Klue Compete

The Competitive Enablement Platform

Learn More

FIND OUT MORE >

We all have that one family member who still hasn’t quite figured out how to text yet.

For me, it’s my grandmother. Her messages are a mazey novel of half-finished sentences, rogue punctuation, and typos galore. Once she discovered emojis… well, then all hope of understanding was lost.

Too often, product marketers and compete pros fall into this same trap when trying to build and share a competitive insight.

Listicles of data, bullet points containing a handful of words, and lengthy background stories overviewing how a competitor company was founded.

This does not help your business gain an advantage over the competition. So, what does?

In this article, we’ll explain why usable competitive insights are critical in helping your revenue teams win more business, provide an example of a winning competitive insight, and walk you through how to build your own using the four layers of competitive intel.

Let’s dive in!

A competitive insight is a piece of information that allows your business to make more informed decisions based on what your competitors are doing and changes in the market.

It is NOT just a list of facts about your competitors.

“Don’t limit your compete program to just data points on a sales battlecard… we are not just a research group,” said Brad Lawless, Sr. Director of Product Marketing at Movista, on an episode of the Competitive Enablement Show.

Competitive insights go beyond raw data and information about competitors, and instead, provide recommended actions that are more usable for stakeholders in their roles.

For example, informing your sales reps that a competitor typically costs $20,000 annually… means nothing to them.

However, if you share that a competitor initially prices at $20,000 but often turns to heavy discounting to undercut your business and brings procurement into a deal early to cement this advantage of being a cheaper option, that’s a stronger competitive insight.

Now, if you also share that the competitor uses this pricing strategy to close early because they typically lose longer deal cycles against you when stakeholders are multi-threaded and pilot groups occur that get end-user feedback because those exact end-users prefer your product…

… now that’s a competitive insight that puts your seller in a much better position to compete within the deal.

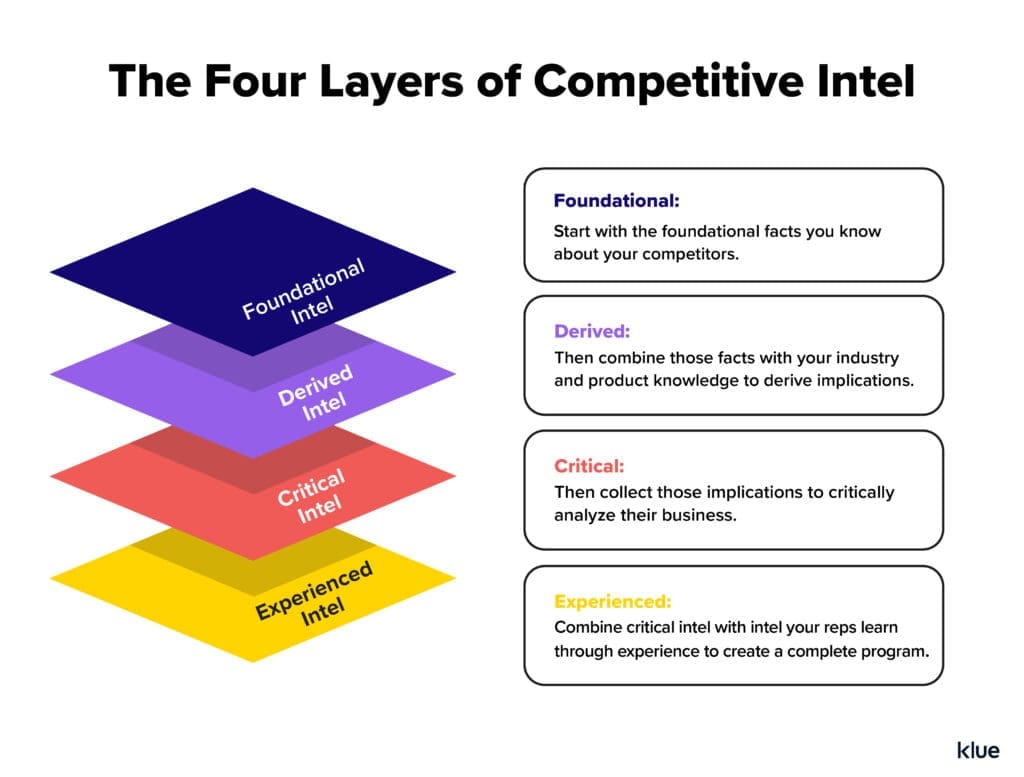

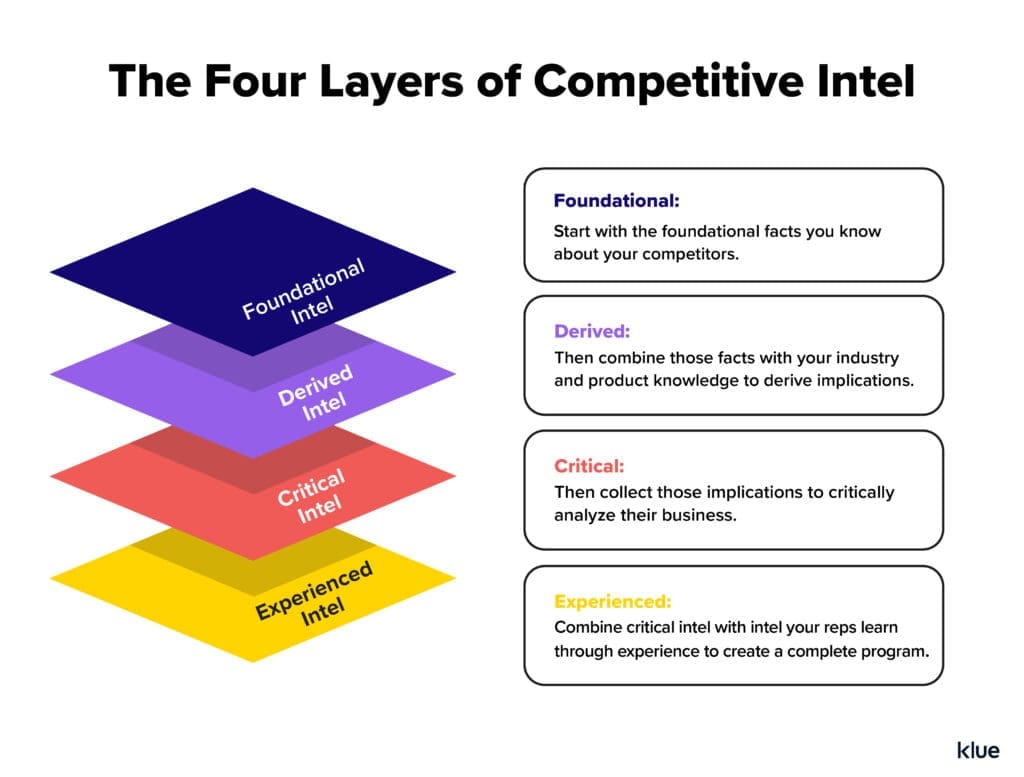

This level of nuance and usability within a competitive insight doesn’t appear magically overnight. Here are four steps — and layers of competitive intelligence — that you need to get there.

Getting to a competitive insight as valuable as the example above relies on what we at Klue call the four layers of competitive intel.

Each of these layers build upon each other so that you can create and deliver a meaningful competitive insight, not just a list of facts.

We’re going to walk you through:

What is this layer of competitive intel?

This layer refers to the basic information about a company that can be found through external sources. This provides a starting point for building more detailed insights on a competitor. By understanding a company’s public-facing activities and initiatives, you can broadly understand its overall strategy and objectives.

In the example mentioned previously, if you were starting from scratch researching foundational intel on this price-cutting competitor, you could assess their website to see if it showcases a persona (their target customer) that you also sell to. You’d also research their messaging, ads, and marketing activities and assess if they’re highlighting a problem that they solve that also overlaps with your own product or service.

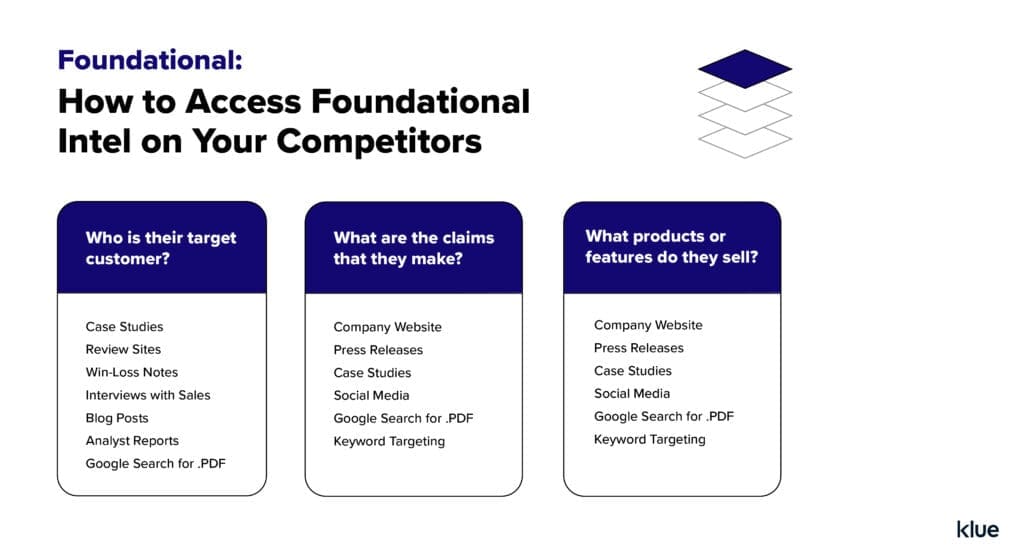

What questions does this intel answer?

The three questions this intel should answer are:

How do I access this intel?

The sources for this competitive intelligence are the easiest to access. Start by scraping publicly available external information: PR news, blog posts, case studies, and website messaging.

What is this layer of competitive intel?

This layer involves taking the external intel from the previous layer and putting it in the context of what is known about your own organization. This is where you begin deriving the ‘so, what?’ of the foundational intel to start building out a usable competitive insight and developing the foundation from which you build your sales battlecards.

In the aforementioned example, you can then dig into the ‘so, what?’ by looking at the messaging and angle of your price-cutting competitor’s case studies and website. Their case studies might emphasize speed of setup and quick return on investment, while their website might have added a time-savings calculator, for example. These are the indicators that outline how they’re going to market and positioning themselves against alternatives.

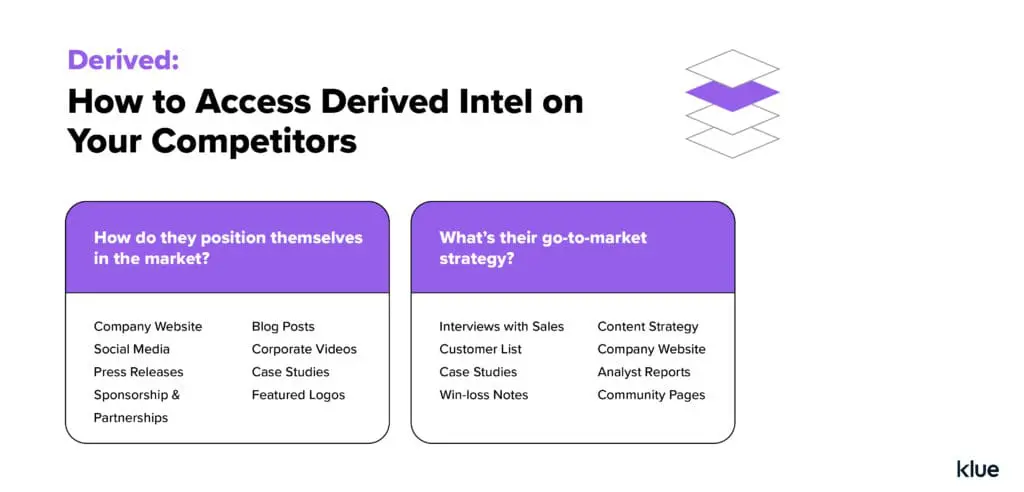

What questions does this intel answer?

The two questions this intel should answer are:

How do I access this intel?

The competitive intel at this level remains broadly accessible. While you’re still keeping an eye on competitor’s public-facing activities, you’re now combining that with what you know about your own organization to establish context. This is your starting point for interviewing internal stakeholders within your business.

What is this layer of competitive intel?

This layer of intel is where you begin to package your competitive insight to be more usable for stakeholders; whether it’s an SDR cold-calling competitor customers, customer success handling a competitive renewal, or a sales rep trying to win a competitive deal.

This layer is important because it begins the practical application of competitive intelligence including battlecards, best practices, and other competitive plays for your revenue teams.

In the example, some initial interviews with sellers that were recently in deals against the price-cutting competitor can help you understand at what point the competitor is dropping their price in the sales cycle so that you can proactively get ahead of the tactic. Reviewing internal win-loss notes can give a sense of how the competitor positions this value proposition to buyers.

What questions does this intel answer?

The two questions this intel should answer are:

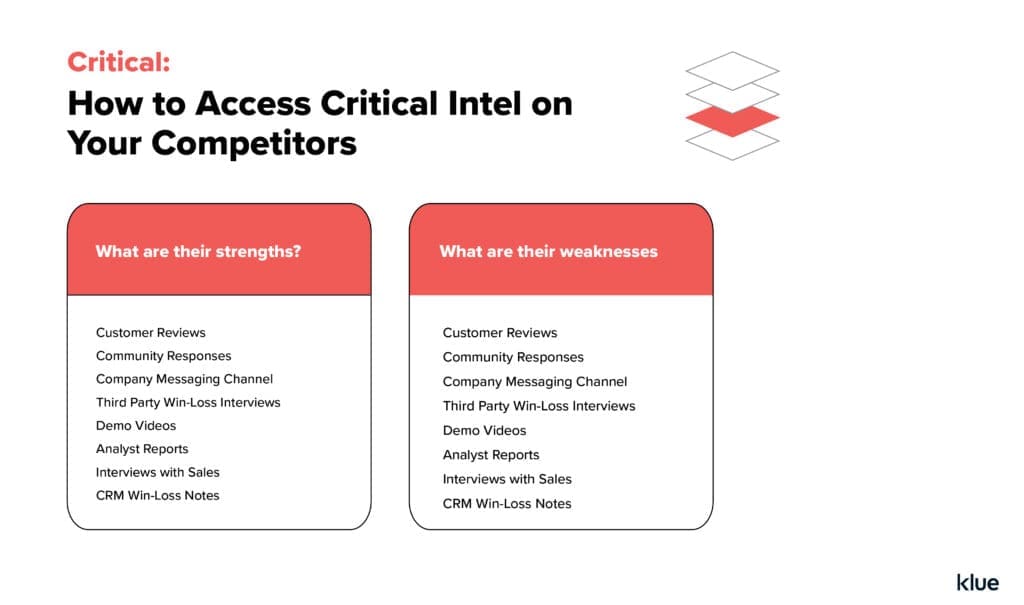

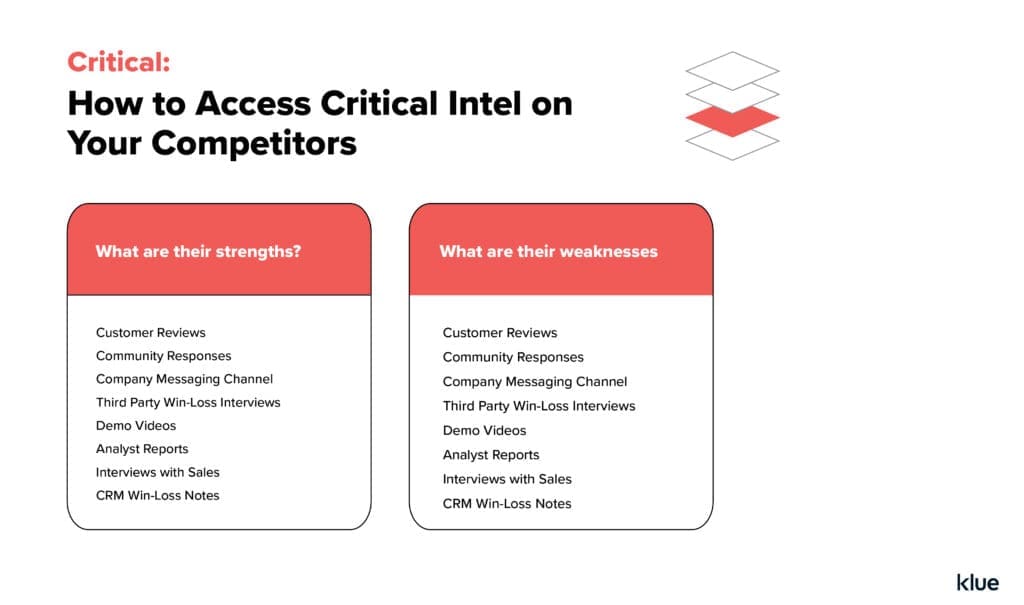

How do I access this intel?

The competitive intel at this level is where you begin to blend internal and external sources. You can still get a sense of a competitors’ strengths and weaknesses by analyzing trends on public review sites, like G2.

However, it’s critically important to now access the tribal knowledge amongst your stakeholders to figure out how they — and competitors — actually execute their strategies within the deal.

What is this layer of competitive intel?

This layer involves gathering competitive intelligence from the hardest channels, such as buyer feedback and sales interactions. This information is the most difficult to obtain but provides the clearest lens into why you’re winning or losing deals and what is actually happening throughout the sales cycle.

Nailing this layer is what unlocks winning competitive insights for your stakeholders.

In the example, experienced intel could include buyer trends that analyze when the price drops were offered to the buyer and why it did or didn’t resonate with them. If your company uses call recording software, you can also analyze and pull examples of your sellers in the field handling this objection, showcasing strong examples of competitive talk tracks to enable your sellers to respond to this competitor’s strategy at scale.

What questions does this intel answer?

The three questions this intel should answer are:

How do I access this intel?

The competitive intel at this level goes beyond the tribal knowledge within your own four walls, but gauges feedback from the most impartial — but critical — source: your buyers. This requires external win-loss interviews and analysis to build actionable competitive insights. Read how to use our free win-loss analysis template to do exactly that.

Using call recording software will also allow you to browse through the competitive situations happening across every deal in your business.

Competitive insights are not just a laundry list of facts about your competitors. They need to provide meaningful recommended actions that your stakeholders can actually use.

If you’re starting competitive enablement from scratch or are inheriting an existing function, build upon each layer of competitive intel so that you can build winning competitive insights for your revenue teams.

Competitive Enablement

Product marketers conducting competitive research are drowning in reviews, reports, and messy notes. Here's how Klue's AI foundation will help you complete this analysis in seconds, not weeks.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X