Klue Compete

The Competitive Enablement Platform

Learn More

FIND OUT MORE >

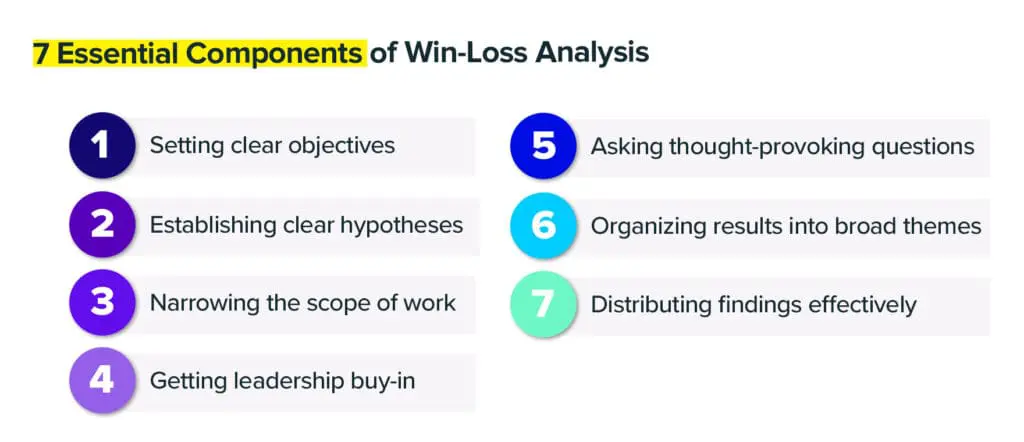

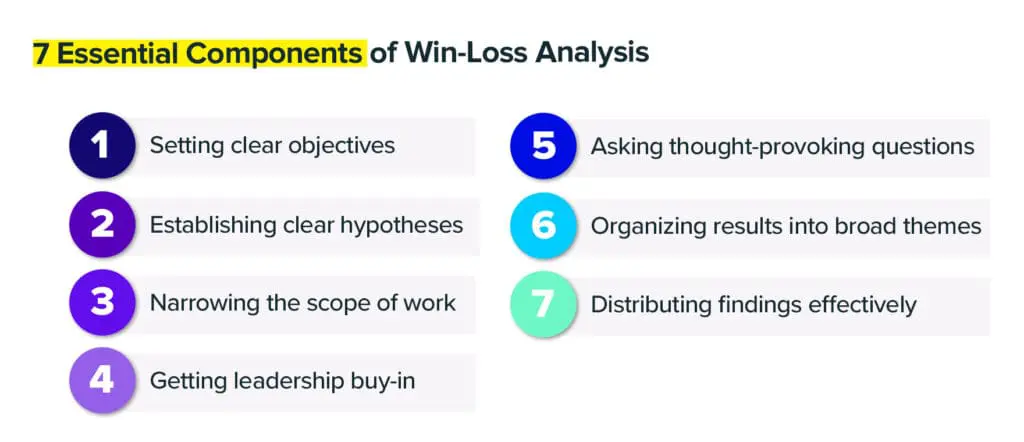

Though the scope and sophistication of your program will vary, there are essential win-loss analysis best practices everyone should follow.

From setting clear objectives at the very beginning all the way to effectively reporting the findings, there are seven essential components of a successful win-loss analysis.

The results and findings of your competitive win-loss analysis program can’t be everything to everyone.

In fact, it’s pretty unlikely that the results will make a massive, immediate impact to your business’s bottom line.

But that’s not the point.

What you should be doing is identifying one (maybe two) areas you’d like to improve, such as:

This focus and clarity will allow you to get important cross-functional partners excited about your win-loss program.

Instead of broadly saying you’re about to start a win-loss program to “make things better”, you can already begin engaging stakeholders by specifying:

We’re going to be looking at some closed win and closed lost deals to see what product differentiators seemed to have the most impact.

Clarity and precision are two principles that will serve your win-loss analysis program — as you’ll see in the second and third components.

Apologies in advance for bringing you back to your 10th-grade science class.

But in order to give some structure and direction to your win-loss analysis, it’s important to have some educated assumptions about the topic you’re exploring.

A hypothesis is just that: a prediction of a result based on a limited set of information.

For example:

We’re losing deals to our competitors because our pricing model is not customizable enough.

Unless you’ve done a full dive into this assumption through a win-loss program, you don’t really know if that’s the case. Even if you’ve heard or seen anecdotal evidence to that end.

Send out a short questionnaire to relevant internal stakeholders to source your hypotheses. Keep it simple and ask two or three basic questions. I.E.:

Take stock of the responses, and use them to pursue the most common assumptions.

We have a favourite metaphor here at Klue. It’s one that comes up all the time when we talk to industry experts like Clara Smyth from Slack or Chris Agnoli from Juniper Networks.

Don’t try to boil the ocean.

Clara and Chris talk about it in the context of building a compete program. But your win-loss program will be served by this advice as well.

Ideally, you’ve already landed on a specific goal for your win-loss analysis. And you’ve got a working hypothesis. Now it’s time to further narrow the scope of work by focusing on:

The more specific you get, the more apples-to-apples comparison you’re likely to be making. Increasing the chances that your findings will be actionable.

Speaking of topics that come up frequently among competitive enablement experts, getting buy-in to your win-loss program is imperative. The best way to do this is by involving others.

It makes sense to have one person (or agency) responsible for the architecture and outcomes of your win-loss program. But if you operate in isolation you’ll be fighting an uphill battle from the very beginning.

On top of internal surveys to help you form your hypothesis, you can run through mini-win-loss analysis sessions with your internal stakeholders.

Getting them acquainted with the style of questions you’ll use in your win-loss interviews, how you’ll ask those questions, and what to look for when assessing the findings.

You’ll also need to set clear expectations with your teams to understand the intention of win-loss analysis.

Sometimes sales reps and other functions may feel as though win-loss analysis programs are designed to find faults — which is certainly not the case.

As Ryan Sorley, CEO at DoubleCheck Research, said during a recent episode of Competitive Enablement Show Live, it’s important to “set expectations with sales through the Chief Revenue Officer that this isn’t a witch hunt. We’re not looking to make people look bad.”

No matter what, make sure you’re engaging and including important cross-functional partners from day one of your win-loss program. And work with leadership to set the right tone and expectations for the program.

The most successful win-loss analysis interviews blend the art of conversation with the art of interviewing.

That’s because it’s as much about the tone of the questions as it is about the questions themselves.

“It’s very much open dialogue — a business conversation. It’s not like we’ve got a script of set-in-stone questions,” said CEO at IceBergIQ Natasha Narayan on a recent episode of the Competitive Enablement Show podcast.

While there’s no script, per se, you should have a set of questions on paper to reference. But the key here is to not be afraid of deviating from the set of questions. Some of the most interesting insights can come from answers to off-the-cuff questions.

Make sure your questions are open-ended, intentional, and cover the entire buyer journey. Below are a few examples of open-ended questions:

Sample Questions:

Remember: open-ended questions are ones that can’t be (or are very hard to be) answered with a one-word response.

These are the questions that will yield the most valuable information.

Once you’ve conducted your interviews, you’re going to have a lot of raw information and data to sift through.

Give yourself the time and space to go through it all. It’s critical that you take the time to ingest as much information as possible and see what qualitative insights arise.

As you’re going through the data, you’ll start to notice recurring themes and topics in your interviews.

Start to categorize each of these until you’ve come up with 3-5 broad themes. This will help give some structure to your findings, and will help you communicate your takeaways to a broader audience.

Messiness is okay — pulling together disparate pieces of information is hard; start with broad categories and refine from there

Let the info sink in — simmer on the results of your interviews for a few days before diving in

Not every finding will be a game-changer — it’s okay if the findings reinforce existing notions as opposed to surfacing new ones

It’s important to keep in mind that not every piece of insight that comes from your win-loss analysis program will be earthshattering. (Part of your expectation setting should really try to drive this point home).

Nevertheless, if you’ve followed all the important components laid out in this article, you will 100% come away with important information that can be of value to your organization.

Generally speaking, you’ll want to avoid blasting out a bunch of information to everyone all at once.

That’s because the way — and the extent to which — you communicate your findings will vary depending on the audience.

The C-Suite will probably want things on a high-level. Whereas with the sales crew, you can get into the weeds a bit more.

Once you’ve done your individual presentations, package up your findings in a way that can be communicated with a broader audience.

If you did your diligence and made sure to engage your cross-functional partners all along the way, this is the last step in the journey.

Then you can pat yourself on the back.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Competitive Enablement

Product Marketing

If your competitive intel game is too strong for automation, too pure for data privacy, and too rebellious for accuracy — then Klue AI is probably not for you.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X