Klue Compete

The Competitive Enablement Platform

Learn More

FIND OUT MORE >

It’s a tale as old as time.

One day you’re king of the castle. The next, you’ve got five competitors at your door trying to take over the throne.

For years in the electric vehicle kingdom, Tesla’s competitive advantage was impossible to beat.

Tesla’s superior technology, futuristic design, and Mars-loving-CEO, all combined to solidify its position at the top of the EV hierarchy.

But a closer look under the hood reveals Tesla is no longer the undisputed champion of the electric vehicle world.

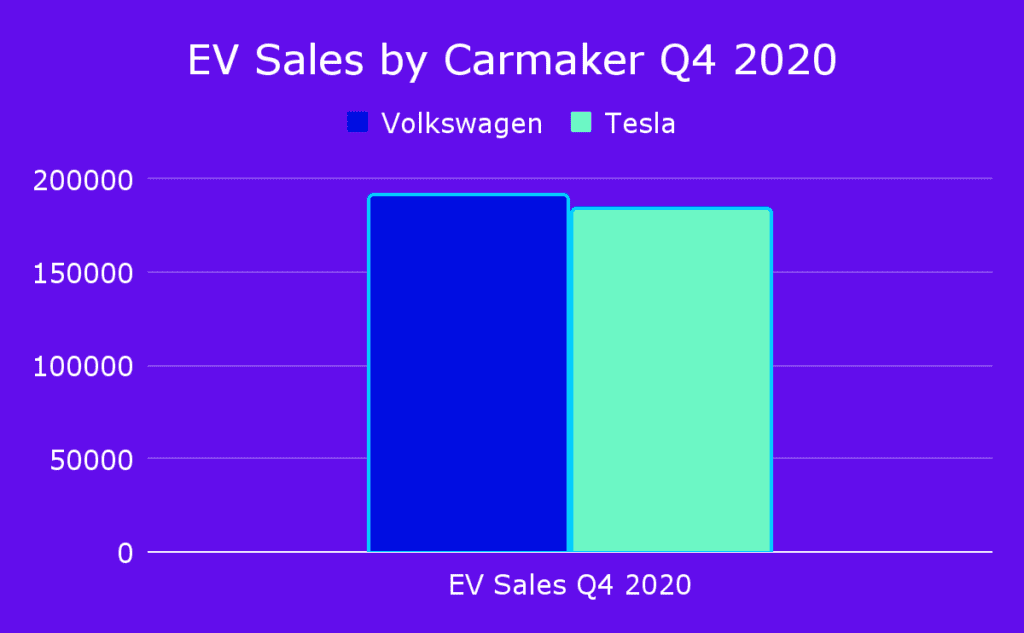

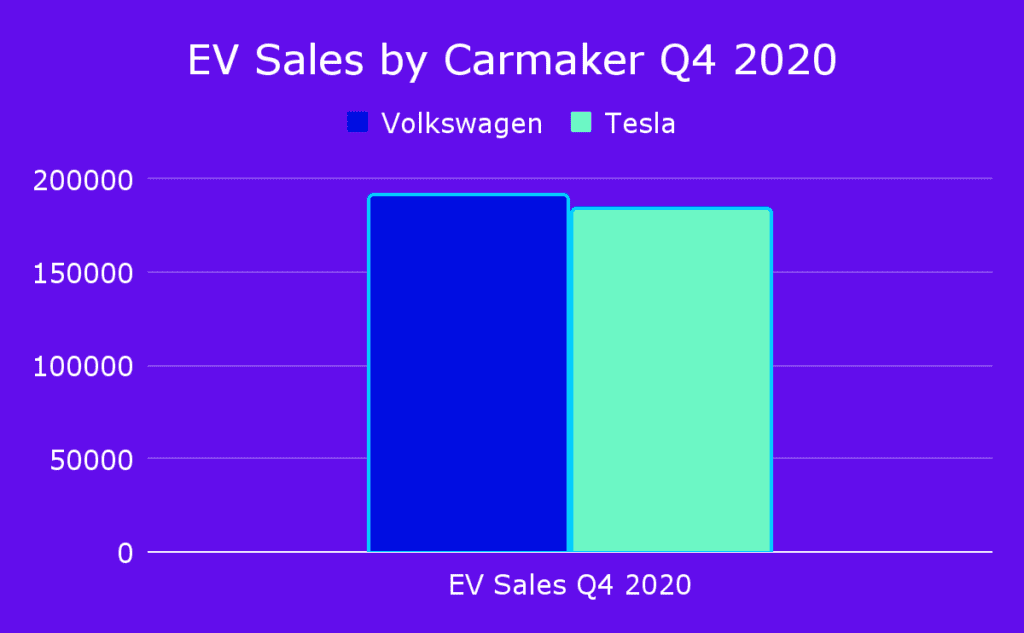

In fact, Volkswagen Group, which includes brands like Audi and Porsche, actually sold MORE electric vehicles than Tesla in Q4 2020.

(VW fell to second position in overall EV sales in 2021 due to supply-chain issues resulting from COVID-19 — which we’ll talk about later.)

And VW Is far from the only competitor looking to take Tesla’s crown.

The competitive landscape for EVs is scorching hot, with Ford, GM and Nissan — not to mention newcomers like Lucid — all putting pressure on Tesla.

So how can Tesla reinforce its competitive advantages and stave off the competition?

What are its competitive advantages?

What are legacy carmakers’ competitive advantages?

And what does the future hold for the current, increasingly disputed, King of Electric Vehicle Land?

When you tally-up total production of all vehicles, Volkswagen produces more vehicles in a month than Tesla produces in an entire year.

Or course, were Tesla’s competitive advantage simply a combination of scale and output, legacy carmakers like Volkswagen would be the ones with trillion-dollar valuations, not Tesla.

That’s because, without a doubt, technology is Tesla’s most pronounced competitive advantage — not output. It dominates the economics of lithium battery cells and EV battery packs.

Some experts predict the battle for producing EVs at the lowest cost will continue to be won by Tesla for at least the remainder of the decade.

But here too the gap is closing.

Startup car manufacturer Lucid Motors recently announced its cars can drive 520 miles (836km) on a single charge. That bests Tesla’s top range by more than 100 miles.

It’s going to cost you a lot of money to get that kind of EV range — Lucid’s Air Dream Edition car will run you $169,000 while Tesla’s Model S sells for closer to $97,000 — but the battle lines are being clearly drawn.

“Tesla’s electric cars have better tech, more mileage than other EVs, but that’s about to change,” said Wynter CEO Peep Laja at Klue’s Competitive Enablement Summit. “Every single car company is coming after Tesla. My bet on Tesla is that, in a couple of years, their competitive advantage ceases to exist.”

And Lucid is far from the only competitor in this space.

While Tesla may have the upper hand in EV tech — for now — it also has to contend with giant legacy carmakers all positioning themselves for a greener, more electric, future.

The sheer size of legacy carmakers gives them a decided competitive advantage over Tesla.

Volkswagen, for example, was the second-largest automobile manufacturer in the world in 2020, beaten out for top-spot by Toyota. Before that, it was the largest automaker in the world from 2016-2019.

And if the company intends on following through with its ambitious goal of producing an electric-only vehicle fleet by 2040, and overtaking Tesla by the end of this decade, Volkswagen and carmakers with similar EV goals like Ford and GM will all need to leverage their massive production capabilities.

That’s because this huge advantage in production leads to large advantages in cost.

“Incumbents have a large cost advantage because they’ve already built and paid for their production factories, while Tesla still has to build their factories,” commented Dan Levy, Senior Equity Research Analyst at Credit Suisse in a 2021 report.

But size isn’t inherently advantageous in 2021.

A reality that became apparent this year when a COVID-induced semiconductor shortage forced VW to cut its Q3 sales and delivery outlook. The second-largest automaker in the world simply couldn’t get their hands on enough parts to meet their targets.

These supply chain issues demonstrate that size can be a disadvantage when it comes to competing against smaller, more nimble competitors like Tesla.

It also reminds us that while legacy carmakers may have an incumbent advantage in the automotive industry as a whole, it’s Tesla who is the incumbent EV carmaker, having already gone through its own “production and delivery logistics hell”, and learned from it.

Tesla might have already made it through this hell, but Volkswagen and other legacy carmakers have only begun their own journey down the river Hades.

Tesla and its superior competitive advantage made the company a category of one for more than a decade. If you wanted a relatively affordable, and overall cool electric car, there was only one place to shop.

You could get a Nissan Leaf, but that was decidedly less cool. (Apologies to my dad who owns and loves his Nissan Leaf).

But just like every other business category on planet earth, Tesla’s competitors quickly multiplied and closed competitive the gap.

Were Elon and gang naive to their increasing competition? Probably not.

But if a company like Tesla is having to battle its competitors and stand its ground, no company is safe.

In other words, Tesla needs to step up their competitive intelligence and competitive enablement game. And your company is almost certainly in the same boat.

The competitive differentiators and advantages Tesla once enjoyed will be a thing of the past — forcing it to find new positioning and differentiators, like brand.

As Peep predicts:

“My bet is that in three, max five, years from now, Tesla will be just like every other carmaker. [And just] like there’s no difference between a BMW or Mercedes or Audi besides the brand, Tesla will also start competing on brand,”

If Tesla’s future depends on the company fighting tooth and nail on branding, it needs to start fighting now.

Owning a Tesla once meant you were technologically savvy, had money to spend, and cared a bit about the environment.

But now, Tesla’s brand is a lot less clear.

What does the King stand for?

What’s clear is that, if His Majesty doesn’t figure it out, Tesla will turn into just another legacy carmaker.

This article appeared in the December 16th edition of the Klue’d in Newsletter. Don’t miss out on competitive content like this. Subscribe below.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Competitive Enablement

Product Marketing

If your competitive intel game is too strong for automation, too pure for data privacy, and too rebellious for accuracy — then Klue AI is probably not for you.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X