Klue Compete

The Competitive Enablement Platform

Learn More

FIND OUT MORE >

In order to understand what stakeholders actually want from their competitive intelligence process, it starts with answering a simple question.

What do business stakeholders really care about and value from competitive intelligence?

In order to answer that question, we need to turn to some data. In partnership with SCIP, Klue conducted a survey to both competitive intelligence professionals and business stakeholders that consume competitive intel.

We asked stakeholders if they feel supported by their current competitive program, why or why not, and what benefits they expect competitive intelligence to bring to their company. Here’s what we learned.

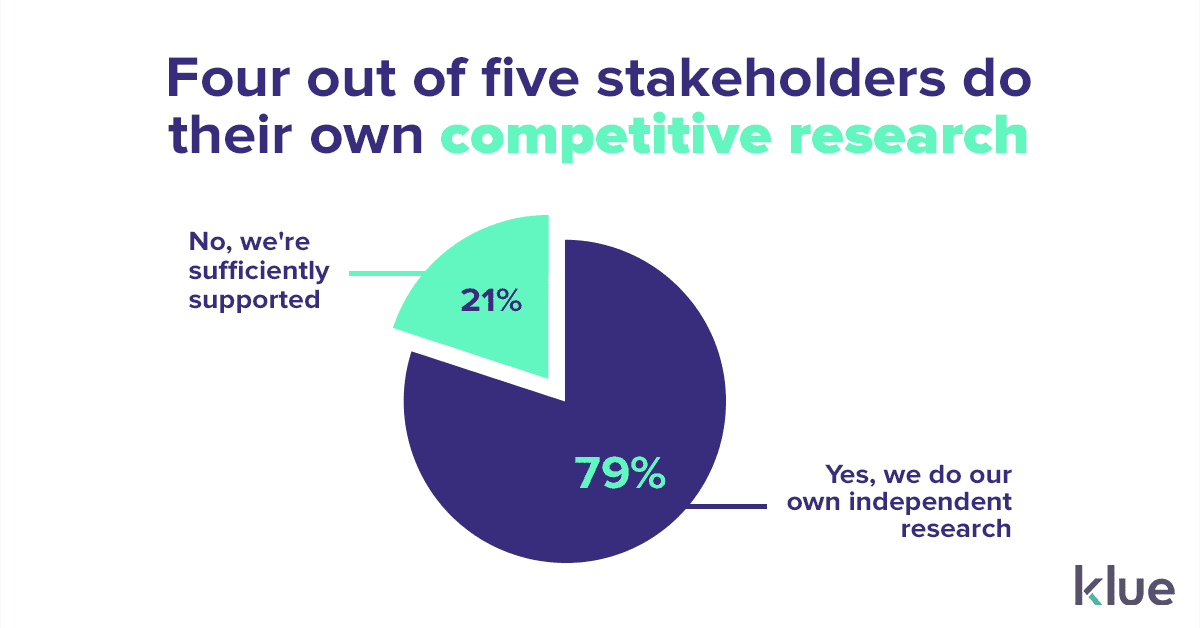

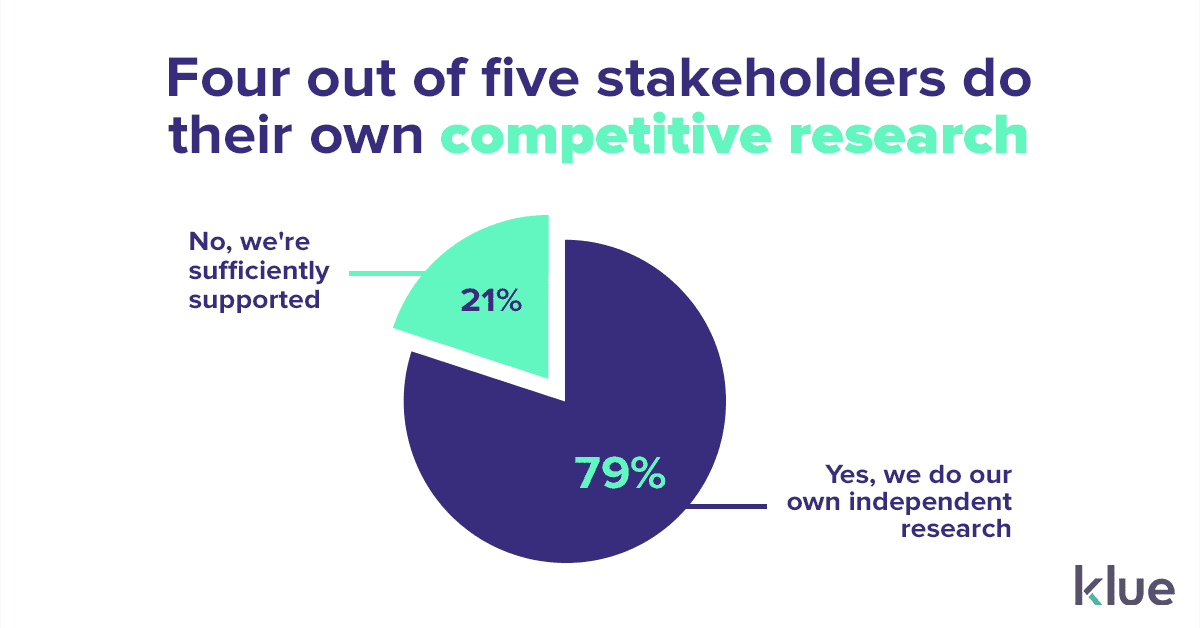

The results from our upcoming ‘2021 Competitive Enablement Report’ show that less than 21% of stakeholders actually say that they currently feel sufficiently supported by the CI function. That’s not a great sign for the effectiveness of many competitive intelligence programs. The rest, nearly four out of five stakeholders, say that their team or department are doing their own competitive intelligence independently.

Now those numbers may make your eyes pop, however, stakeholders conducting their own competitive research isn’t necessarily a bad thing. First, it indicates that employees care about understanding and beating their competition. Plus, according to our report, the most mature competitive intelligence processes adopt a cross-functional approach that encourages stakeholders from various departments to collect and share competitive intel across the org.

With this being said, it’s critical to understand the reason that stakeholders are doing their own competitive intelligence.

So… The good news?

A very small minority of stakeholders feel that they were not supported by the competitive intelligence process at all. There isn’t an overwhelming number of teams stranded on an island, completely isolated from any competitive intel whatsoever.

Also, over 40% of stakeholders say that they’re doing their own competitive intelligence because they are responsible for it in their own region or business. This is a common, yet not ideal, circumstance for competitive intelligence teams that are under-resourced and don’t have the headcount nor technology to serve every specific region in their org.

Now it’s time for the bad news…

A considerable amount of stakeholders (35%) feel that they really needed to go deeper to augment findings that were provided by the competitive intelligence function. The intel they currently receive isn’t sufficient.

Call us curious, but we wanted to know… why do stakeholders feel the need to dig deeper than the insights that they are provided by their competitive intelligence function?

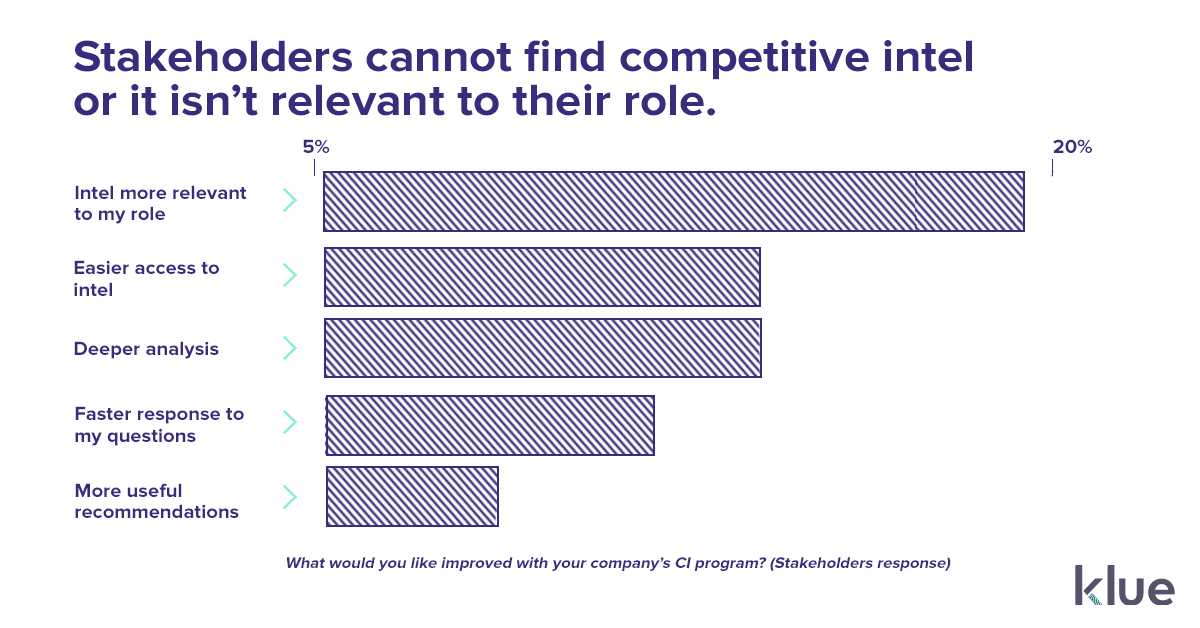

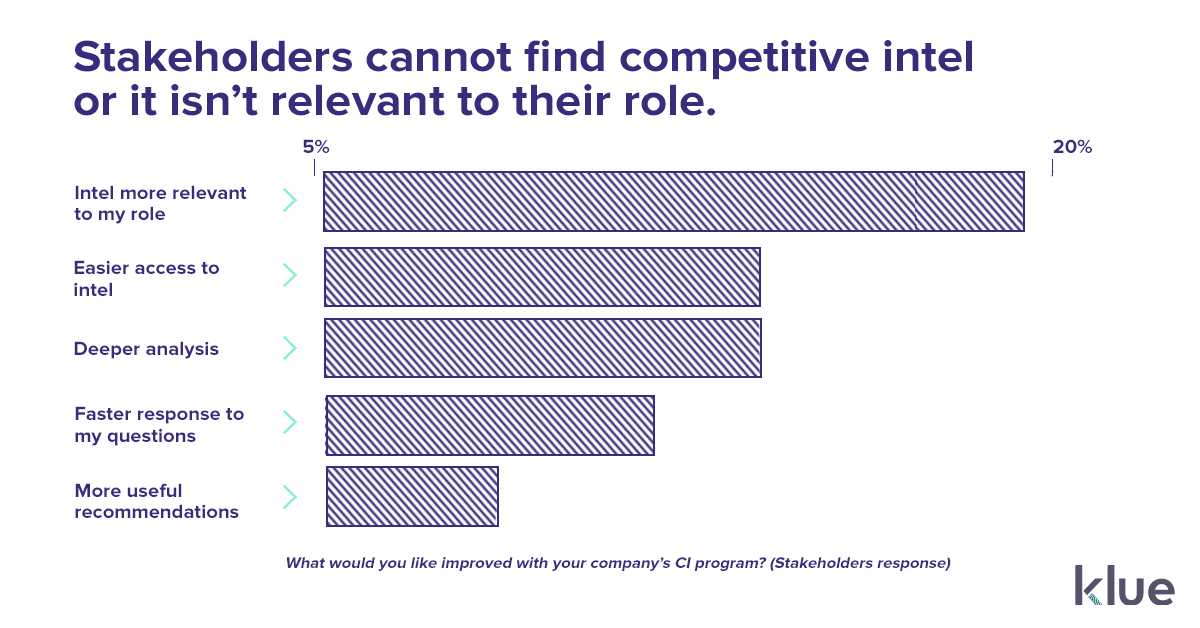

The reason that stakeholders conducted their own competitive intelligence research results came down to two key themes:

First, the intel that stakeholders receive from their competitive intelligence function really isn’t relevant, helpful, or deep enough for their respective roles. It simply doesn’t help them with their immediate objectives, nor are there actionable recommendations to guide how stakeholders should use the intel to their advantage.

This lack of depth or relevance is a significant pain point for arguably the most important and influential stakeholder group: salespeople.

Sales teams require tactical competitive intelligence that goes beyond surface level information. They need insights that will allow them to quickly deposition a specific competitor and present their own value proposition. Vague generalities don’t cut it.

This issue can be a result of the split focus that corporate competitive intelligence teams adopt. They support C-Suite decision makers with strategic ‘big picture’ information to help them understand different landscapes and competitors at a high-level. It’s not deal-specific, but rather a view of the market.

When this strategic approach to competitive intelligence bleeds into tactical sales-specific material, sales teams are not equipped with the insights they need to win in the moment.

A strong competitive intelligence process separates ‘strategic’ and ‘tactical’ intel. When they fail to do so, it leaves stakeholder groups that need deal-specific material scrambling to do their own independent research.

Salespeople require a hands-on competitive intelligence team and a high touchpoint.

The second reason that stakeholders conduct their own competitive research is that when the intel does exist and is both relevant and helpful, they just can’t find it! Stakeholders don’t know where to actually go about accessing the information that they need quickly.

This is a common issue for competitive intelligence processes that don’t have standardized processes or technologies. Although stakeholders doing their own research isn’t a bad thing, competitive intelligence teams must be the custodians of the intel, organizing insights so that they are easily shared and accessible. We like to think of it as a competitive intelligence librarian.

There’s a compounding effect to stakeholders doing their own independent research when access to competitive information is difficult. Because the competitive intelligence function isn’t easily sharing insights, information silos begin to form as knowledge is scattered across the org in the minds of a few individuals or teams operating independent of one another..

There’s a distinct difference between this and how mature functions incorporate a cross-functional approach. Although in both cases stakeholders do their own research, the latter is an additive process that promotes collaboration amongst departments to increase the competitive intelligence IQ throughout the org.

We now know a few of the main problems stakeholders feel their competitive intelligence process should fix, but in order to build a process that they love then it’s also important to understand what benefits they expect to see.

So, our report asked this very question to both stakeholders and competitive intelligence professionals.

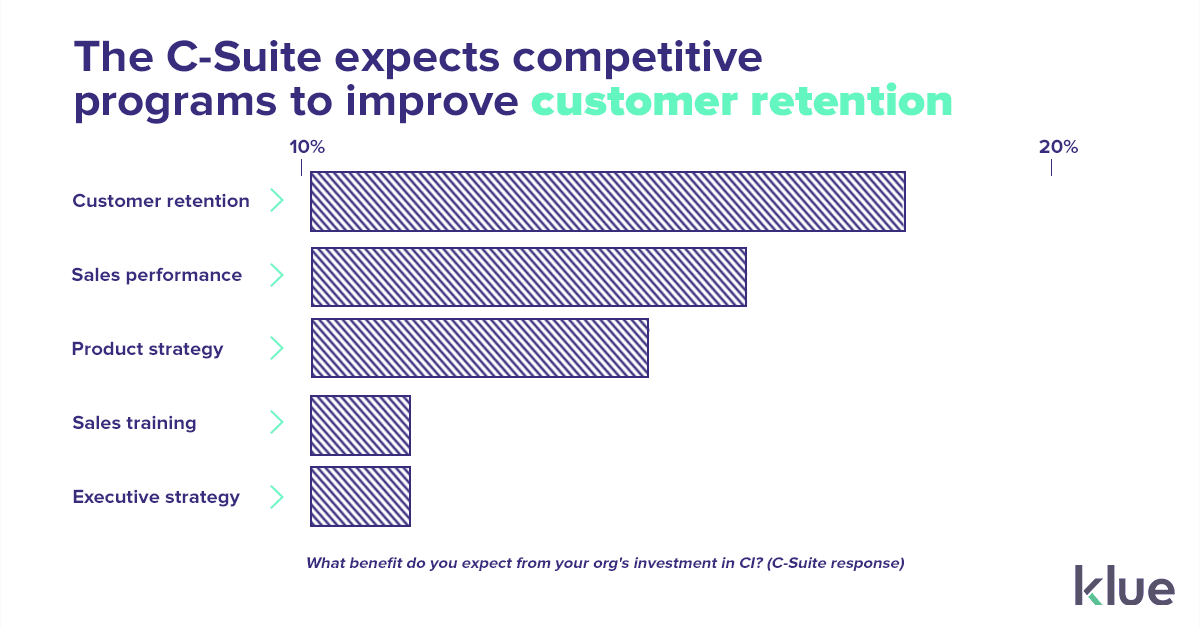

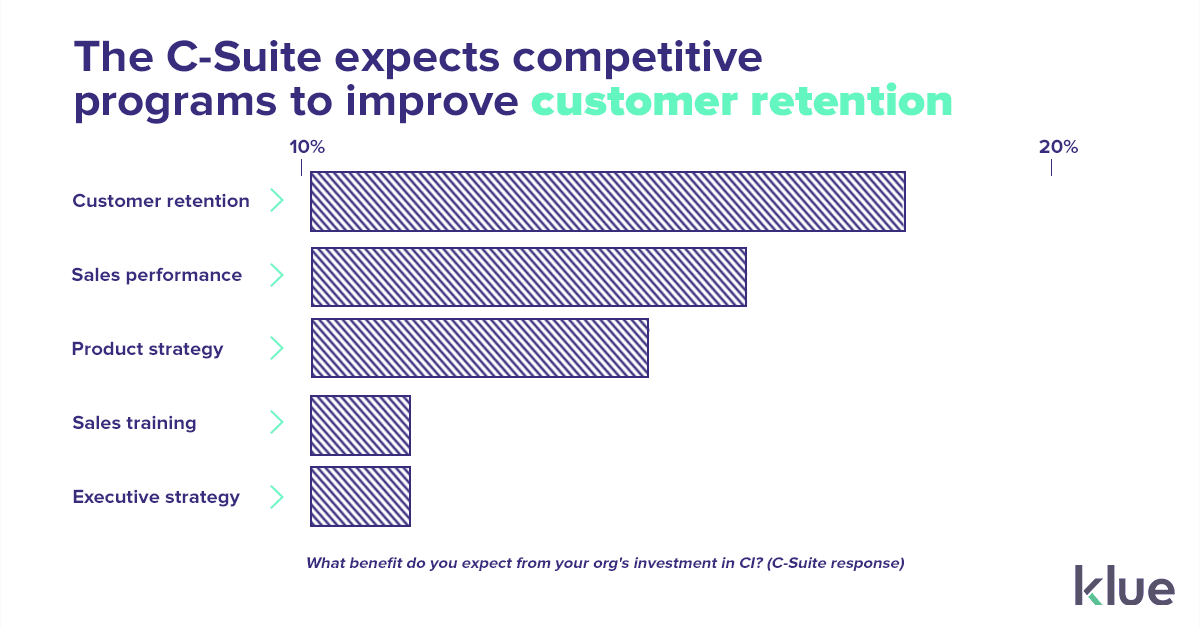

The results pointed to something clear and obvious: competitive intelligence teams and their stakeholders aren’t aligned on what competitive enablement program’s value to the org should be.

In particular, they don’t agree on the importance of customer retention and executive strategy.

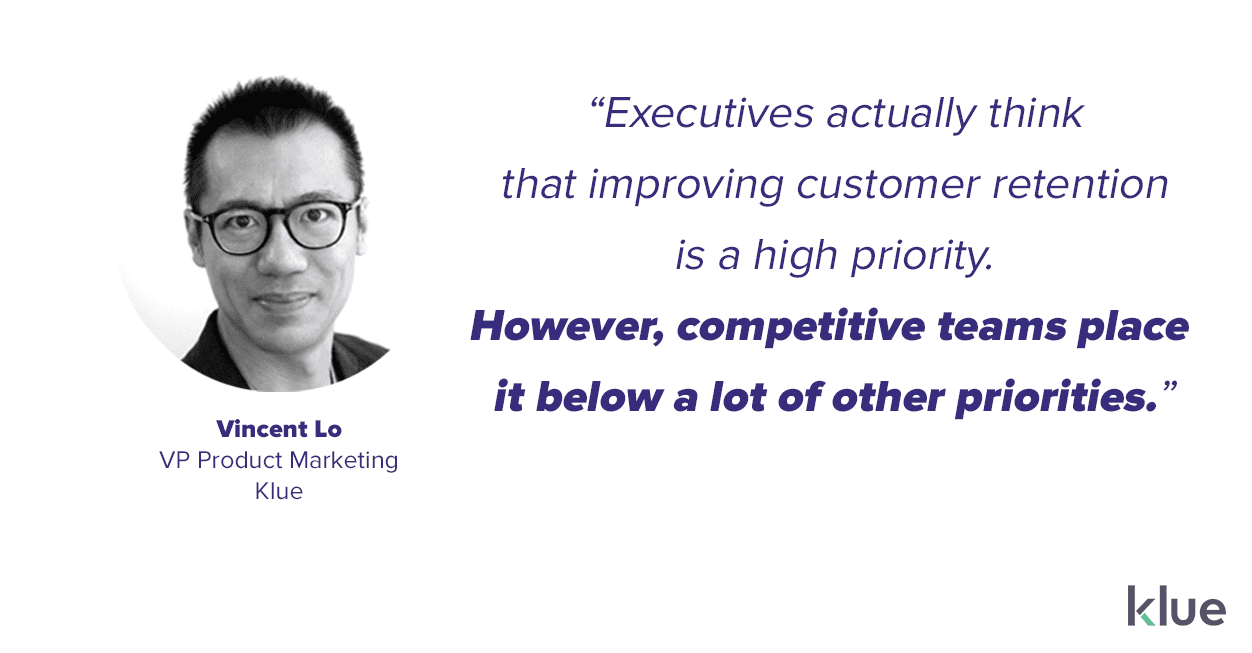

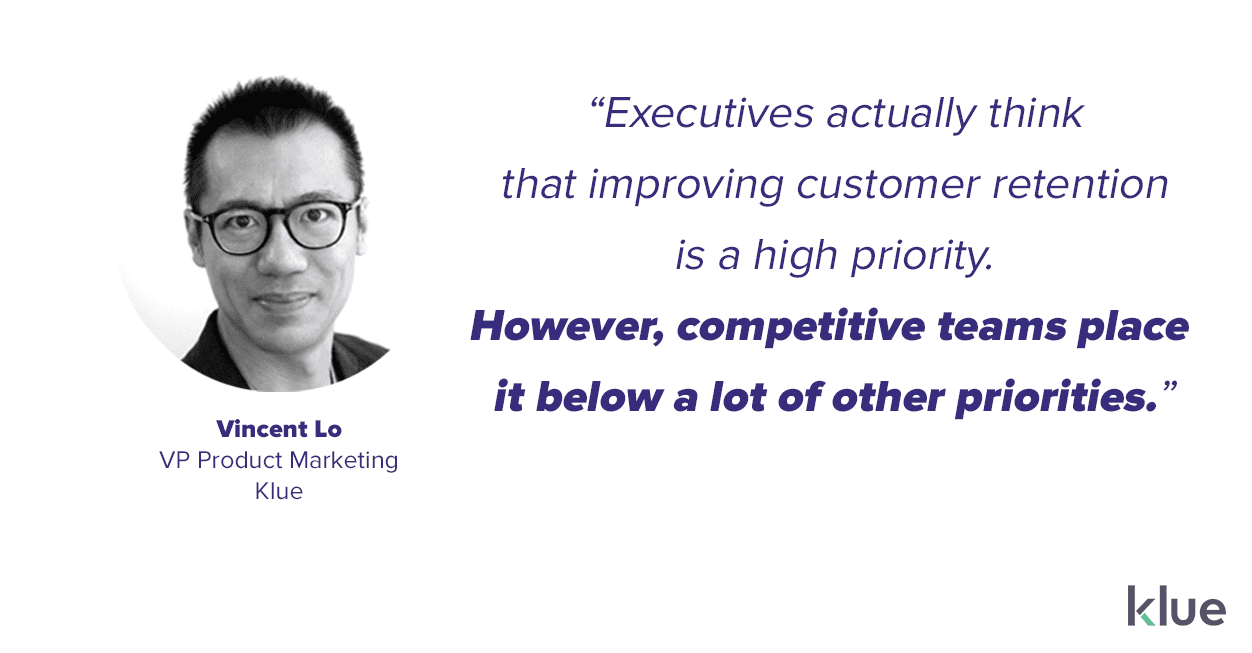

The C-Suite actually think that improving customer retention is one of the high priorities for a competitive enablement function. Yet, competitive teams placed that far below a whole lot of other benefits. Customer retention was listed as the most important benefit from competitive intelligence by stakeholders, but competitive programs only ranked it as the seventh most important.

Customer retention isn’t something that competitive intelligence has traditionally focused on, however, given the ‘new normal’ post-pandemic landscape it has risen up the list of stakeholder priorities..

So, why is there such a misalignment?

By looking at who competitive teams are serving, it becomes clear why customer retention isn’t a priority for competitive intelligence professionals. Results from our report show that the first stakeholders that competitive teams serve are sales teams (38%), C-level executives (23%), and marketing (17%). Customer success teams are the least supported (1%) in the org.

In addition, when asked who are the most important stakeholders for the next 12-24 months, Competitive teams maintain a similar response. Sales (21%), C-level executives (18%), and marketing (16%) remain the most important stakeholders being served, whereas customer success remains low (8%) in the pecking order.

It may be a sign of the ‘new normal’, but the entire org (aside from the CI function) are casting greater attention towards customer retention. Based on what stakeholders and C-level executives expect from their investment, there is an opportunity for CI professionals to better serve the business by collaborating with customer success teams on improving customer retention.

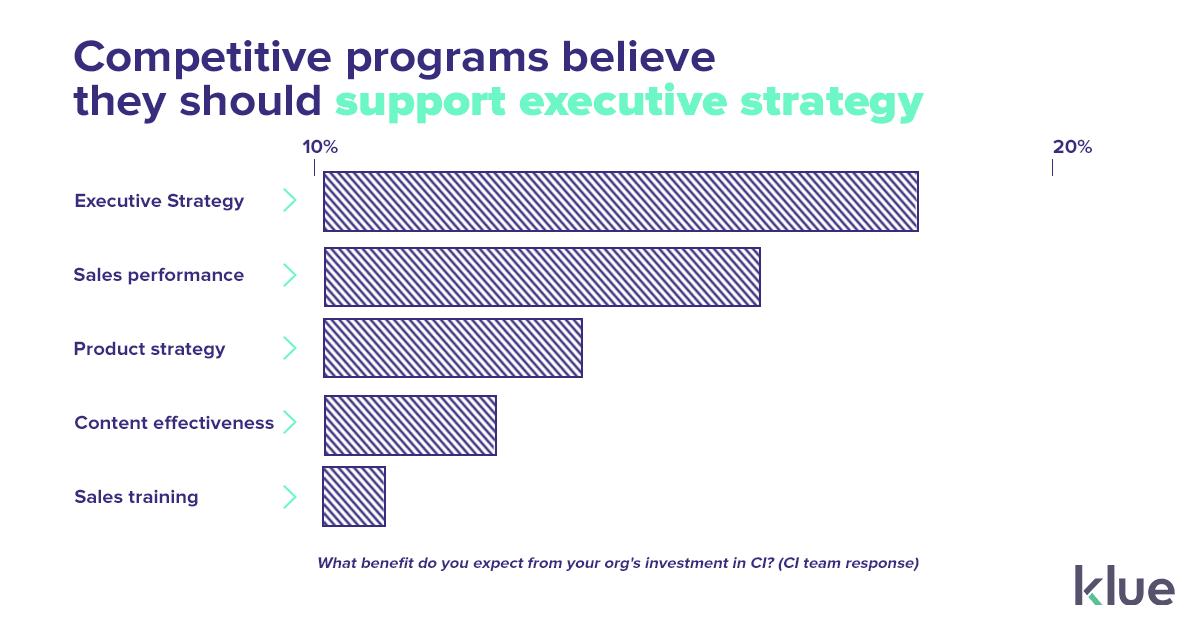

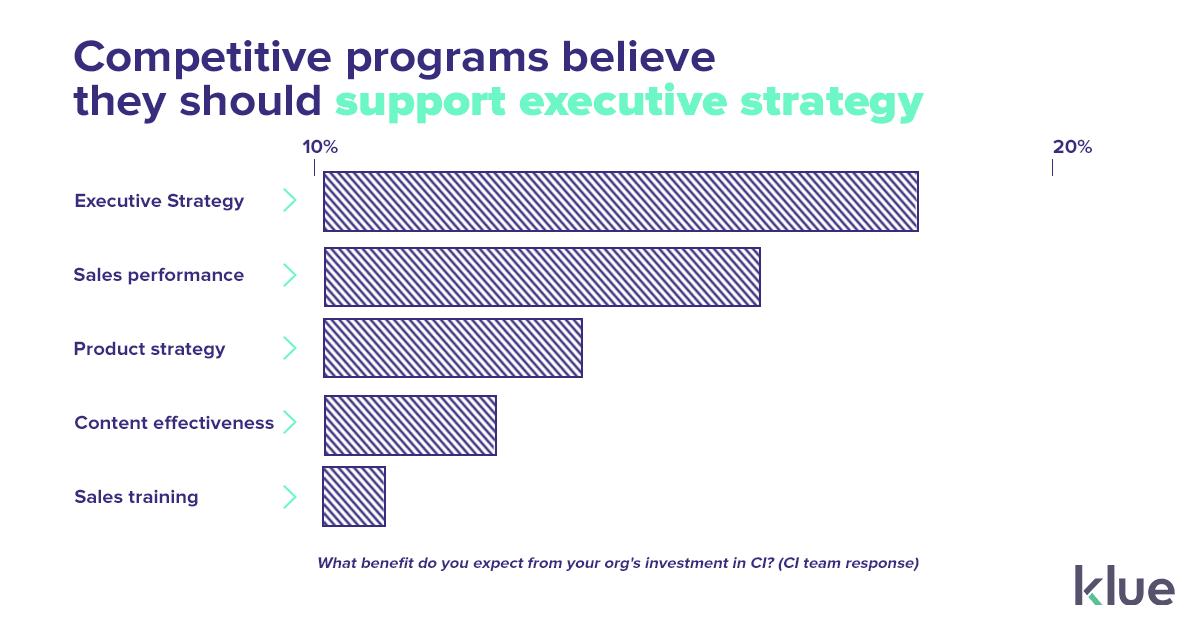

When asked what benefit they expected to see from investing in competitive intelligence, stakeholders felt that improving sales performance (18%) was most important, yet CI professionals considered supporting executive strategy and alignment (17%) as most important.

The results show a misalignment between stakeholders and CI professionals beyond just the primary benefit they see with CI investment.

Similar to CI professionals and all stakeholders, C-level executives valued improving sales performance (15%) greatly. However, the most important benefit they envisioned was customer retention (16%). This may come as a surprise considering that customer retention was of very low priority amongst CI professionals.

On the other hand, competitive intelligence professionals believe that improving executive strategy and alignment is most important. It’s a little ironic that there’s a belief that serving executives is a major priority, yet the executives themselves would prefer the competitive intelligence process to be focused elsewhere.

Strategic ‘big picture’ competitive insights that are provided to C-Suite is often information that isn’t really applicable to other departments. It’s utility is far more limited than tactical insights that directly helps sales reps win deals in the moment.

Although this misalignment is disheartening, it also presents an opportunity. The competitive teams can shift their thinking about how their role and their skill sets are required to help drive and increase that influence within the business. An awareness of what stakeholders expect from competitive intelligence and the common problems they are facing are two key pieces of insight that can help you build your competitive intelligence process.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Competitive Enablement

Product Marketing

If your competitive intel game is too strong for automation, too pure for data privacy, and too rebellious for accuracy — then Klue AI is probably not for you.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X