Klue Compete

The Competitive Enablement Platform

Learn More

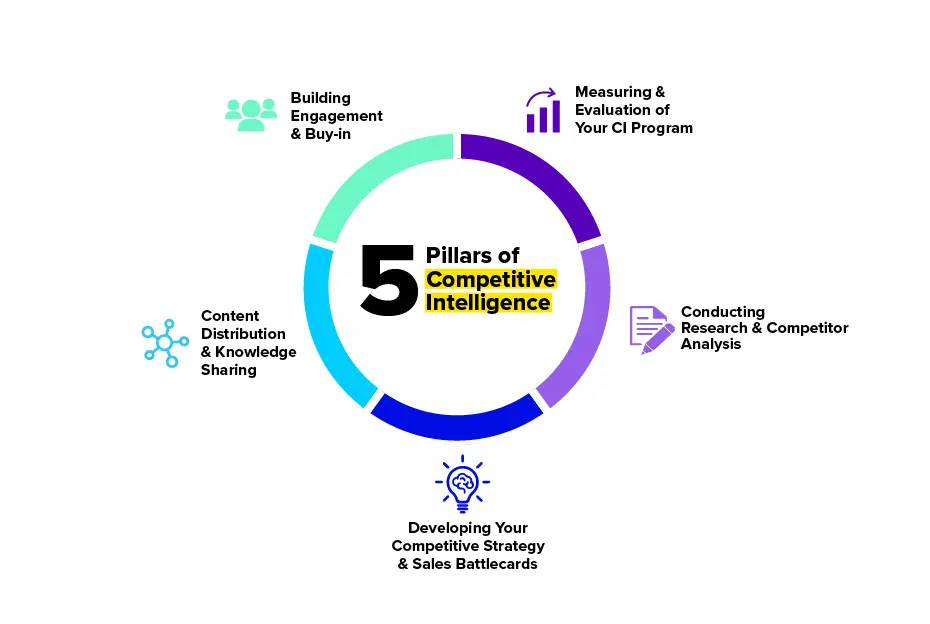

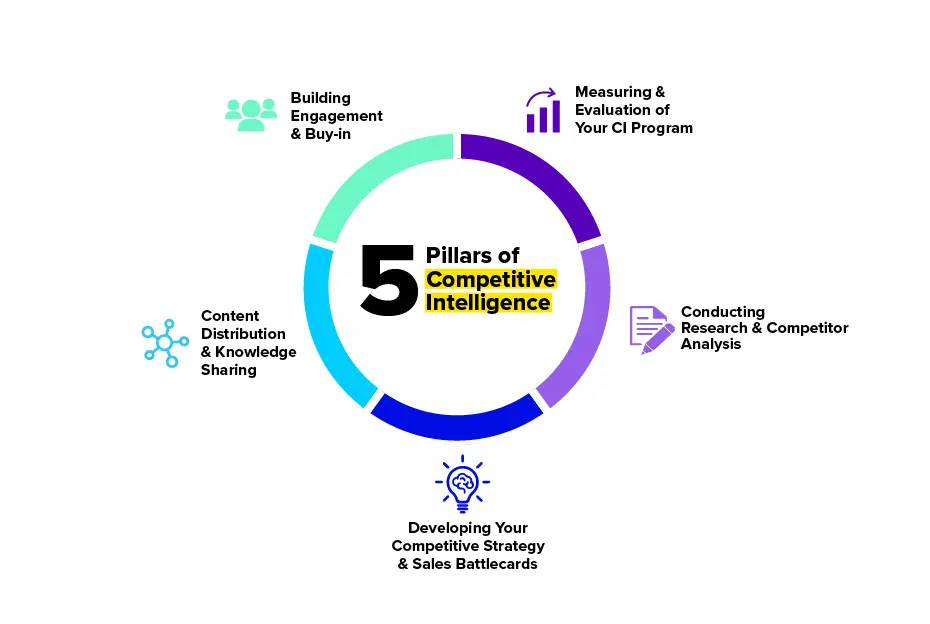

Building a top-notch compete program hinges on your ability to gather and disseminate competitive intelligence. Intelligence that your stakeholders will actually turn to in order to beat their competition.

However, gathering competitive insights isn’t as simple as a quick Google search, followed by messaging your company’s Slack channel.

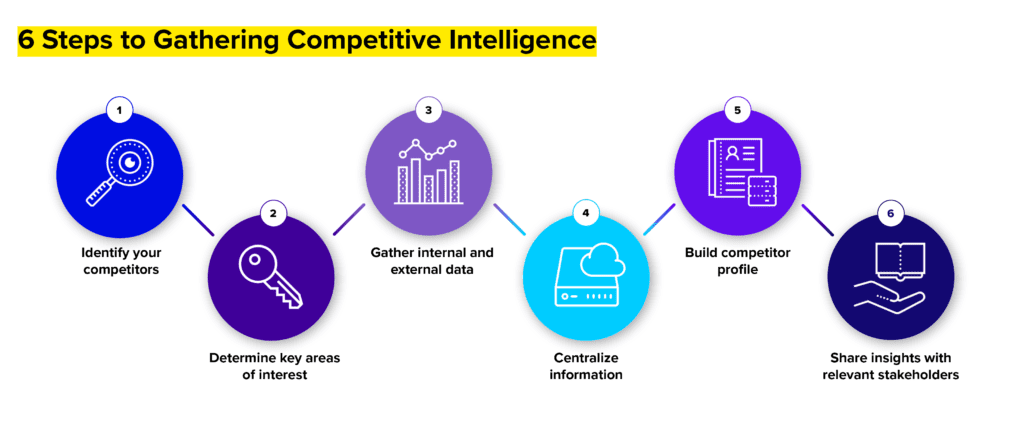

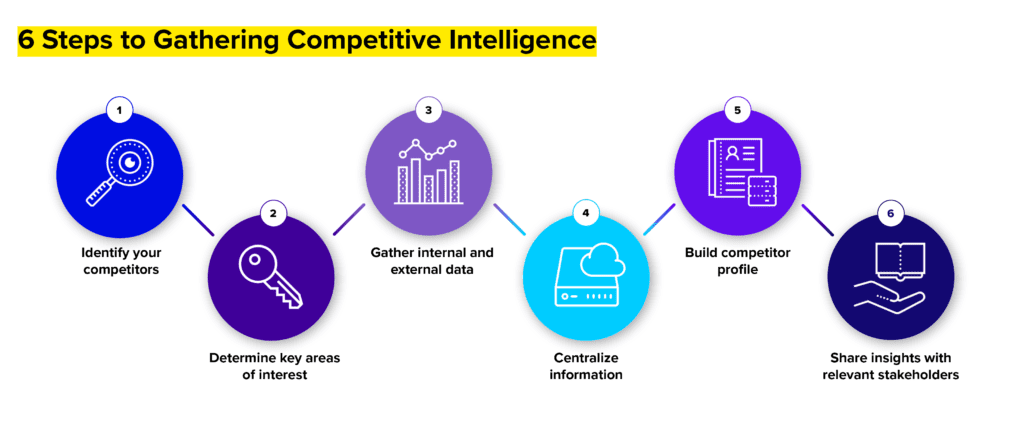

Competitive intelligence teams need to have a defined process in place to identify their competitors.

After that, the goal is to research them beyond surface-level insights. The third — and often most challenging — step is to share this competitive intel with the stakeholders who need it.

Challenging as these steps may be, we won’t make you go it alone. We’ve put together six steps to help your program gather competitive intelligence.

Before digging into competitive intelligence research, establish a plan beforehand on who you should track and what competitive insights matter. This planning stage will save you from wasting your time and effort uncovering insights that don’t truly help your business

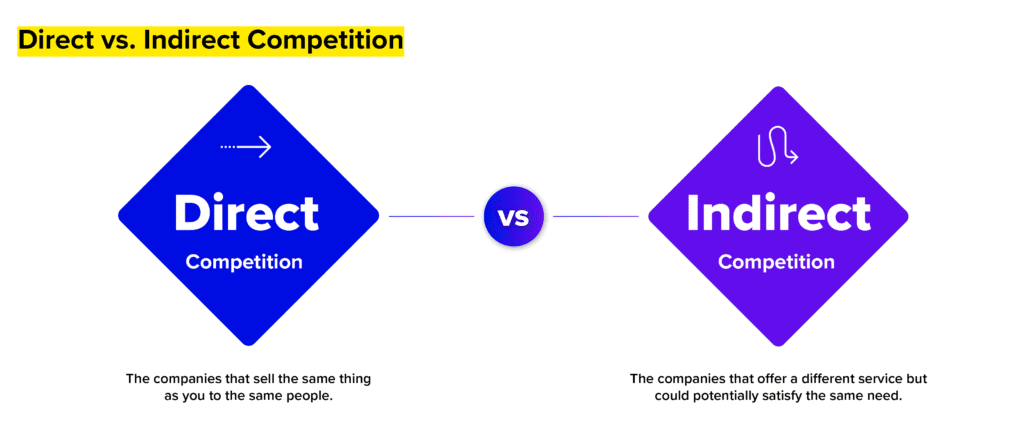

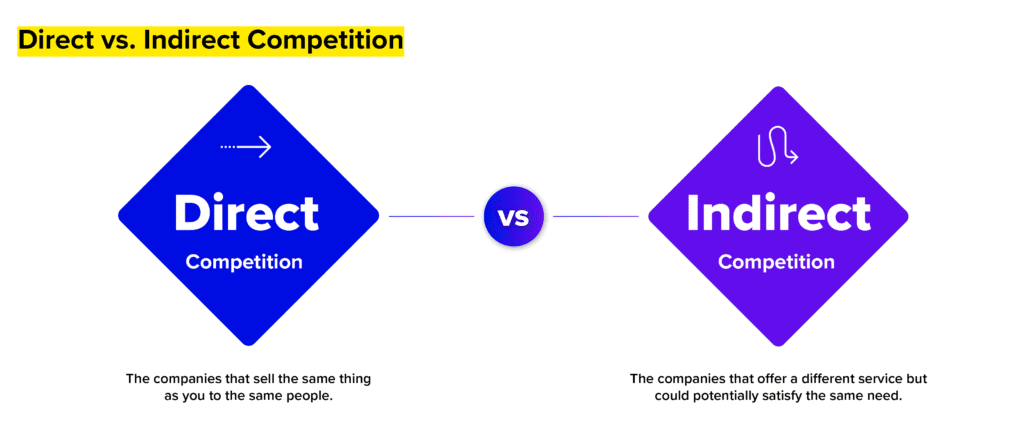

Clearly identifying your competitors is the first step in building out a cohesive competitive landscape. Depending on your industry, you may have a vast amount of competitors, or just a few.

In either case, your primary objective should be to identify your most direct competition. In other words: the companies selling essentially the same thing as you to the same customers.

The best way to narrow down the companies that are frequently popping up is by conducting win-loss analysis.

By systematically storing the notes that your sales reps make during deals, and the feedback your prospects give after a deal is won or lost, you’ll have qualitative results that highlight who might be the biggest threats to your business.

But you don’t want to only rely on the qualitative side of win-loss analysis.

The clearest way to map your director competitors is if your reps are listing the competitor field in your CRM, which will provide you data-backed evidence of who is most frequently in your deals and your win rates against them.

Now, getting your reps to actually fill out your competitor field… easier said than done. Raise your hand if your CRM data is messier than a toddler’s bedroom.

One of the most successful ways we’ve incentivized reps to fill out a competitor field is by integrating Klue battlecards with Salesforce.

Reps will be prompted to mention a competitor’s presence during the opportunity stage of a deal. They’ll then immediately get access to your competitive battlecards on that competitor with the Klue Battlecard Button.

The competitive intelligence that you are able to gather can often feel limitless. It’s critical to outline exactly what areas you’re looking to learn about your competitors, the internal teams you want to enable with insights, and the goals you’re aiming to achieve with your competitive intelligence program. With this in mind, your competitive intelligence research has more direction, and you’re not drowning in a sea of unusable intel.

With more clarity on the goals you’ve set out to achieve in gathering competitive intelligence, you should also establish the methods that you’ll use to measure your program’s success. These can be a combination of quantitative and qualitative KPIs, but it’s crucial to have in place in order to demonstrate the impact of your program on the company’s objectives. Otherwise, your gathering efforts are merely throwing darts in the dark.

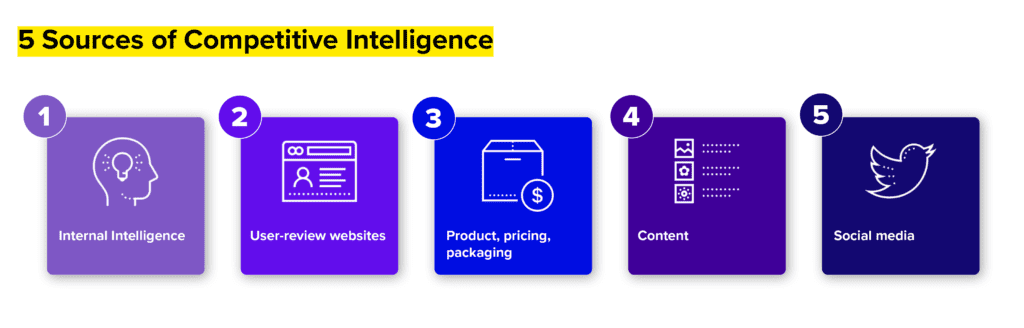

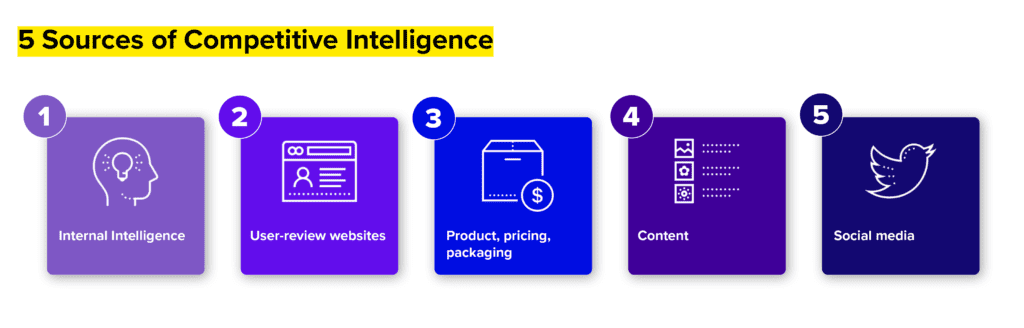

There are plenty of sources that you can use to gather information on your competitors. We like to break these up into internal and external competitive insights.

With a competitive intelligence tool in place you can get instantaneous access to external information living on the internet, and more importantly, a living central repository that enables your entire organization to share real-time internal insights and store it for easier access.

In lieu of this, here are some of the most important competitive intelligence sources that you can use to gather competitive insights.

There’s information on your competitor living in every corner of the internet, and here are some places to go digging:

Review websites

You are what your customers say you are. User review sites such as G2 Crowd, Capterra, and Trust Radius are goldmines of competitive intelligence where customers spill the beans on your competitors.

There’s a little bit of everything in there: the pain points prospects are facing and how well your competitor is providing a solution, their satisfaction with the product, quality of service, and a glimpse into the size and industry of their customers.

Social media and content

A company’s social media presence and the content that they share offer insights into who they want to speak to, and how they’re positioning themselves in the industry.

Corporate social media accounts are a critical online marketing tool that gives them a microphone to directly speak to their future and current customers, so you better take notes on what they’re saying.

The competitive intelligence gathered from a competitor’s content strategy can go beyond simply the keywords they’re targeting and topics they want to be considered experts in. Take a peek at who they’re talking to in interviews, or better yet, who they’re profiling in case studies.

Those bottom-of-funnel content pieces are used to close deals so it is a pinpoint insight into the client base of your competitor.

Product, Pricing, and Packaging on competitor websites

Pricing is always top of mind for potential customers. Your sales team wants to avoid getting into ugly pricing battles, so it’s a no-brainer to have battlecards with competitor pricing information and tips on how to position yourself against that.

Information on a company’s pricing tiers should be available on their website or known by your own salespeople from previous competitive deals.

The support threads and FAQ pages on your competitor’s websites are a sneaky source of competitive intelligence that provides intel on the user experience (UX) of a product.

Ensure that your team provides better support in an area where competitor clients are frequently experiencing difficulties. Marketing teams can also capitalize on this information by crafting campaigns that focus on resolving these ‘pain points’ that competitor clients struggle with.

The idea that competitive intelligence teams wave their magic wand with an easy solution by scraping external publicly available information is a myth.

The juiciest bits of competitive intelligence gathered are internal sources that come from within your own company.

Those off-hand remarks salespeople hear on a call, or the prospecting emails your competitors send your current clients will give you the real meat of competitive insights that your stakeholders will sink their teeth into.

However, the key to internal intelligence (and all competitive intel for that matter) is making sure that people share what they hear and that this competitive intelligence doesn’t get lost in an email, Google doc, or chat thread.

Competitive intelligence is only as useful as the people it’s shared with. Too often silos begin to emerge as employees keep the competitive insights to themselves, forget about what they heard, or simply don’t know how to share it across their entire organization.

Competitive intelligence teams have to not only be researchers but the custodians of competitive intel. This is how you can serve teams at scale.

Imagine going to a bookstore and the books are randomly stacked on the shelves. They’re not categorized by genre or author.

Would you find the book you wanted? Probably not. Well, at least not easily.

Competitive intelligence teams storing external and internal information in a central location that is easy to access is a critical first step in organizing a library of competitive intel.

So, your competitive information is in an easy-to-find location that makes your life a whole lot easier. Now it’s time to make it even easier for stakeholders to use this intel too. Let’s help them find the book they want so that they don’t leave empty-handed.

By categorizing insights by specific competitors, you’ll begin to build out a fully-fleshed profile of the companies that you’re up against. It’s a one-stop shop for employees to get a 360-degree view of a competitor.

Although a full view of your competitor by building out profiles is a great next step, we can do even better.

In order to enable your stakeholders to leverage insights, the competitive intelligence gathered has to be relevant to them. According to the ‘2021 Competitive Enablement Report’ the greatest problem stakeholders face is that they aren’t receiving competitive insights that are relevant to their role.

How do we fix this? Provide context.

To take your competitive insights to the next level, share quality information, address who it matters to, why, and how they can leverage it moving forward. It’s all well and good telling employees your competitor has hired a new VP of sales, but sharing that VP’s background, the industries they worked in, where they’ve excelled, and the size of clients they typically brought in, begins to show how that hire may reveal your competitor’s future strategy.

Learn how Alex McDonnell, the Market and Competitive Intelligence lead at Airtable, puts competitive intel into action for his sellers on Spotify or Apple.

We’ve barely scratched the surface on the sources of competitive intelligence you can use to gather insights, and the methods to distribute this intel to enable your entire organization.

For more information on how to build out a competitive intelligence program that dominates your competitors, check out our ‘Guide to Competitive Intelligence.

Competitive Enablement

Interviews

Dylan D'Urso shares why old school competitive analysis, like SWOT and Harvey Balls, is old news in competitive intelligence.

You can new get your reps competitive insights from Klue instantly in the Gong Engage platform.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X