Klue Compete

The Competitive Enablement Platform

Learn More

FIND OUT MORE >

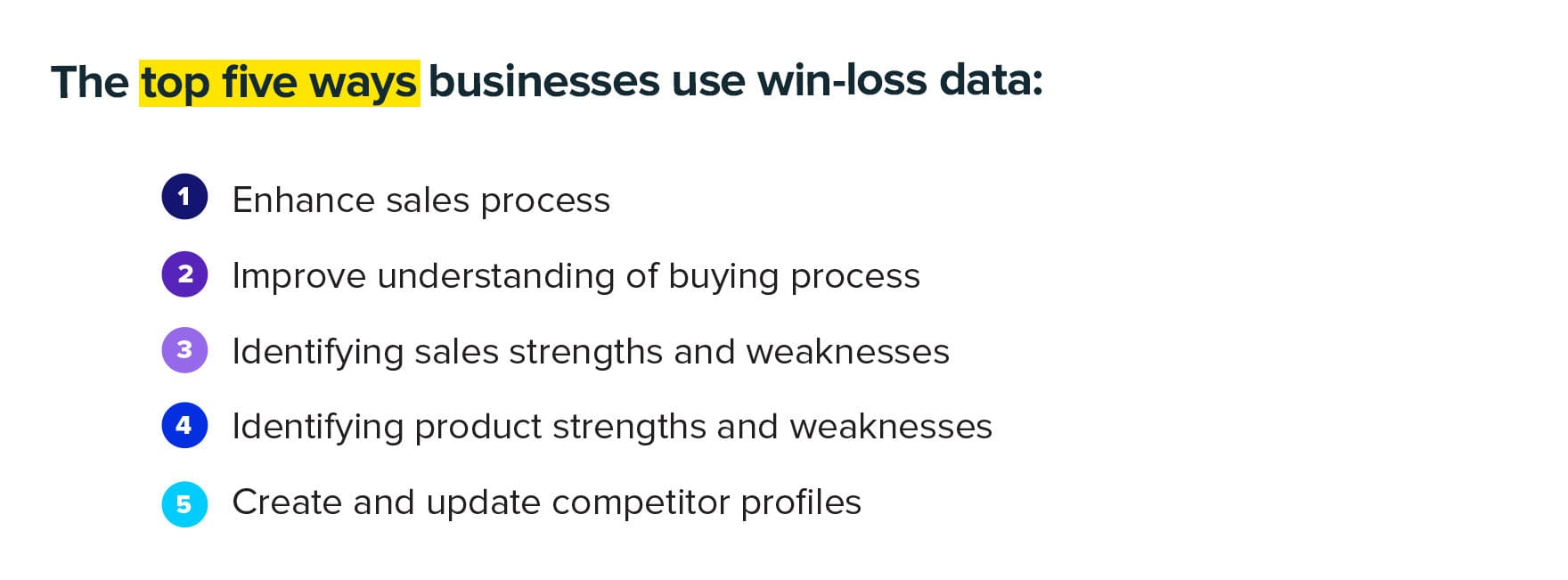

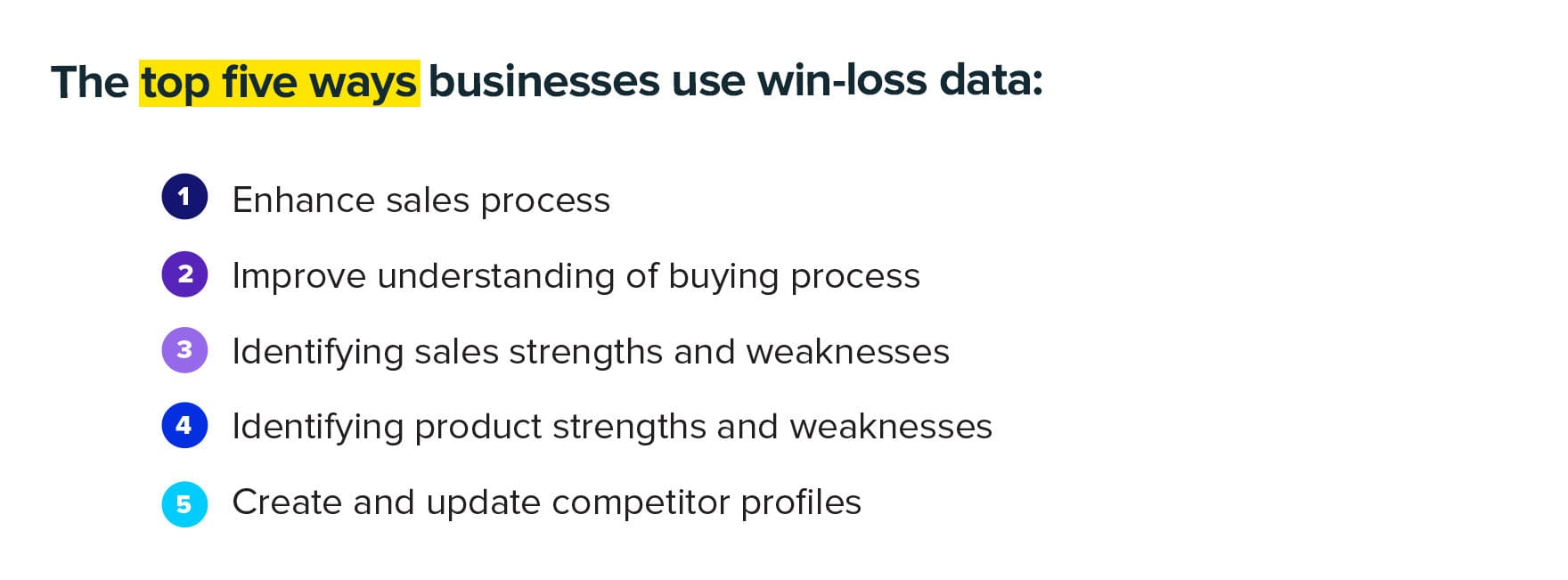

Win-loss analysis is a fundamental part of any competitive intelligence or competitive enablement program.

When combined, interview and CRM win-loss data unearth a trove of strategic and tactical competitive insights. Of course, getting there is easier said than done.

Without the right understanding of the value of win-loss analysis, preparation and reporting, you are setting yourself up for failure.

This blog covers the basics of everything you need to start building a win-loss program within your competitive intelligence program.

From win-loss best practices to interview questions and how to distribute your findings across the organization, by the end of this article you’ll have a handle on win-loss analysis from interviews to insights.

Win-loss analysis is the process of using buyer interviews and CRM data to understand why your company wins and loses deals.

These data points deliver some of the best primary competitive intel on the perception of your organization from lost prospects and customers alike.

☝️ We interviewed 5 win-loss experts in one month on the Competitive Enablement Show. Here are six things you NEED to know about win-loss☝️

When done correctly, this intel can be turned into insights benefiting teams across your organization, especially, but not limited to, sales. As Alida’s SVP of Global Sales Jenna Dorman says:

“By far the most useful tool is win-loss: Understanding what’s happening in real-time in the field. It’s probably the most valuable information sales reps could be getting.”

For competitive intelligence practitioners, enabling your customer-facing teams and informing your company’s strategic priorities can feel like a push and pull.

The insights drawn from win-loss analysis however support in accomplishing both goals.

Not only do these insights level-up your competitive battlecards, capturing the voices of your customers and lost prospects is sure to make any executive team take notice.

“Is this something our customers really care about? Is this something the market wants? Win-loss analysis is definitely the vehicle for answering those questions,” says ServiceTitan‘s Director of Marketing Strategy Jennifer Roberts.

The ability to speak to the reasons why her company is winning or losing from the voice of their buyer gives Jennifer the substance she needs to influence decision making at the executive level.

That’s why professionals like Jennifer and many others care about win-loss analysis — and why you should too.

Watch Jennifer Roberts’ appearance on the Competitive Enablement Show to learn how she uses win-loss analysis to get a strategic seat at the table

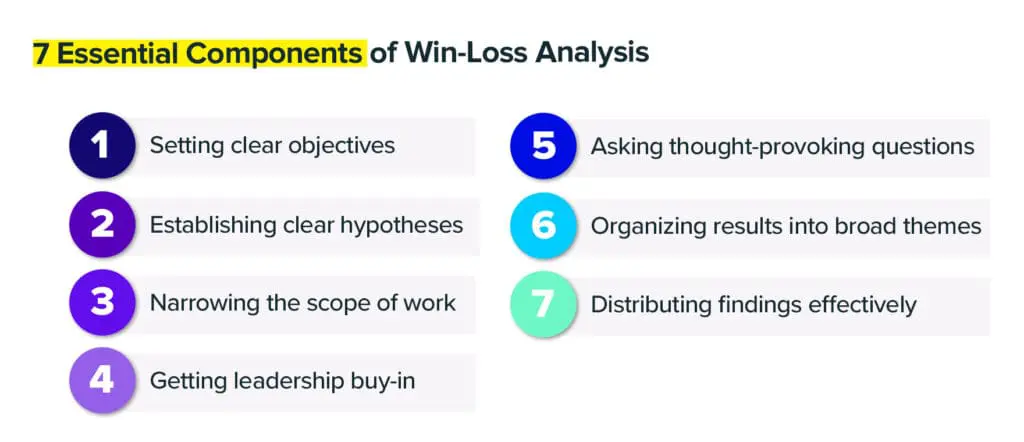

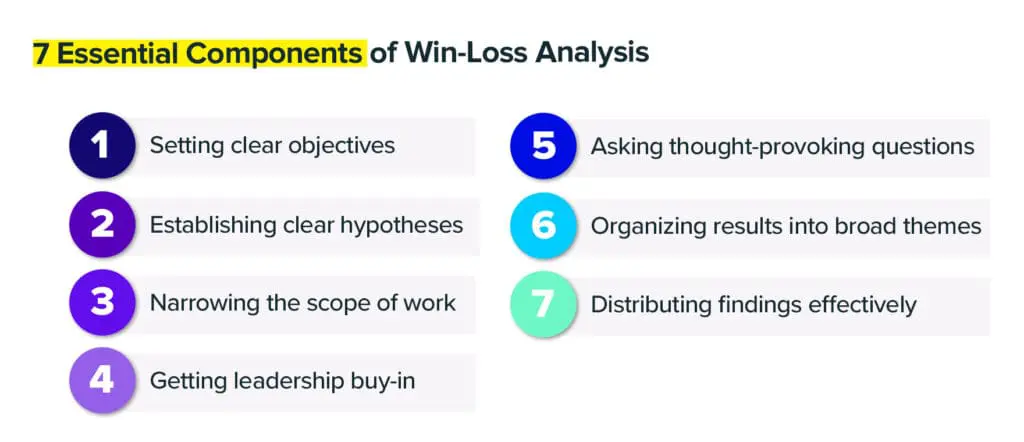

Whether you’re starting from scratch or taking your program to the next level, there are win-loss best practices you need to follow.

These best-practices can be broken down into seven essential components.

Establish 1-2 objectives for your win-loss analysis program. Objectives like:

Defining your objectives early in process keeps you on-track as you move onto the each next step.

Come up with a small set of working hypotheses of why your company is winning or losing deals.

One of the best ways to do this is by sourcing hypotheses from internal stakeholders.

Send out a short questionnaire with two-three basic questions:

Gather the results, pull out common themes, and use them as a guide to form your hypothesis.

Don’t try to boil the ocean. Give your win-loss analysis the best chance for successful by focusing on either:

Scope creep is a very real thing when it comes to a project like win-loss.

The clearer you are with the objectives and scope from the start, the better off you’ll be.

Get in front of key stakeholders from your leadership team and ask what they want to see from a win-loss analysis.

This is an opportunity for you to form working hypotheses, as well as set expectations for delivering results.

If you can, call in a favour with senior leadership and have them send out a memo to everyone about your win-loss analysis program taking place.

Some may be hesitant to be interviewed about losses for fear that it will reflect poorly on them.

Use your leadership team’s leverage to quell fears and get alignment.

Listen to DoubleCheck CEO Ryan Sorley, Forrester’s Derek O’Grady and Seismic’s Valerie Bonaldo dive into win-loss best practices for distributing insights.

When it comes to conducting win-loss interviews, asking the right questions is paramount to success. (We’ll cover this in more depth in the next section of this article.).

Of course, what constitutes the ‘right’ questions will vary. But no matter what, your questions need to be concise and open-ended.

Once you’ve got enough win-loss data, the next step is to organize your findings into themes before you can start to draw actual insights.

Key considerations:

Once you’ve organized your findings it’s time to package the findings and distribute them.

The way you choose to communicate the findings should depend on your audience. Not every insight will have the same relevance to each team.

This is arguably the most challenging and nuanced component of win-loss analysis.

And one we’ll dive deeper into later in this article.

Coming up with the best win-loss questions, determining who to interview, and then conducting the interviews is where art meets science when it comes to win-loss.

That’s because in addition to the importance of asking the right questions, the tone you set as an interviewers goes a long way in dictating the success of your interview.

An interview is not an interrogation — the interviewee should never feel like they’re under pressure to deliver.

As Ryan Sorley, CEO at DoubleCheck Research, says:

“You want the interview to be a safe haven for feedback and information. You don’t want to do things like handle objections.”

Start with some easy questions to make the interviewee feel comfortable before diving into the nitty-gritty.

And don’t be afraid to go with the flow of the conversation.

The questions, the tone you set, and who you choose are the main components of nailing your win-loss interviews.

Here are some key tips according to win-loss services firm DoubleCheck Research:

Interviewing is truly a specialized skill that takes time to hone and develop.

But you can hone and develop a lot quicker by following these important tips.

Watch DoubleCheck CEO Ryan Sorley take the audience through what it takes to nail win-loss interviews on this episode of CE Live

If you’ve established — and stuck to — clear primary objectives, crafted effective interview questions, found the right people to interview, and successfully conducted the interviews, you’ll be set up to draw valuable insights from the interview data.

The next step is reporting on those findings in an effective way.

Whether you rely on interview data, CRM data or both, be prepared to have a mountain of unorganized data on your hands.

This is part of the reason why effective distribution and analysis of win-loss analysis can be so challenging.

Overcome this challenge by following these five best practices from win-loss experts.

You can even check out our free downloadable, customizable win-loss analysis template, inspired by DoubleCheck Research’s executive summary template.

This involves identifying and surfacing commonly occurring keywords. If a given word or phrase is coming up repeatedly across different questions, you should consider that a trend worth diving into.

Once you’ve a group of isolated keywords and phrases, narrow your scope down to two or three trends.

These could be trends that came up most often — but not always. If a trend doesn’t come up as frequently as another but is judged to be more impactful to the business, or more aligned to your primary goals for win-loss, it can still be worth highlighting.

Grab one or two punchy quotes taken directly from your win-loss data.

While a quote might not be able to stand on its own, when combined with a larger dataset, a human voice can paint a more powerful picture.

Especially as it relates to executive presentations, your audience needs to understand the story arc of your win-loss data.

You are the one connecting the disparate dots to make it all come together. So before you present on your findings, you need to be crystal clear about what you’re seeing and gleaning from the data.

Using the objectives you set at the beginning of the process as a North Star, summarize your findings in two or three recommendations for action.

These recommendations will likely be the same across all departments. But you should tailor how you share them to the audience — especially to the executive team.

“If your key stakeholders are your executives, don’t throw a thousand things at them. Give them the top three headlines of what you learned and why they matter,” says Forrester’s VP of Customer Experience Derek O’Grady.

The insights you uncover form some of the most powerful competitive intel there is.

But connecting that intel with your end users so they can leverage it isn’t always obvious.

As with most competitive enablement, it’s helpful to separate tactical intel from strategic intel.

Intel regarding why a prospect chose your offering over a competitors — or vice versa — is great fodder for your Why We Win and Why We Lose cards.

Not only can this help to deposition a competitor in the moment, it can inspire you to adjust your selling process.

Win-loss interviews also surface quotes that can be used as social proof in a sales cycle.

Beyond sales reps, your enablement teams can use win-loss insights to paint a more complete picture of your main competitors.

A better understanding of your competition helps guide you towards which talk tracks and intel are most impactful.

Beyond enabling revenue teams to perform better in the short term, win-loss insights should inform your competitive strategy as a whole.

Feedback received around your product or service offering can provide directional guidance with respect to your product roadmap.

If pricing is a common trend, you might consider how it can be tweaked to make your company’s offering more valuable.

While understanding the perception of your brand, the value of your marketing content, and gaps in the market can be of great use to your marketing teams.

Watch Community Brand’s Sr. Product Marketing Manager Tirrah Switzer and Paul Senatori share their best practices for bringing win-loss analysis into your compete program

A win-loss analysis program is a big undertaking.

It’s also quickly becoming an indispensable pillar for any competitive intelligence and competitive enablement program.

The win-loss best practices laid out in this article won’t make you an expert overnight.

But by considering all the elements we touched on here, you’ll be set up with all the basics you need to know to start a win-loss program.

And with those basics in place, you’ll be one giant step closer to making your compete program the star of the organization.

Competitive Enablement

Product marketers conducting competitive research are drowning in reviews, reports, and messy notes. Here's how Klue's AI foundation will help you complete this analysis in seconds, not weeks.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X