Klue Compete

The Competitive Enablement Platform

Learn More

FIND OUT MORE >

Competitive intelligence is not about snooping, stealing or spying (although that last one does sound kind of cool).

What it’s actually about is collecting information about your competitors, your market and your buyers to make better decisions.

But it doesn’t end at collection — far from it. Because competitive intelligence is worthless if you don’t surface insights from that intel collection, and then enable your teams with those insights to beat the competition.

In this guide, we’ll walk you through the nine steps you need to get there.

(If you prefer watching over reading, then check out everything that’s covered in the blog so you can launch competitive intelligence successfully below.)

Competitive intelligence is all about collecting, curating and deploying competitive information in a way that improves organizational performance.

Competitive enablement is about facilitating the use of competitive intelligence among your colleagues.

A system of repeatable processes that deliver customer, buyer, market and competitive insights to employees so that they can leverage them to outmaneuver the competition.

Now that you know what it is, it’s time to get into action. Let’s dive into the nine steps required for you to establish competitive intelligence in your organization

Help your cause by defining the objectives of your program and aligning those objectives to organizational priorities.

Your competitive intelligence program can and should be an accelerant to business objectives — especially the ones revenue leaders are prioritizing.

The closer you get to aligning your program’s priorities to those of your leadership team, the more success you’ll experience.

Expanding into a new region, attracting new ICP, improving customer retention, no matter the objective, competitive intelligence can help you get there faster.

Land on one-to-three organizational priorities your program will support. Then, develop a 30-60-90 day rollout plan with clear timelines and yard-marks to measure success that roll into these organizational priorities.

If your program’s goals line up to what leadership — and revenue leadership — are prioritizing, then you’re in a much better setup for success.

Listen to how Andy McCotter-Bicknell to launched his competitive intelligence function at ClickUp👇

We all know one bite at at time is the best way to eat an elephant. Yet we’re all guilty of biting off more than we can chew.

Don’t make this mistake with competitive intelligence. You’ll need to prioritize which types of competitors to focus on first. And your CRM data is the first place you should look.

1. Calculate your baseline competitive win rate across all competitors

2. Find out which competitors appear most in deals

3. Calculate your win rate against them [wins/loses*100]

4. Look at the ACV of these deals to identify which competitors impact revenue most

5. Keep taps on competitors making more or fewer appearances quarter-over-quarter

Acknowledgement: we know your CRM data is going to be messy. That’s okay — it always is at the beginning. And that fact alone can be a catalyst for change.

Using your CRM to understand which competitors are most often cutting into revenue you should have won is the first step in closing your competitive revenue gap.

Some of those lost deals likely weren’t winnable. But a good slice of them were. And you need to start tipping those winnable deals in your favour toute suite.

Check out how Dan Hamilton and CI team at Salesforce are getting dirty with deal support and winning more deals👇

CRM data doesn’t paint the full picture. But when you layer qualitative feedback on top of the quantitative CRM data, you start to get awful close. Throw on top of that your own competitive intelligence research, and now we’re getting somewhere.

Take a page out of Tracy Berry’s playbook and interview your stakeholders to figure out the gaps in your competitive intelligence program today. Look for quick wins you can deliver based on their feedback – whether that’s a competitor that reps have no intel on or FUD from a competitor that keeps tripping them up in deals.

Watch the strategy and tactics Tracy Berry uses to launch a Compete Program in 90 days

You don’t have to do 30, 30 minute interviews to get a handle on what your stakeholders want.

But do get a decent sample of interviews (at least 10). Talk to a variety of stakeholders, from different departments and at different levels of seniority.

Get a gut check on how confident your sellers are going against the competitionwith our Competitive Confidence Survey👇

The reasons why you’re winning or losing deals don’t show up on the scoreboard, just the results. If you never take the time to understand why, you’ll do a lot more losing than winning.

That’s why you need to run win-loss analysis as baseline research when analyzing your competitors’ strengths and weaknesses (or competitor SWOT analysis).

The good news? This doesn’t have to be a complicated process to start!

Begin by interviewing reps after deals and revenue leaders on your team. Read through deal notes in your CRM. Watch sales call recordings. And maybe even interview a buyer or two.

Now, these sources do have an implicit bias. Win-loss insights straight from your buyers conducted by a third-party is the most truthful source of information. But those starting steps should get your win-loss muscles firing.

Watch Emplifi’s Chief Growth Officer Vijay Gupta talk about how he’s used win-loss in his career on our podcast, Blindspots👇

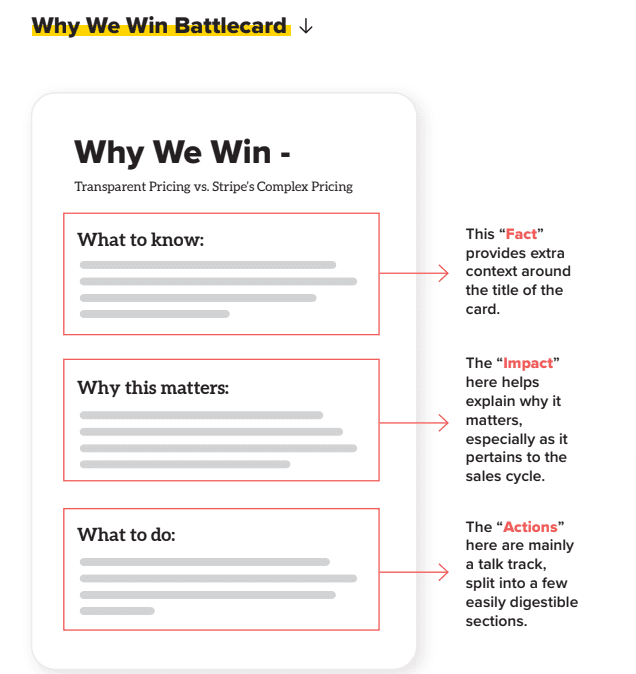

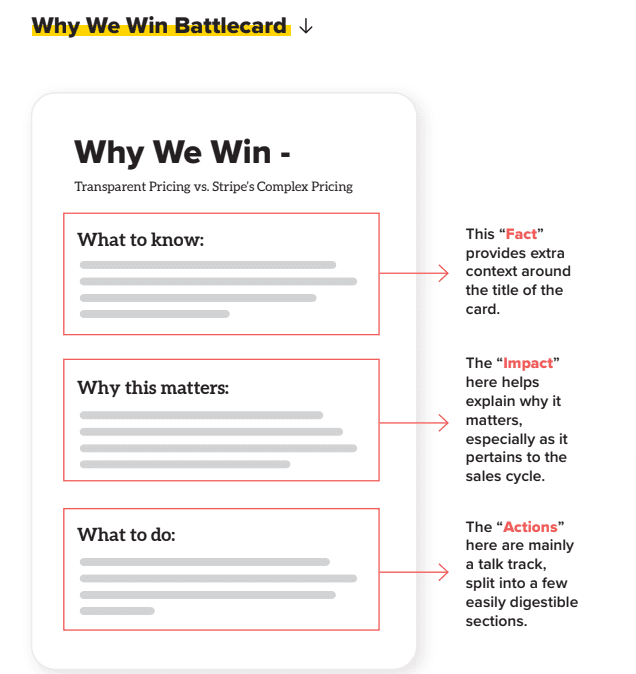

At this point you have enough competitive intel and content to build your first battlecard. Choose one competitor and start by building out three individual cards to incorporate in your sales battlecard.

We recommend using the “Fact, Impact, Act’ framework within your battlecards. This gives them structure and also makes them far more usable for your reps in a deal. Using a repeatable framework like FIA helps you build faster, and makes your content consistent, promoting adoption.

But don’t blast it out to the entire team just yet. Work with a pilot group of end-users (build a team of killer competitive sellers and solution engineers) to test, collect feedback and iterate.

A deal-winning battlecard can be your reps’ secret weapon in competitive selling scenarios.

Keep the momentum going past battlecard number 1 with our downloadable Competitive Battlecards Templates👇

Now that the pilot group is in love with your compete content, it’s time to roll it out to the whole team.

Okay we lied, it’s not quite the time to roll it out. That’s because, before you do it, you need to get revenue leadership on your side. Here’s how:

Once you’ve got leadership buy-in, now the time to communicate to the rest of the team.

Good content doesn’t matter much if your end-users don’t adopt it. And the quickest path to content adoption is through leadership and peers.

A seller is much more likely to nab a talk track from another rep that has used it to win deals than something that’s just written on a battlecard. It’s your job to show that the battlecards aren’t just words.

Collecting publicly available intel is table stakes for competitive intelligence programs. Gathering internal competitive intel, and turning that into competitive insights, is where the real magic happens.

Help make it happen by creating a #competitiveintel channel in your internal messaging platform. But don’t just set it and forget it.

Take ownership of the channel by jumping in to conversations, adding and asking for more context when necessary, and gently push back on intel that’s more conjecture than evidence.

Above all, make sure you’re acknowledging your colleagues for sharing and participating. That’s how you build the much-coveted culture of compete.

The always-on drumbeat of an internal messaging channel still needs to be complemented with a regular competitive intelligence newsletter.

This is your weekly, bi-weekly or monthly roundup of all the competitive intelligence gathering you’ve done — highlighting the best intel that’s come across your desk and the world wide web.

Give it some character — it should not be another boring, stiff newsletter. Have some fun with it.

And above all, make to give your analysis of why the intel matters. Make it super simple for your readers to understand your, and your company’s POV, on why a particular piece of intel or a competitive event is important.

Watch veteran product marketer Jenny Sung break down what it takes to build a killer competitive intelligence newsletter 👇

Even once you stand up your competitive intelligence program, the work isn’t done there.

You should be ready at any point in time to be able to justify and prove the value of your program. Tracking, analyzing and reporting back on key metrics and KPIs will be your saving grace.

It all starts with content adoption, passing through competitive win-rates, competitive confidence and beyond. And of course there will be some variation in the kinds of KPIs tracked company-by-company.

Either way, here are 10 of the most important competitive intelligence metrics you need to get a handle on.

We live in a time when buyers are better informed than ever. Throw in the fact that there are more competitors than ever fighting for those same buyers and it’s your cue to take action.

The best competitive intelligence and competitive enablement programs are the ones that leverage insights from competitive intel to make better decisions and win more deals.

Your competitive intelligence program can do it to. And these nine steps are just the start.

Competitive Enablement

Product marketers conducting competitive research are drowning in reviews, reports, and messy notes. Here's how Klue's AI foundation will help you complete this analysis in seconds, not weeks.

Competitive Enablement

The topic of Large Language Models (LLMs) has a lot of confusion. Here's what you need to know about how Klue is working with them.

Let’s do it. Tell us a bit about yourself and we’ll set up a time to wow you.

Let's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XLet's do it. Tell us a bit about yourself and we'll set up a time to wow you.

XSubscribe to get our latest AI functionality and news in your inbox.

XOur Buyer Pulse feature, set to launch in Q2 2024, offers valuable insights into the factors influencing buyer decisions in your pipeline. By signing up for the waitlist, we can better gauge interest and proactively engage with you to streamline the setup and integration process before the feature becomes widely available.

X