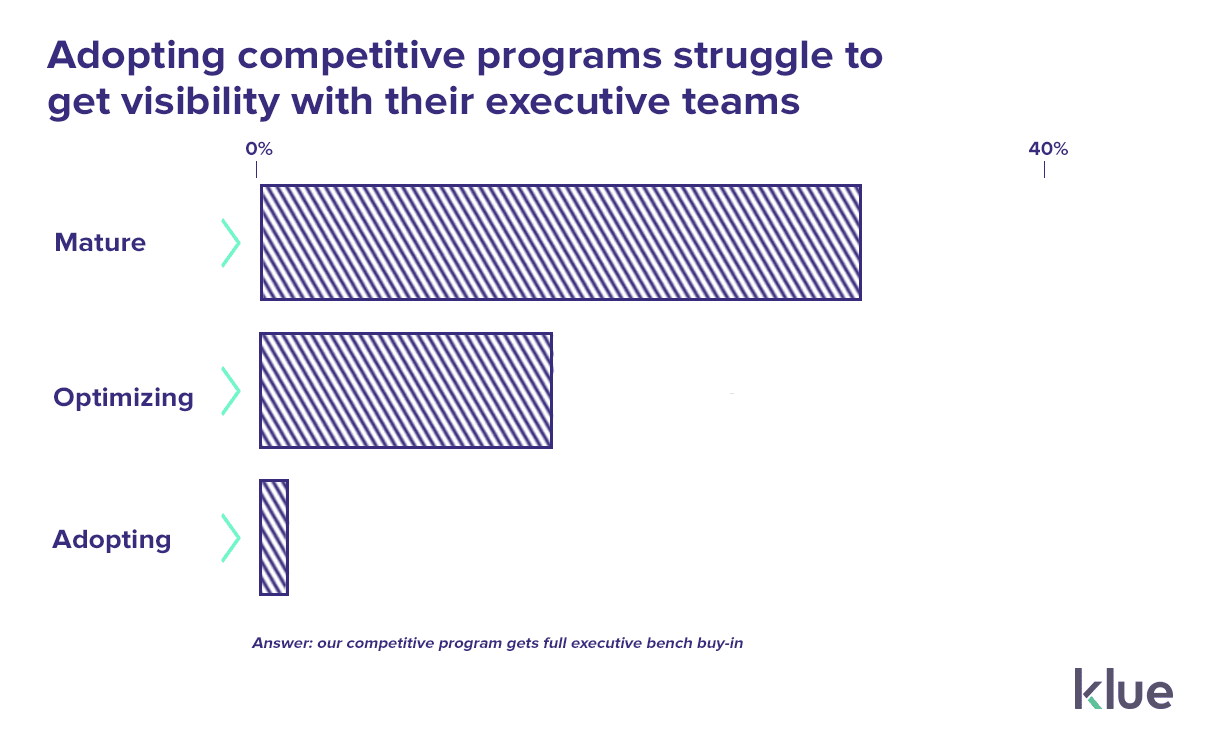

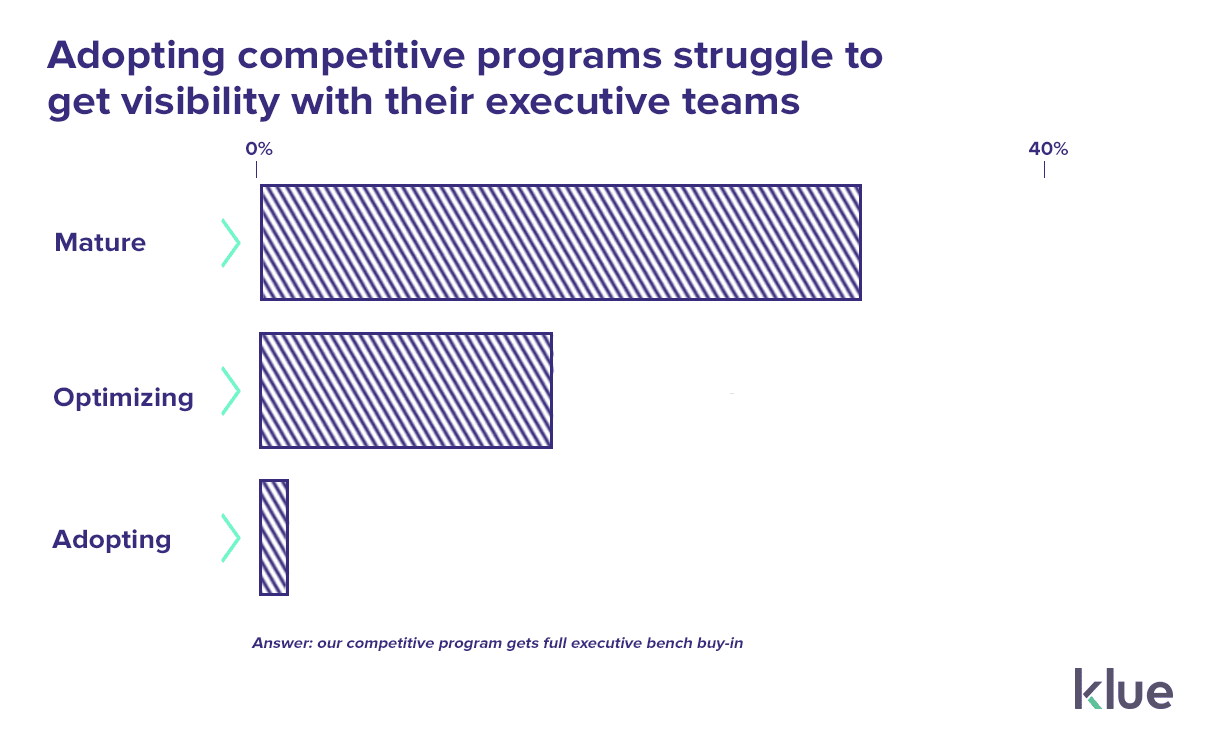

Less than 2% of adopting competitive functions have full executive buy-in. They may be visible in the company, but they don’t have a seat at the table.

Whereas two out of three mature competitive functions are either receiving executive sponsorship or full executive buy-in with their program.

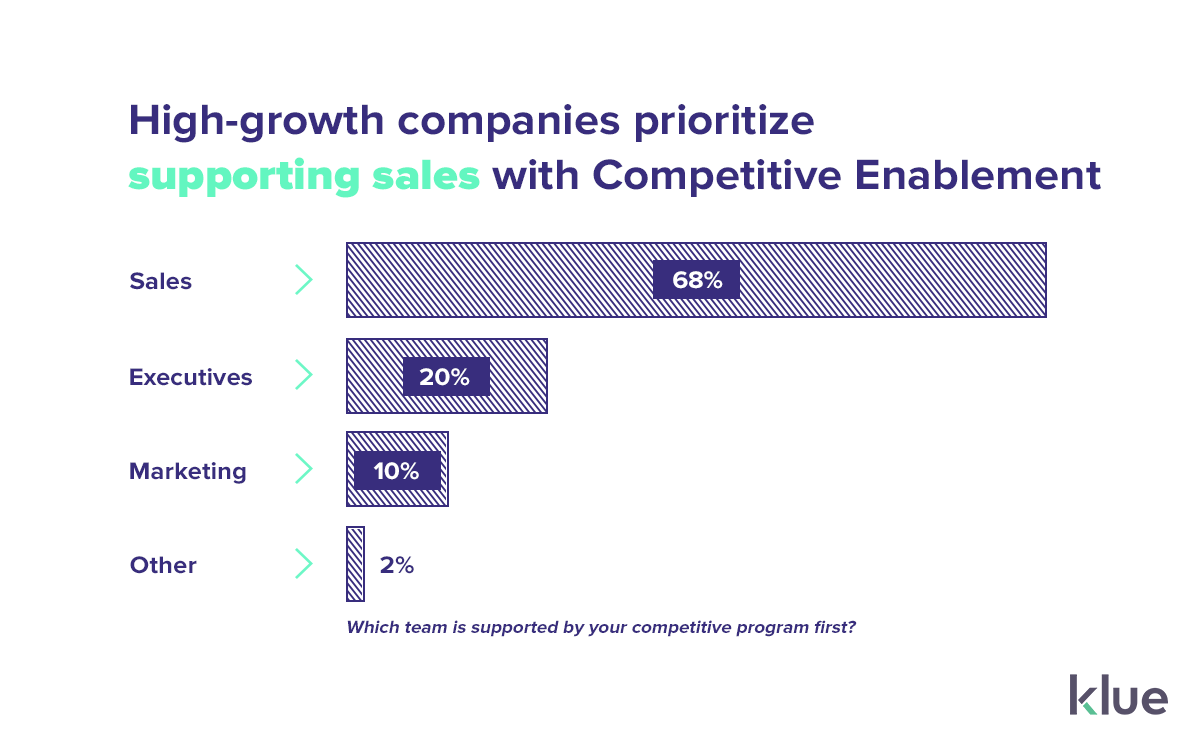

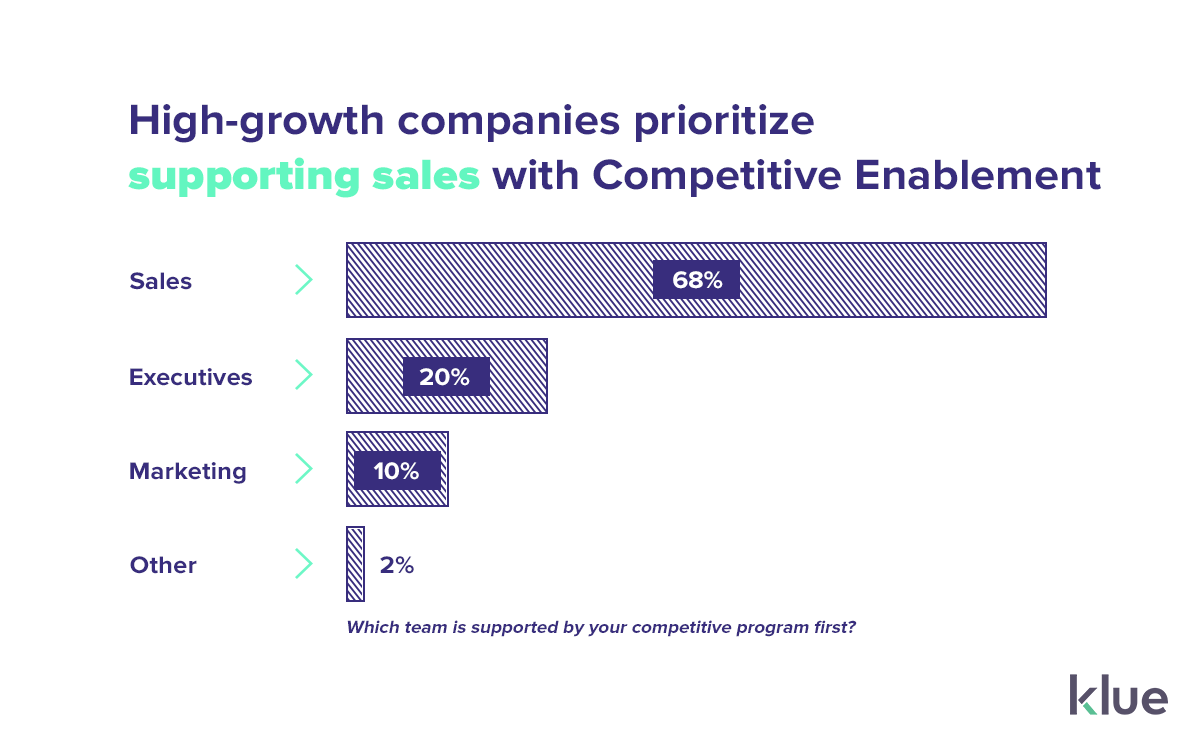

Competitive enablement programs in high-growth companies are overwhelmingly supporting sales teams (68%) first, before any other department. They’re also using revenue-based KPIs to demonstrate ROI of CI activities. On the other hand, only 31% of slower-growth companies say that sales are their main priority.

The greatest problem stakeholders at high-growth companies face are that their competitive intel is scattered across the organization (19%). This was noted twice as much as the next biggest problem – intel being shared irregularly (9%).

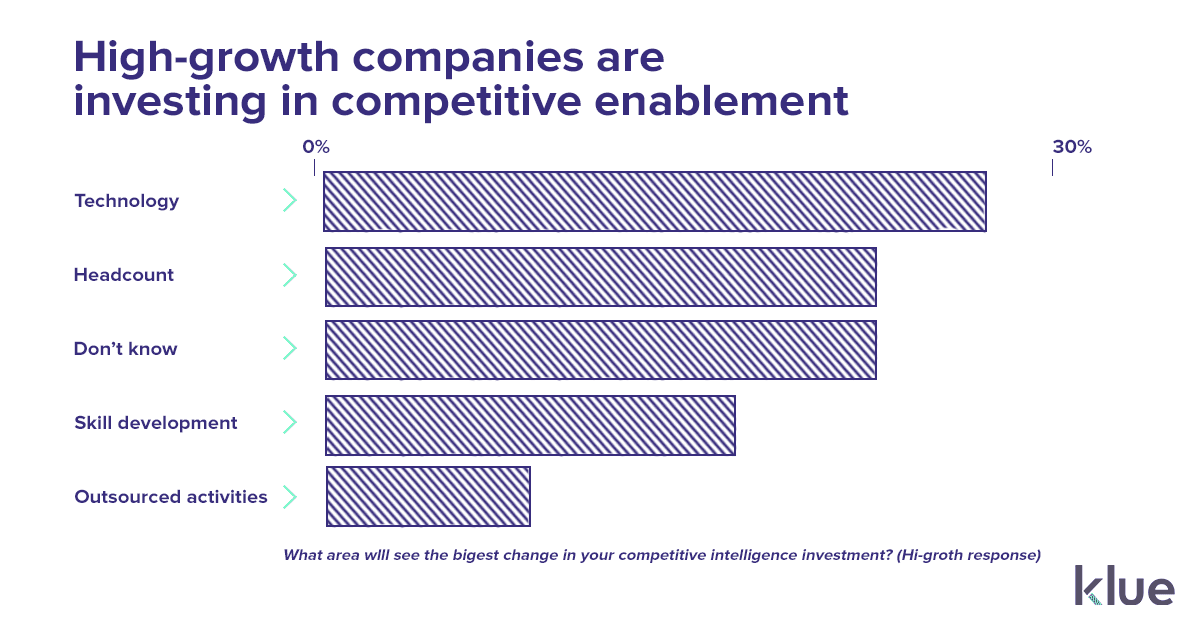

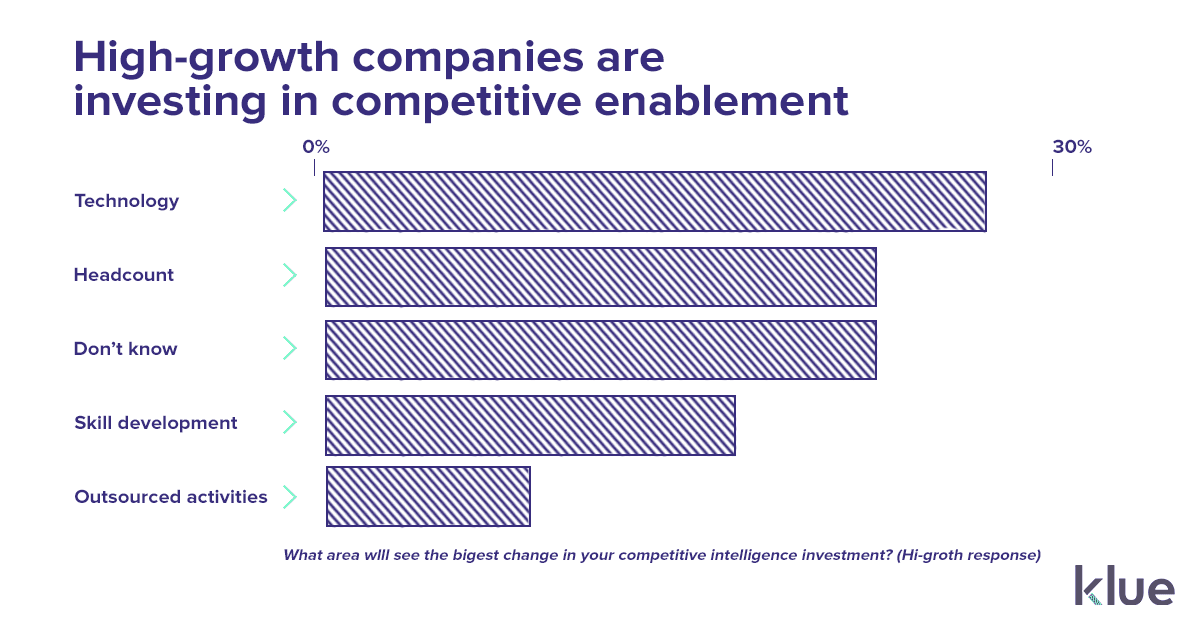

84% of high-growth companies are planning to increase their investment in competitive intelligence in 2021. Nearly 50% will invest in headcount and technology, however, 22% still don’t know where their money will go.

These ten takeaways are just the tip of the iceberg. but there’s plenty more in the full 2021 Competitive Enablement Report. Insights, interviews, and a whole lot of data. Get everything you need to arm your competitive program in 2021 right here.

The 2021 Competitive Enablement Report was developed in partnership with our friends at SCIP.

Competitive Enablement

Product marketers conducting competitive research are drowning in reviews, reports, and messy notes. Here's how Klue's AI foundation will help you complete this analysis in seconds, not weeks.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X